The selloff of 2022 has been brutal.

First, inflationary concerns hit high-growth stocks…

Then, recession worries came for the rest of the market…

Even energy stocks—the strongest part of the S&P this year and the best place to hide year-to-date—dropped this week into bear market territory. And the Fed’s change of heart carries a lot of blame.

As the economic recovery picked up post-COVID, so did most prices.

Meanwhile, the Fed insisted inflation was transitory… keeping a zero-rate regime alive much longer than needed.

With the Fed’s balance sheet at a record high… the central bank’s easy policies long overstayed their welcome.

The net result: the highest inflation in 40 years… exacerbated by the energy crisis brought on by the Russian aggression in Ukraine.

Having been left with no choice, the Fed is now firmly on a tightening path, insisting it can engineer a soft landing…

But this week, Fed Chair Jerome Powell admitted a recession is a possibility.

However, while the market might seem scary right now… it’s actually one of the best times to be in it… especially if you’re a contrarian like me, and you have time on your side.

Over the course of my 20-plus-year career, I’ve learned it pays to go against the flow. Trading along the prevailing momentum is a perfectly valid strategy… But when panic rules the market, that’s when contrarian investing truly shines.

And there’s little doubt we’re in a market ruled by panic and fear.

Last week, for instance, the S&P lost almost 6%…

Utilities—traditionally one of the safest corners of the market—dropped by 9%. And energy—one of the most economically sensitive sectors—plunged more than 17%.

These are the kind of losses one normally sees for an index over the course of a year… or in a panicky bear market.

Markets that panic are often irrational… creating compelling buying opportunities as investors dump stocks regardless of their quality, valuation, dividends, or growth prospects.

In other words, irrational markets create the best bargains.

Don’t get me wrong: Many stocks are being crushed today for a perfectly good reason. The unprofitable dreamers whose businesses mushroomed in a free-money environment have little chance of ever making money in a higher-rate economy.

These are the stocks that made ARK Invest—and its flagship ARK Innovation ETF (ARKK)—famous.

And these are the stocks that fell the most during this bear market.

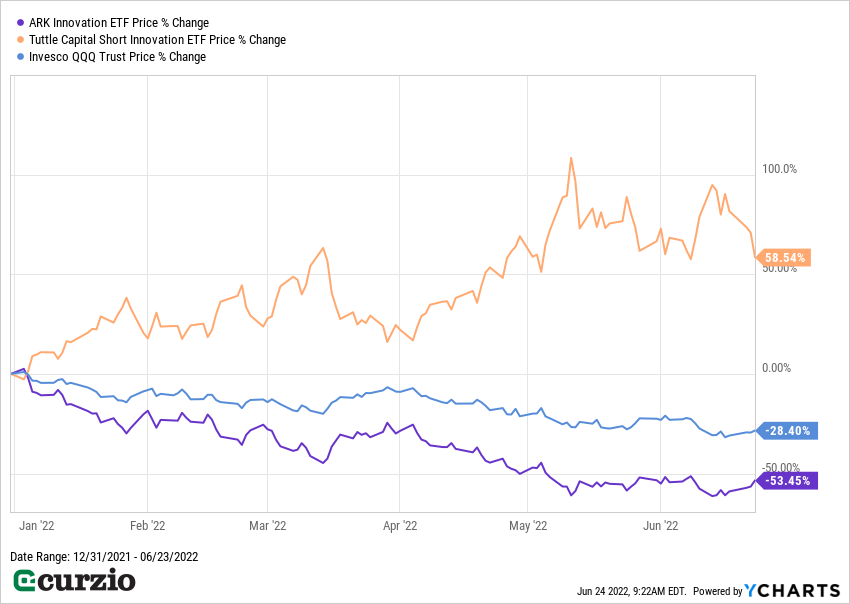

Year-to-date, ARKK has lost more than 55% of its value… much more than the S&P and 25% more than the loss of the tech-heavy Nasdaq 100 (represented on the chart below by the Invesco QQQ ETF).

Contrarian investors, such as Tuttle Capital Short Innovation ETF (SARK), could see this coming… This young fund (created in November 2021) was specifically designed to bet against ARKK… It promises to deliver the exact opposite of ARKK’s returns.

SARK has been one of the best contrarian ways to play this market. As you can see from the chart, it’s up some 58% this year.

And it remains an easy, relatively safe way to stay protected against further declines in unprofitable tech—a sector that simply doesn’t work in this economy.

I recommended a SARK trade to my Moneyflow Trader members in December 2021. We closed half of the trade for a tidy profit in just four months… and we’re letting the other half ride for even bigger gains. (And it’s far from the only trade that’s made great money for us as the market declined.)

Many tech companies are now in bargain territory… and becoming more appealing for corporate takeovers and investors alike.

However, I’d still be ultra-careful with the group.

Especially in a market where higher-quality, dividend-paying companies—many of which can grow profits even as rates rise—are also much cheaper.

That’s what contrarian investing is about: finding bargains to own for a long haul.

And even if you don’t call yourself a contrarian, it’s a better long-term strategy to be in the market, not out of it. Right now, you could be picking up bargains and positioning yourself for much higher profits than those who bought the same stocks at the top of the market.

You’ll never get every single holding right… and you’re not likely to catch the very bottom either.

But being invested pays over time… despite periodic selloffs.

Take a look at the chart below.

Had you bought the S&P three years ago and held steady, you’d still be up almost 34%… despite waiting out a COVID-related decline… and the ongoing bear market of 2022.

Simply buying and holding would position you to outperform inflation… and increase your total purchasing power.

Buying at the 2020 bottom (and selling at the 2022 top), of course, would have improved your standing dramatically…

But don’t look at that chart longingly, wishing you’d known better.

Look into the future… and for the newly created bargains to invest in. Chances are, that stock you like—with compelling fundamentals and a bright future—has gotten cheaper this year.

Stocks rarely bottom all together… So my recommendation now is to start buying the best individual stocks you can find. This will help you survive—and profit—from this bear market.

Over the next couple of weeks, I’ll give you more strategies for staying ahead of inflation and taking advantage of the bear…

But for now, remember: The stock market remains the only place where investors can outperform inflation… position themselves for long-term gains… and secure a growing stream of income for years to come.

P.S. For easy access to an outstanding portfolio of income stocks that can withstand inflation and build long-term wealth… join us at Unlimited Income.

These carefully selected assets have consistently returned double-digit gains… And right now, many are trading for bargain prices.

If you’re ready to take your investing game to the next level…

Learn more about our Moneyflow Trader strategy… You’ll be astounded at the consistent double- and even triple-digit gains we’re generating with contrarian strategies—often in just a few weeks.