2024 is shaping up to be “the year of the pivot…”

No one expects the Federal Reserve to cut interest rates at this week’s meeting… but the market sees a 48% chance of a rate cut in March.

On its surface, that might sound like good news… But as I explained last week, a premature Fed pivot would be disastrous.

That said, long-term interest rates aren’t controlled by the Fed…

You see, one special group of investors has the ability to take rates into their own hands. And if they see the Fed isn’t doing its job properly, they’re likely to step in—and force rates to stay higher for longer.

I’m talking about the “bond vigilantes.”

Today, I’ll explain why a Fed pivot won’t necessarily mean lower interest rates… and reveal a lucrative (and safe) way to play higher-for-longer rates.

But first, let’s take a look at the “bond vigilantes”—and the unique power they hold over the economy.

How these bond market ‘superheroes’ could save the day

When you hear the term “bond vigilantes,” you might picture a group of masked crusaders taking the law into their own hands… And that’s not entirely off-base.

Coined by market analyst Ed Yardeni back in the 1980s, the term refers to bond investors who make large buys (or sells) with the specific intent of moving interest rates.

Remember: Bond prices and yields have an inverse relationship. So when bond prices rise, yields fall… and vice versa.

In other words, if investors sell a big chunk of bonds, it causes prices to crash… and sends interest rates soaring. Meanwhile, massive bond-buying causes prices to rise and rates to plunge.

And the results can be dramatic, especially when the vigilantes’ actions move Treasury yields.

You see, longer-term Treasury rates are the benchmark for every other type of debt, from credit cards to mortgages and auto loans… and a wide range of business debts, like corporate bonds and small-business loans. When these rates rise, it typically leads to an economic slowdown.

As Yardeni wrote, “If the fiscal and monetary authorities won’t regulate the economy, the bond investors will. The economy will be run by vigilantes in the credit markets.”

Put simply, the bond vigilantes can have a massive effect on the economy… and they’ve appeared several times throughout history to help the Fed do its job.

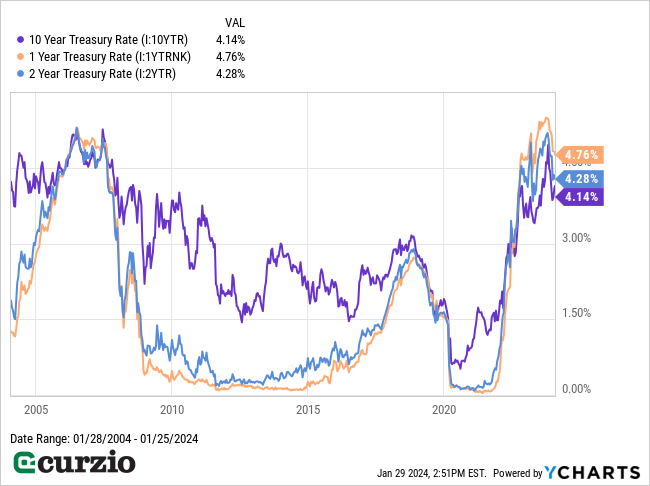

Most recently, this past summer, the bond vigilantes realized that the Fed’s rate-hiking efforts weren’t sufficiently cooling the economy—so they took matters into their own hands. As you can see below, long-term rates started to surge in July as selling in Treasury bonds accelerated.

And if the Fed pivots prematurely in a still-strong economy, these vigilantes will likely step back in to keep the economy—and inflation—from roaring back out of control. They’ll start selling their bonds again… sending rates (and bond yields) of all kinds higher.

In that case, one group of bonds stands out as a lucrative (and relatively safe) way to profit.

The best bonds for low risk and high yield

Today, shorter-term bonds offer higher yields than longer-term bonds.

As you can see on the chart below, both the 1- and 2-year Treasury notes are yielding more than the 10-year bonds. (Notably, the S&P 500 currently offers a dividend yield around 1.5%.)

There’s another reason to opt for shorter-dated Treasuries vs. their long-dated counterparts: duration.

Typically, the shorter a bond’s duration, the less its price will be affected by changing interest rates. So if the bond vigilantes keep pushing rates higher, shorter-duration bonds won’t take much damage… while longer-duration bonds will see their prices plunge.

Think of it this way: Who would want to wait 30 years for a bond yielding 1% to mature… when you can get a 4%-plus yield on the newly issued bond?

Put simply, short-term bonds offer the best of both worlds right now: They’re paying higher yields than their longer-term counterparts… while carrying less duration risk.

And there’s a simple way to profit…

A one-click way to lock in market-beating income

When you buy individual bonds, you lock in a specific yield. And if interest rates rise, you’re stuck with the lower payout until the bond matures.

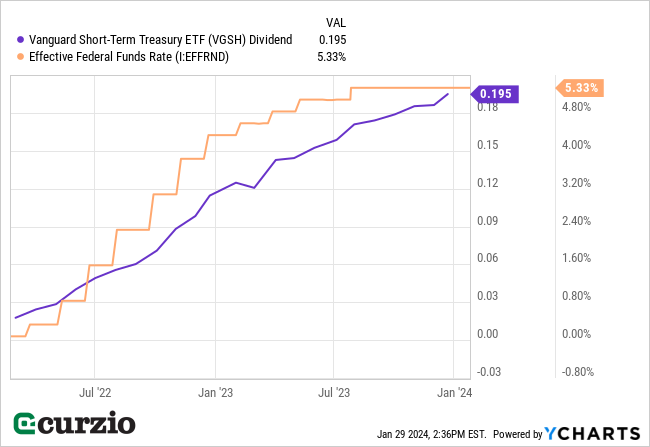

But with an ETF, you get a basket of dozens (or even hundreds) of different bonds. And as its bond holdings mature, the fund can reinvest the proceeds into newly issued ones. In this market, that means the fund gets to lock in rising yields… which raises the ETF’s payouts.

The Vanguard Short-Term Treasury ETF (VGSH) fits the bill.

The fund owns U.S. Treasury bonds—basically the safest, highest-quality bonds you can buy—with maturities ranging from one to three years.

And remember: While VGSH’s current yield is 3.3% (below the recent yields on short-dated Treasuries), that yield is set to rise as the fund reinvests its assets into newer, higher-yielding bonds.

In fact, the fund’s monthly payout has already increased almost 10-fold since March 2021 (when the Fed started hiking rates)—from less than $0.02 per share to the current $0.195.

And, as you can see above, there’s a significant lag between fed funds rate increases and VGSH’s dividend growth. That’s because it takes time to replace the lower-yielding securities with higher-yielding ones. This lag also means that the income on VGSH will continue to grow for a while… even after the Fed pivots.

A 4% forward yield (based on the latest dividend) is exceptional for such a low-risk fund.

The bottom line: With short-term Treasuries yielding above 4%—and least likely to respond quickly to changing interest rates—this group offers the perfect combination of high income and safety in this market… And one-click, liquid investments like the Vanguard Short-Term Treasury ETF (VGSH) let you easily generate market-beating income with very low risk.