If the overall market corrects—as it looks like it will—the Russell 2000 small-cap index is going to decline even more…

Last week, I broke down why—based on market conditions—large caps will continue to grow… while small caps will continue to shrink.

Regardless of the recent (and since-passed) craze of buying companies already in bankruptcy… small stocks have been doing much worse than their large-cap counterparts.

The market is bidding up companies it expects to take market share from their smaller rivals—companies like Microsoft (MSFT), Amazon (AMZN), Netflix (NFLX), and Wayfair (W) that are benefitting from lockdown conditions and the accelerated work-from-home trend.

I don’t see this trend changing anytime soon…

So today, I’m going to tell you a great way to capitalize on continued weakness in the small-cap sector.

The Russell 2000 Index is the benchmark index for small-cap stocks. And it’s uniquely suited as a potential short in the current environment.

By the mid-’80s, the S&P 500 and the Dow Industrial Average were already well established. Both indices were designed to track the action in large-cap stocks.

But the small-cap universe still lacked a proper benchmark… one to reflect the fast-changing number of small- and micro-cap companies—many of which are too small to make any significant impact on a market-cap weighted index.

So in 1984, the Frank Russell Company created the Russell 2000.

It was a simple idea: Rather than take all the smallest companies in the market, the index uses a well-designed size cutoff.

Most investors aren’t interested in the smallest, least liquid companies. To eliminate these names, the index doesn’t start from the bottom… it starts somewhere in the middle.

Specifically, the Russell first looks at the 3,000 largest U.S. stocks by market capitalization (the value of all a company’s outstanding shares). Collectively, these 3,000 names make up the Russell 3000 Index.

From there, the index draws a line between large and small. The bottom 2,000 of this huge group automatically go into the Russell 2000. (And the top 1,000 form the Russell 1000 large-cap index.)

In other words, the Russell 2000 is the “bottom 2,000” of the 3,000 biggest U.S. stocks.

These 2,000 companies are surprisingly small. Despite including 2/3 of all the stocks in the Russell 3000, the Russell 2000 Index is about 10% of the size of the Russell 3000 based on total market cap.

You might think shorting the Russell 2000 is a bad idea because of the growth potential of these small-cap names. Maybe you’re thinking you could use this index to find the next Microsoft or Facebook before they become large caps.

Nothing could be further from the truth. That’s because of the way the Russell 2000 is constructed.

You see, the S&P 500 is weighted by market cap. This means that the bigger a company is, the larger its contribution to the index value. So when a giant like Apple rallies, it has a big effect on the S&P 500’s performance.

The Russell 2000 is also weighted by market caps… but with a key difference.

You see, the best performers in the small-cap Russell 2000 end up “graduating” from the index.

In other words, the most successful performers end up getting taken out of the Russell 2000 before they get too big.

It’s a survivorship bias, but in reverse…

And today’s trends are only going to accelerate this effect.

Let’s look at the top holding of the Russell 2000, Teladoc Health (TDOC). Teladoc allows “televisits” (virtual visits via your phone or tablet) with your doctor. It’s widely considered one of the beneficiaries of today’s economy, where people are staying home more than ever.

Shares of Teladoc have more than tripled over the past year. As a result, TDOC is no longer a small cap. It’s actually already a full-fledged large cap, with a market cap of nearly $15 billion. For comparison, that’s about the size of energy giant Occidental Petroleum (OXY) and almost twice as large as leading appliance company Whirlpool (WHR).

That $15 billion market cap makes Teladoc too big for the Russell 2000. After the Russell rebalances (which happens once a year, at the end of June), TDOC will be removed from the index.

Many others will migrate up the market cap scale, too. They’ll be largely replaced by underperformers… companies that fell to the bottom of the barrel.

As a result, further appreciation of TDOC and similar stocks will no longer benefit the Russell 2000 and its investors.

Of course, these quirks of the index are important to understand if you want to short it (or go long).

But what’s even more important is that Russell 2000 is shaping up to be on the losing side of the “winner-takes-all” economy.

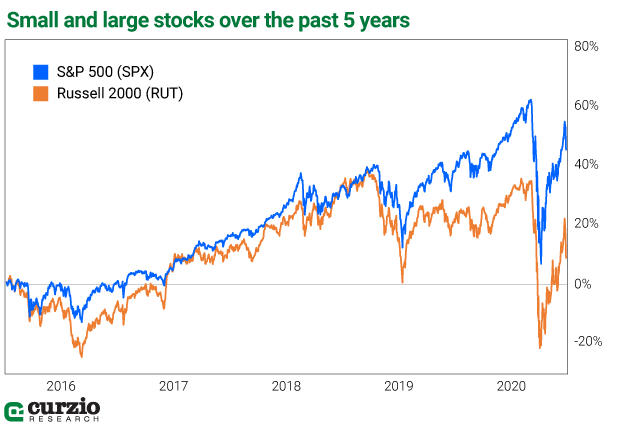

This trend is already playing out. As you can see below, the Russell 2000 is underperforming its large-cap index peers, like the S&P 500.

The Russell 2000 has underperformed the large-cap market by about 36% over the past five years.

I expect this relative weakness to continue…

And one of the easiest ways to play the near-term decline is an exchange-traded fund (ETF) that moves in the opposite direction of the Russell 2000 Index—by about the same amount.

The largest and the most liquid of such funds is the ProShares Short Russell 2000 ETF (RWM).

It’s important to keep in mind, however, that this ETF is best used as a daily trading instrument—not a long-term investment vehicle. (Learn more here.) That’s because like its inverse peers, RWM is designed to track daily moves of the Russell.

When an index ETF tracks daily moves rather than long-term action, it tends to exacerbate the volatility of the index and lag behind it on the downside. To see what I mean, take a look at the chart below.

This year, the Russell 2000 declined more than 17%. And while RWM has been tracking its daily moves quite faithfully, it’s up only 5% for the year

But as you also can see from this chart, when the Russell 2000 declined sharply, RWM rallied in response.

RWM works fine as a short-term hedge—but be very careful with this ETF for longer-term investing. If you’d rather make a long-term bet, you can place long-dated put options on the Russell or even short it outright.

As I mentioned above, If the overall market corrects, the Russell 2000 is going to decline even more…

A major price support on the index (1,450–1,460) is now broken, and a 10%-plus decline seems inevitable.

Any of the potential trades I mentioned on the Russell 2000 have strong potential to benefit… just as long as you understand each trading instrument, and apply it according to your own risks and goals.

Editor’s note: Frank follows Genia’s hedge advice with his own money—for good reason. During the last market crash, her Moneyflow Trader subscribers collected triple-digit gains—from 5 different hedges.

Just ONE great hedge using Genia’s elite strategy can be enough to protect the rest of your portfolio from a downturn. Learn more about this strategy—and how to put it to work today.