When I first started on Wall Street, my colleagues and I would place bets on the outcome of each Fed meeting—what actions the central bankers would take… and how the market would react.

That’s because, in the days of yore, these meetings used to be mysterious, secretive events…

The Fed would play its cards close to the vest… and communicate very little about its intentions in advance.

But over the years, policymakers became much more transparent about their future actions.

That’s why the final Fed meeting of 2023 was so surprising…

By now, you’ve undoubtedly heard that following the December 13 meeting, Fed Chair Jerome Powell made an extremely dovish pivot when he hinted the Fed could start cutting interest rates as soon as March 2024.

It’s worth noting that in his public speech on December 1, Powell wasn’t dovish at all. He said:

It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so.

Powell’s change of tone sent the market into hardcore rally mode—largely because it was unexpected and, therefore, not priced in.

It remains to be seen whether the Fed will follow through on this pivot. The market currently sees just a 40% chance of a rate cut in March. It’s worth noting that expectations have plunged by more than half—from around 88%—a month ago.

But if the Fed does indeed start cutting rates in March… it would be a big mistake.

Today, I’ll tell you why a Fed pivot in March would be wildly premature… and why it could cause a resurgence in inflation that would hurt consumers and investors alike.

But first, let’s talk about the Federal Reserve’s goals.

The Fed’s dual mandate

By law, the Federal Reserve has two mandates: Maintaining price stability in the economy… and ensuring maximum sustainable employment.

But there’s a problem with the Fed’s dual mandate…

Some measures designed to fight unemployment can also cause a wave of inflation.

You see, when inflation runs hot, the Fed’s best defense is to raise interest rates. Higher interest rates lead to higher borrowing costs… which result in less spending throughout the economy. Lower spending puts downward pressure on prices. And the ultimate effect is typically a slowdown in the economy—and sometimes even a recession.

The problem with this formula is that economic contractions typically mean higher unemployment.

(It’s also worth noting that policymakers hate recessions for personal reasons. Recessions are bad for their reputations and can lead to negative political consequences.)

Put simply, when inflation runs hot, it forces the Fed to make a tough choice between its two goals.

And, as I’ll explain, the Fed has clearly chosen the economy over inflation…

Three reasons why a March pivot would be premature

You might think it makes sense for the Fed to prepare to pivot in 2024…

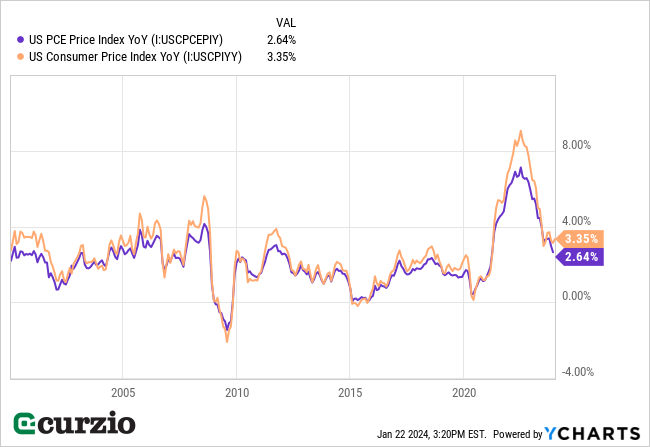

After all, inflation has been coming down (as you can see from the chart below)—so the Fed’s job must be done, right?

This line of thinking is wrong—for a few reasons…

1. Inflation is still way too high

The standard benchmark for consumer prices—the Consumer Price Index (CPI)—is still well above the Fed’s 2% goal, as you can see above.

And while the Fed’s preferred inflation gauge—the Personal Consumption Expenditures Price Index (PCE)—is approaching the goal line, that doesn’t mean inflation has been defeated.

For one, the PCE index tends to run lower than the CPI—as you can see on the chart above.

And even the CPI often understates real-life inflation. Put simply, not all inflationary pressures are reflected in these numbers… and policymakers are well aware of this discrepancy.

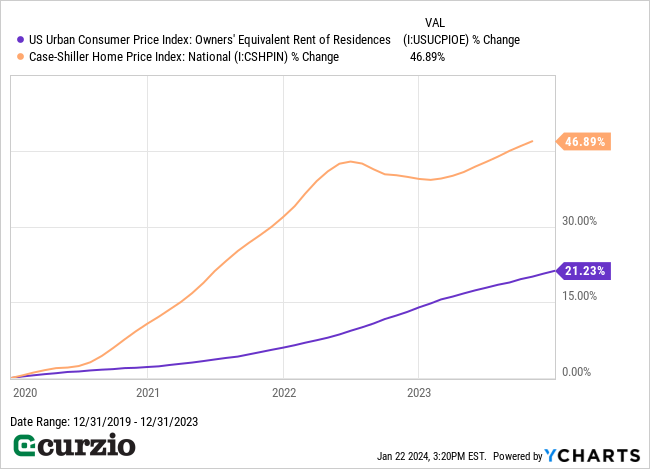

For example, U.S. housing prices are through the roof… and these increases are largely not reflected in the inflation indices.

