Not long ago, Blockbuster was dominating the movie rental business… and seemed destined to make a fortune for its investors.

Founded in 1985, the company grew from just two stores into a rental empire in less than a decade. At its top, it was worth $8.4 billion… which was the price Viacom paid to acquire the company in 1994.

But as we know now, the story would soon change.

In 2004, as competitors like Netflix (NFLX) began eating into market share, Viacom spun off Blockbuster… And in 2007, when Netflix began offering streaming services… it became clear the days of the movie rental business were numbered.

In 2010, the company finally declared bankruptcy… closing its corporate doors and leaving individually owned franchises to manage on their own. By 2019, one (privately owned) Blockbuster remained, located in Bend, Oregon. (Ironically, Netflix made a documentary about it, The Last Blockbuster.)

That single Blockbuster is a reminder of a bygone era… and the power of progress.

For many businesses, explosive growth can fade as fast as it started.

And stocks that trade on the expected value of future growth can quickly pivot from market darling to pariah.

You’ve probably heard the term “story stocks.” These are stocks with growth projections based on the bigger outlook for their business or industry, rather than their underlying fundamentals… or valuations.

We hear a lot about the story stocks that ultimately work out (like Netflix)—the ones creating brand-new trends… disrupting large and diverse markets… and replacing outdated competitors.

But there are countless companies like Blockbuster—poised to whittle and even disappear as the story gets stale… or the stock is sold off sharply as its growth prospects shrink.

The market gives us countless examples of this happening… Many former highflyers like Blackberry (BB) and Nokia (NOK)—and, more recently, Peloton (PTON) and Beyond Meat (BYND)—are unlikely to see their highs ever again.

It’s common for investors to get overly excited about a new company and overbid the stock into extreme valuation territory. When the market has few fundamentals to judge a company’s worth, it can bid a stock up on nothing more than claims of innovation… favorable press coverage… or social media buzz.

But when economic or sector growth is downgraded, or when the market corrects, these overvalued stocks are often the first group to plummet.

And 2022 is the wrong environment for these types of investments.

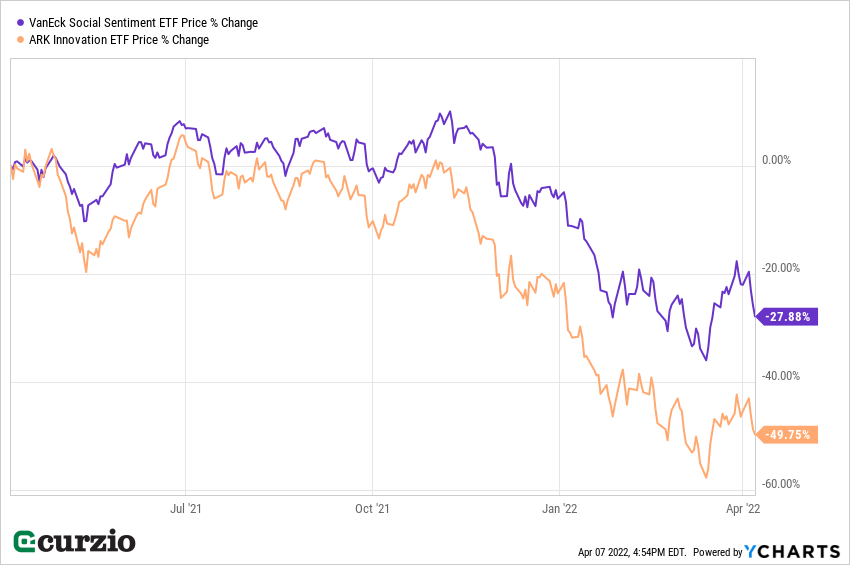

Take a look at the chart below…

It shows the action in two story-stock funds over the past year:

VanEck Social Sentiment ETF (BUZZ) is composed of 75 large-cap U.S. stocks with the strongest investor sentiment (based on various data points). Everything was fine with BUZZ until early November 2021. Since then, it’s lost some 23%—despite having big names in the portfolio, like NVIDIA (NVDA) and Apple (AAPL).

Similarly, the recent slump in the ARKK Innovation ETF (ARKK)—another story-stock fund—started on November 1… and the fund has lost about half (50%) of its value since then.

And that’s despite owning Tesla (TSLA)—the fund’s No. 1 holding—which held on relatively well during this time (down only 13% from November 1). Many other story stocks throughout the portfolio, from Roku (ROKU) to Zoom (ZM) to Teladoc (TDOC) to CRISPR Therapeutics (CRSP), have done much worse, losing more than 50% of their value since then.

And I expect story stocks to continue underperforming…

One of the main reasons: The end of the Fed’s free money policies. Stocks love free money, and these policies have been propelling many overvalued story stocks even higher over the last couple of years. But now that the policies are ending… so is the market’s love affair with overly expensive stocks.

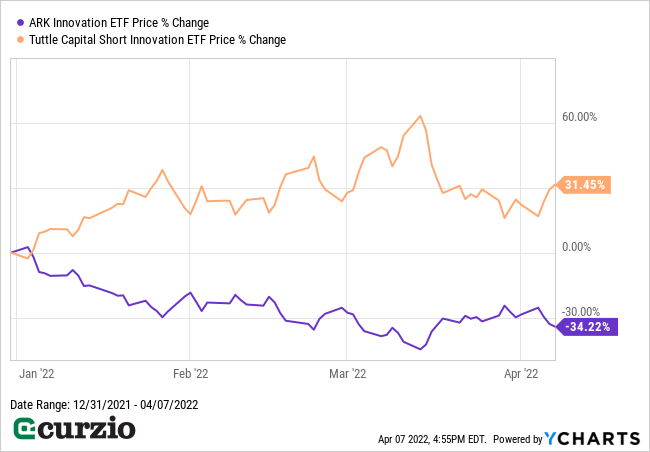

The simplest way to bet against the staying power of the story stocks is with a new exchange-traded fund (ETF).

The Tuttle Capital Short ARKK ETF (SARK) only started trading in early November of last year… but it’s already up some 56% since then.

This fund, which is up double digits in our Moneyflow Trader portfolio, is specifically designed to benefit from ARKK’s troubles—it generates a daily inverse return to that of ARKK. So when ARKK falls by a certain percentage in a given day, SARK is designed to rise by approximately that same amount (although extra volatility can add or detract from longer-term returns… as with any other inverse ETF).

So far, the strategy is working… This year alone, SARK is up more than 30%… closely mirroring the decline in ARKK.

And there’s more room to go for SARK, as ARK Innovation’s portfolio of still-expensive story stocks continues to take on water in today’s difficult market.

No trend lasts forever. With an economic slowdown, higher interest rates, and stubborn inflation, even many strong stocks are on discount right now.

But overvalued story stocks—the kind based on exciting narratives rather than fundamentals… and the kind that comprise ARKK’s portfolio—will continue to unravel.

Editor’s note:

Everyone wants to find the next Netflix… or Apple… or Nvidia. And Frank has spent decades building a network of Wall Street insiders to bring you these ideas—the kind that can turn a tiny initial stake into a windfall…

Join Frank at Curzio Venture Opportunities today… and don’t miss his next 10x opportunity.