Two Sundays ago, Fed chair Powell was interviewed on CBS’s 60 Minutes.

By itself, being on TV isn’t too big a deal for the leader of the country’s central bank…

Most of the time, however, we see him on financial networks like CNBC or Bloomberg… or testifying before Congress (as he’s scheduled to do in March). An appearance during primetime is very rare… as is the 60 Minutes interview.

Of course, he couldn’t go on primetime TV to claim victory over inflation… which is still running hotter than the Fed’s 2% goal.

So why did chair Powell get on TV?

Below, I’ll tell you what’s behind this unusual behavior… and a big reason why we’ll be facing “higher-for-longer” interest rates… Plus, I’ll give you three strategies for profits and portfolio protection this election year.

But first, let’s go back to Powell’s 60 Minutes interview—where, almost from the get go, he asked for our patience during the Fed’s ongoing fight against inflation…

Powell vs. inflation

Powell went on to say inflation is a big reason why “people are… relatively dissatisfied with what is otherwise a pretty good economy…”

And finally, he warned the public that the Fed wasn’t ready to cut rates yet.

To Curzio Research readers, this should not come as a big surprise.

Just last month, I noted that the Fed would make a mistake by cutting interest rates too soon.

Since then, the probability of a quick rate cut has become increasingly less likely.

For example, the chance for a March rate cut has now decreased from a massive 80% a month ago to under 10% on Friday. And, as of the end of last week, the chances of a May cut were just 35%, versus 98%, a virtual certainty, a month ago.

Chair Powell would love to start cutting rates… if it wasn’t for the pesky, still-too-high inflation.

So he’s telling us straight up that interest rates will stay higher for longer.

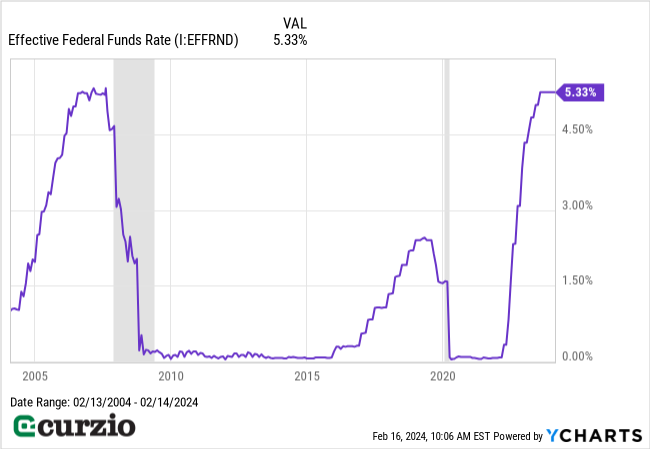

But don’t make the mistake of thinking that the Fed won’t cut the rates in a hurry—and to extreme levels—if something truly bad happens to the economy or to the banking system. They’ve done it before, as you can clearly see from the chart below. The cuts in two gray-shaded areas were during recessions… And in 2019, the Fed moved quickly when a slowdown started looming.

There’s no reason to suspect today will be any different—especially considering that we’re in an election year.

The market knows this—and this is why stocks are rallying in the face of the highest interest rates in a generation.

In other words, the markets are betting that the economy will take preference for the Fed over inflation… and that the rates will stay high only for as long as the current economy can take it.

Prudent investors should take notice—and plan accordingly.

Here’s how.

3 best ways to profit

Taken together, all of the above can be translated into the following three investment principles to follow for the rest of the year.

1. Stick with shorter-term bonds

The Fed’s higher-for-longer stance means most bonds are likely to be “dead money” in 2024 at best… or a money-losing proposition in the worst-case scenario.

Here’s why.

You remember that bond prices and rates have an inverse relationship: When rates are going up, prices decline, and vice versa.

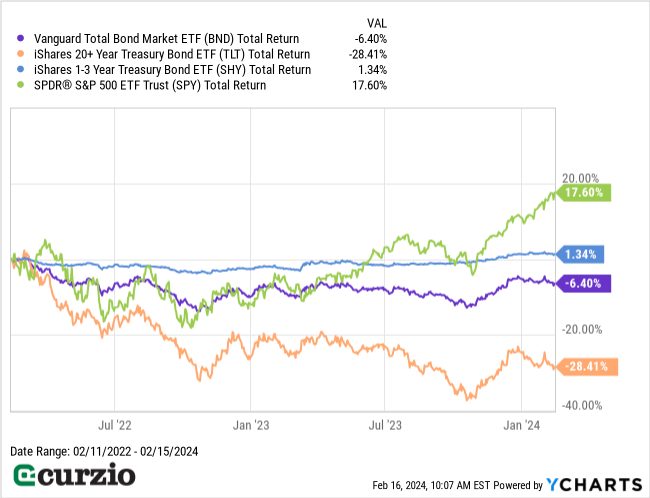

This is why bonds (especially the longer-dated group, represented on the chart below by the iShares 20+ Year Treasury Bond ETF TLT which lost almost 29%), have been some of the worst assets during the Fed’s inflation fight that started two years ago.

During that time, the entire bond market—represented by the Vanguard Total Bond Market ETF BND—declined by 6.4%…

Shorter-term bonds—which are less sensitive to the changes in rates—were slightly up during that time (and outperformed both TLT and BND). Here’s one way you can invest in this sector right now.

Better yet, as you can clearly see from the chart above, short-term bonds were the best group to hedge the market’s declines during these two years. In other words, when the markets (represented on the chart by the SPDR S&P 500 ETF SPY) declined, shorter-term bonds would create a much-needed balance and protection for a portfolio.

2. Invest for the long term

Historically, stocks have been one of a few investments that could keep up—and outperform—inflation. Put simply, investing in the stock market is one of the easiest ways to keep (and grow) your purchasing power over time.

Of course, it matters when you buy… how much you pay… and how long you own your stocks. Be careful with your stock selection… don’t follow the crowd… and only buy stocks you’d be happy to own for the long haul.

Plus, to reduce the risk of buying near the top… ease your mind…and make money from the inevitable market declines, follow rule #3.

3. Own hedges

Staying invested is easy if you have a long-term time horizon… if you don’t watch your portfolio all the time… or if you believe the Fed is omnipotent and will bail out all investors every single time.

But even if the latter is true—as it has certainly been the case in the modern world—we still went through several painful bear markets in recent years. These selloffs happened fast… and came seemingly out of nowhere.

To protect the rest of your portfolio from the unexpected—and to make money from such events—owning a few hedges like put options can be a very profitable strategy… And with stocks trading near all-time highs, the chances are you’ll need this protection well before the year is over.

Of course, options are not a tool to be used randomly or without planning: If you’re wrong, or if the market keeps rallying, your puts could expire worthless. So remember to only invest what you can afford to lose on the “insurance premium.”

But if you plan carefully and understand the risks… owning a put can provide strong protection in a bear market, when most other investments decline.

Conclusion

Staying invested through thick and thin is the best way to fight inflation. But every market is different… and following the steps above should help you stay safe—and profit—in 2024.