Stocks are on an absolute tear lately… and growth stocks are leading the charge.

Last Thursday, the S&P 500 closed at a new all-time high after rallying 30% over the past year. Meanwhile, the tech-heavy Nasdaq 100 has added a staggering 50% over the same time frame.

If you’re invested heavily in growth stocks, you might be tempted to keep riding this momentum indefinitely…

But market history tells us that it won’t last: Sooner or later, growth stocks will lose their steam.

No one knows exactly when it will happen—just that it will happen.

The good news: You don’t have to guess when the market will shift. There’s a simple method to capture the gains from your best performers at (or near) the top… and scoop up bargain stocks before they skyrocket.

In other words, this strategy takes the guesswork out of “buying low and selling high.”

I’ll explain how it works below… but first, let’s look at why growth stocks are bound to take a breather.

Growth stocks won’t lead the market forever

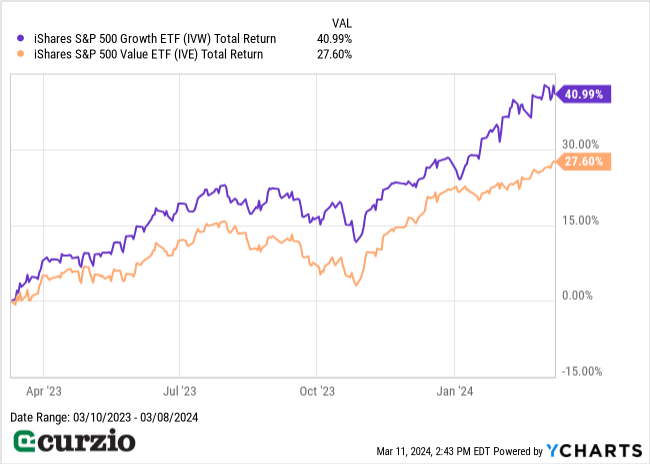

If you invest in both growth and income, you’ve probably noticed that your growth holdings have massively outperformed their value counterparts over the past five years, as you can see below.

In the past 52 weeks alone, growth stocks—represented by the iShares S&P 500 Growth ETF (IVW)—have outperformed value stocks—represented by the iShares S&P 500 Value ETF (IVE)—by more than 13%.

But market history tells us this trend is bound to shift…

You see, value and growth stocks tend to take turns leading the market.

This century, we’ve had several distinct periods where value stocks outperformed. For instance, between the 2000 dot-com bust and the 2007–2008 bear market, value stocks added almost 60%… while growth stocks declined. In fact, it took more than a decade for the growth stock returns to turn positive.

As you can see, trimming your growth position at the top of the 2000 bubble (or shortly thereafter) and reinvesting in value would have meant the difference between a loss and a gain.

Of course, it’s impossible to predict the market’s top (or bottom).

Fortunately, one simple strategy puts timing the market on autopilot…

‘Buy low and sell high’ without the guesswork

Rebalancing your portfolio is the act of trimming some of your winning positions… and reinvesting the proceeds into some of your underperforming holdings. The goal is to re-weight your portfolio to hold your desired mix of assets.

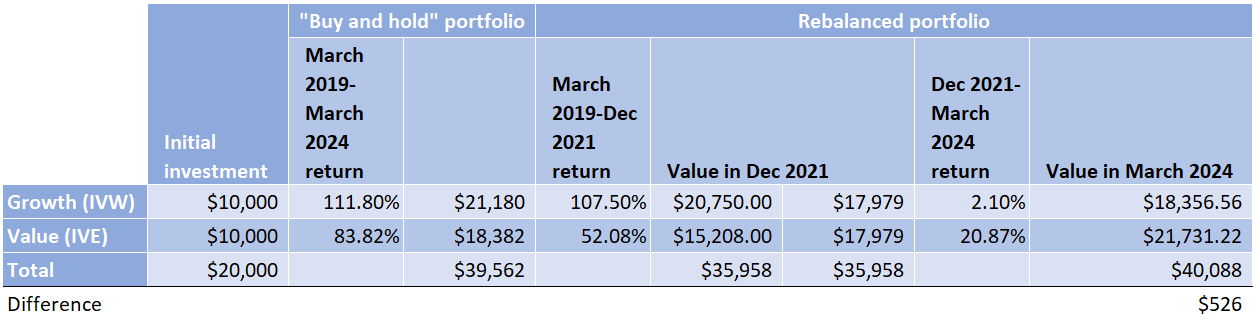

So, let’s say your ideal equity portfolio holds a 50/50 mix of growth and value stocks. You started five years ago by putting $10,000 into each group—represented by IVW and IVE, respectively. Since then, you have not rebalanced your portfolio.

As the chart below shows, your portfolio is now worth more than $39,000—nearly double your original investment. Not too shabby!

But thanks to growth stocks’ outperformance, the allocation is out of whack. Instead of your ideal 50/50, you now have a 54% weight in growth… and 46% in value.

That might not seem like a big deal… until the market shifts to a value focus. Then, this imbalance would amplify your losses… and limit your potential gains.

By selling some of your IVW position and investing the proceeds in IVE, you effectively take timing the market out of the equation.

And it pays off…

Let’s look at the same hypothetical portfolio above, but let’s say you rebalanced at year-end 2021. In that case, you’d be sitting on an extra $526, or more than 2.6%.

The bottom line: While growth stocks have been on a tear lately—leaving their value counterparts in the dust—this action won’t last forever. We can’t know for sure when the trend will shift… By periodically rebalancing your portfolio, you can “buy low and sell high” without trying to time the market.