Warren Buffett, CEO of Berkshire Hathaway (BRK/B), is widely regarded as one of the greatest investors (if not the greatest investor) in market history…

But according to Buffett himself, the credit for Berkshire’s decades-long success goes to someone else entirely…

Buffett began his latest annual letter to shareholders with a touching tribute to his longtime business partner, Charlie Munger—who passed away in November 2023 (a month shy of his 100th birthday).

He wrote, “In reality, Charlie was the ‘architect’ of the present Berkshire, and I acted as the ‘general contractor’ to carry out the day-by-day construction of his vision.”

The tribute also included some of Munger’s greatest investment advice that guided Buffett’s investment decisions for decades…

Based on Berkshire’s incredible track record, it’s clear this lesson stands the test of time.

And the best part: It’s easy for any investor to implement…

How to invest like the architect of Berkshire Hathaway

Not long after Buffett bought control of Berkshire Hathaway in 1964, Charlie Munger told Warren Buffett he’d made a dumb mistake.

Fortunately, it was a mistake that could be corrected with a simple adjustment…

According to Buffett, Munger told him:

Warren, forget about ever buying another company like Berkshire. But now that you control Berkshire, add to it wonderful businesses purchased at fair prices and give up buying fair businesses at wonderful prices. In other words, abandon everything you learned from your hero, Ben Graham. It works but only when practiced at small scale.

And Berkshire’s long-term success proves just how effective this advice is…

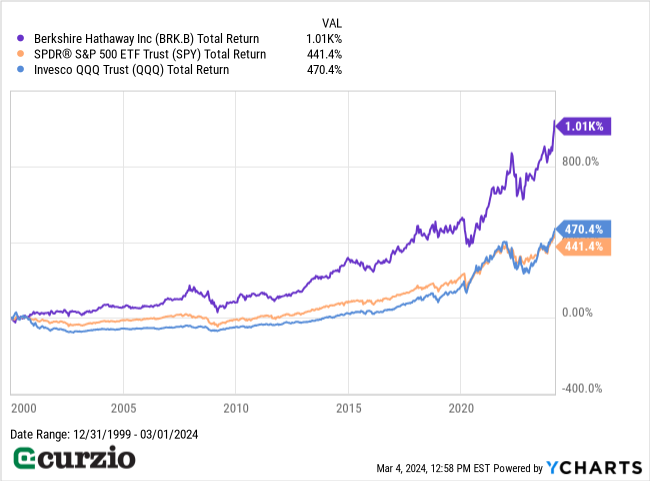

This century alone, the company has delivered more than twice the return of the market and even the tech-heavy Nasdaq-100, as you can see from the chart below.

So let’s break down the two main components of this advice…

1. Find wonderful businesses

What makes a business “wonderful” by Berkshire Hathaway’s standards?

It’s pretty simple…

According to Buffett’s 2007 letter to shareholders, the No. 1 criterion of great companies is an enduring “moat” that creates a long-term competitive advantage and protects the company against economic changes. This moat can take the form of being the lowest-cost producer (like Geico and Costco)… or having a powerful global brand (like Coca-Cola and Gillette). Such businesses will continue to deliver steady profits over time.

Ideally, a good business will also have strong management—but a business should not rely on a stellar manager.

“If a business requires a superstar to produce great results, the business itself cannot be deemed great,” wrote Buffett.

2. Pay a fair price

Of course, the market doesn’t give away great companies for free—or even cheap.

Investors are constantly on the hunt for such companies… driving up share prices… and making it nearly impossible to find them at a bargain price.

Put simply, a truly great company is rarely cheap.

That’s why Munger advised looking for “fair prices” vs. “wonderful prices.”

But what makes a price “fair”?

There are many ways to value a stock… But as a shortcut, look for a company that trades at an average valuation vs. its peers—while growing faster than the market. All else equal, these businesses are well-positioned for future profits… and for share-price gains.

Of course, not everyone has the time—or the desire—to comb through a business’s financials to find fair prices…

Fortunately, there are a couple of simple shortcuts you can take.

2 one-click ways to buy the market’s biggest moats

The obvious way to piggyback off Berkshire Hathaway’s success is by owning BRK/B shares in your portfolio. And that’s certainly a valid option… But it’s not the only one.

The Morningstar Wide Moat Focus Index aims to invest in attractively priced companies with sustainable competitive advantages (moats), as determined by Morningstar’s equity research team.

And the VanEck Morningstar Wide Moat ETF (MOAT) seeks to replicate the price (and yield) of this index as closely as possible.

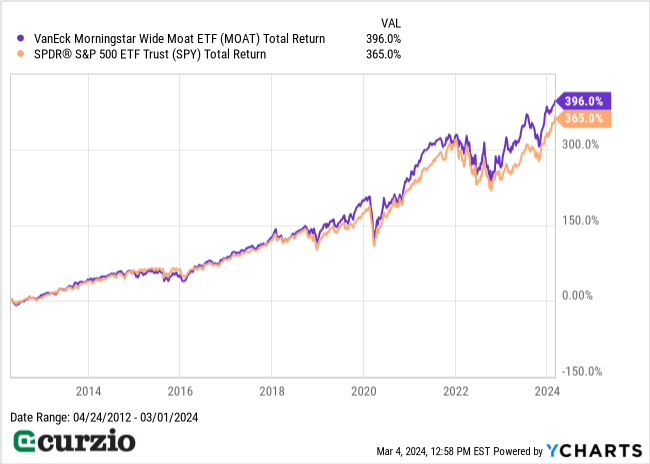

Since its inception, this ETF has outperformed the market by about 33%, as you can see from the chart below.

This action further proves the effectiveness of Charlie Munger’s wisdom: The surest way to build steady wealth over time is by buying businesses with strong moats at fair prices.