You’ve probably heard the market maxim, “Don’t fight the Fed.”

With inflation at a 40-year high, the Fed has no choice but to tighten its policies… hike interest rates… and reduce its bloated balance sheet.

And because the Fed’s easy money policy sent stocks soaring after the COVID selloff… removing it is causing the market to crash as investors flee.

In other words, if you “follow the Fed,” you can explain most of the recent action in stocks.

And once you understand how the market reacts to Fed policies—and vice versa—you can even predict the Fed’s next step… and prepare yourself.

Some investors step back from the market… then go back in when they see an all-clear signal. Others might reduce their market exposure…

And others add to their hedges, such as put options—or what I like to call “portfolio insurance.”

Similar to life insurance, portfolio insurance protects an investor against an adverse event… More specifically, put options—when properly used—allow you to profit from a stock, sector, or market decline.

Here’s how to use put options to build portfolio insurance…

When you buy a put option, you buy the right (but not the obligation), to sell an underlying security (stock or ETF) at a specific price (strike) before a certain date (expiration).

If the underlying security declines in price, the put option increases in value—and the faster and sharper the asset’s decline, the more you can potentially make on your put trade, all else equal.

Buying a put will cost you money upfront. Think of it as an insurance premium…

But, like an insurance premium, that’s the maximum you’ll be out if the asset doesn’t end up declining. And if you’re right, you’ll get paid.

In other words, when you own a put on a specific security, you’re positioned to benefit from that security’s decline…

You might think it’s too late to start buying insurance in the middle of the market selloff…

But nothing could be further from the truth.

For one, no one ever really knows where the market is heading. It makes sense to maintain hedges of some kind at all times—for safety when the market is rallying… and for profits when it’s not.

Secondly, the decline can feed on itself—as investors start to flee, others get spooked and do the same—generating more pain for your “long” portfolio (assets you believe have upside) but more profits for your short, put-based positions. (The tech-heavy Nasdaq is already down about 28% off its highs—and put positions on some of these stocks are generating big Moneyflow Trader gains.)

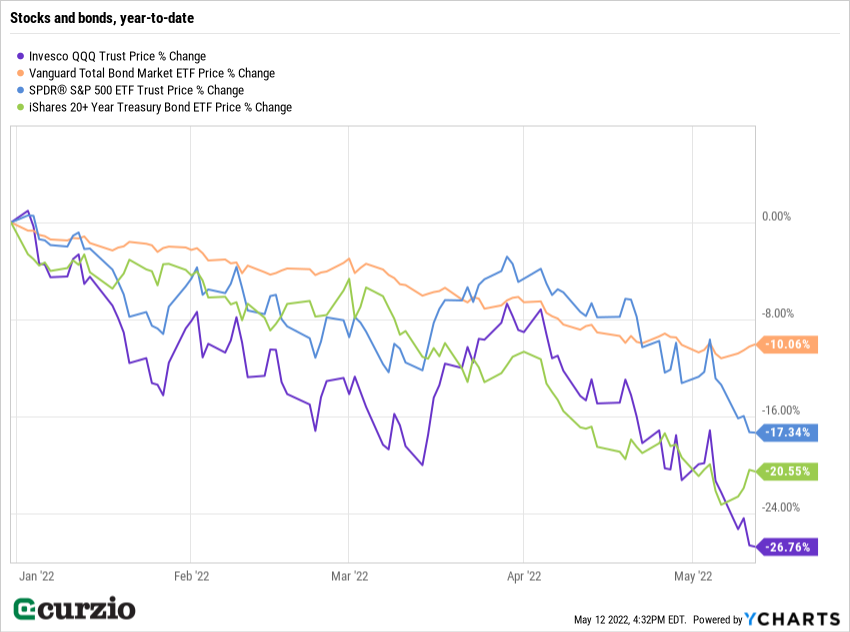

And finally, there’s almost no place to hide in this selloff—as you can see from the chart below. Put options offer investors a way to go against the grain… and profit when all else is failing.

Of course, all the usual disclaimers apply.

Options are a tool to be used carefully… If you’re wrong about the direction of the asset, its volatility, or the timing of your trade, among other things, your put could expire worthless. So only invest what you can afford to lose on the “insurance premium.”

But if you plan carefully and understand the risks… a put can provide great protection against a falling market.

P.S. Last week, my Moneyflow Trader readers had a chance to lock in triple-digit gains for the 4th time in 2022…

Using the strategy I described above.

Don’t let options scare you away from profits like these.