That’s because the CPI uses a measure called “owners’ equivalent rent” to calculate the cost of shelter. And that number lags the actual increases in housing prices, as you can see below.

Looking at the Case-Shiller Home Price Index (the yellow line), shelter prices are up 47% since the end of 2019 (through September 2023). That’s more than double the increase in owners’ equivalent rent.

In other words, current inflation data understates what’s happening in the real world… and the Fed knows it. If it chooses to cut interest rates anyway, it’s clearly choosing the economy over inflation.

2. The economy is still red-hot

The U.S. economy recently posted its strongest quarterly growth since Q4 2021…

As you can see below, real gross domestic product (GDP) grew 4.9% last quarter. That’s almost double the average GDP growth for the past 10 years… and the highest growth reading since 2021.

In other words, the economy is stronger than it’s been since the Fed started hiking interest rates two years ago.

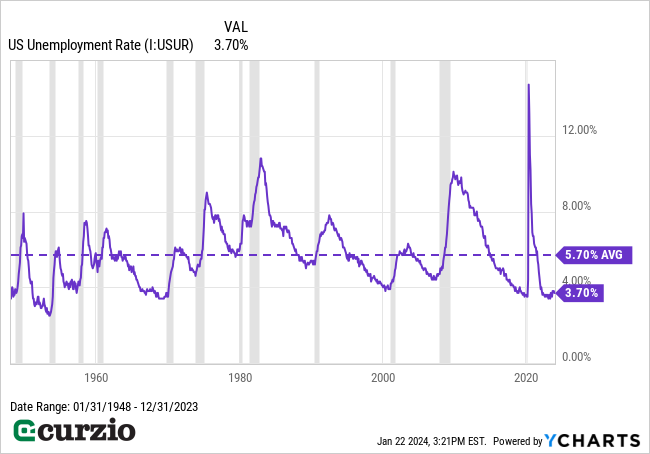

And as you can see below, unemployment is still sitting near historic lows… and far below the long-term average.

Put simply, if the Fed pivots… it would have to ignore two of the biggest reasons for keeping rates high: a strong economy and ultra-low unemployment.

Something doesn’t compute… unless their ultimate goal is to pump the economy at the expense of higher inflation.

3. A premature pivot could have dire consequences

History has taught us that inflation is “sticky.” Once it rears its head… it’s tough to beat back.

Even worse, it can get out of control if the Fed declares victory too soon.

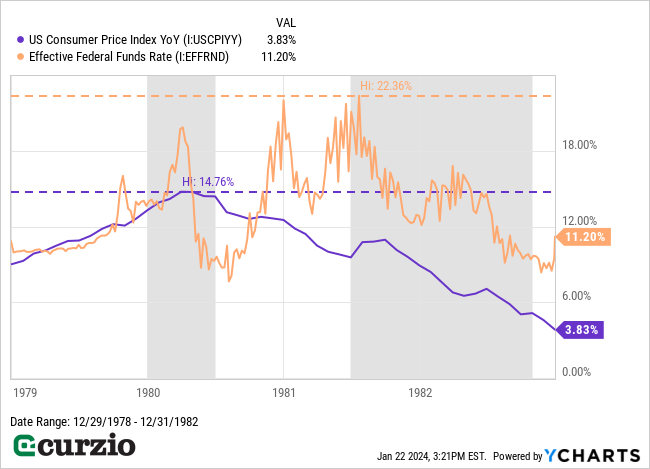

That’s exactly what happened during the inflationary 1970s.

As you can see from the chart below, after several rate increases to beat back record inflation, the Fed cut rates by more than 7% in April 1979 in an attempt to end a recession. As a result, inflation spiraled even further out of control—and the Fed had to hike rates higher than before, unleashing a longer recession than the one it was fighting. (Note that recessions are the gray-shaded areas on the chart).

In short, history tells us that if the Fed cuts rates too soon, it could cause inflation to come back stronger than before. That would force the Fed to re-initiate a rate-hiking cycle… and potentially send the economy into a massive, prolonged recession.

Conclusion

Investors are celebrating the Fed’s dovish pivot. But they’re ignoring the potential pitfalls.

If inflation doesn’t continue falling, the Fed will be forced to embark on a new, higher-for-longer rate regime.

That would be devastating news for the S&P 500… which just set a new all-time high.

This is where our hedging strategy at Moneyflow Trader comes into play. It’s the perfect way to protect your portfolio from the market’s biggest risks.

And if the Fed goes through with its premature pivot, I expect 2024 to be highly profitable for us.