If you’ve been in the markets for a while, you know not many tech companies survived the dot.com bust.

Those that did—and rallied afterwards—had what it takes to make it big.

I saw this potential in one small company called LivePerson (LPSN)… As online shopping grew to dominate commerce, its methods of marrying cutting-edge technology with customer-service business were about to become much more valuable.

Founded in 1995 and public since April 2000, it took 10 years for early investors to see their investment pay off…

But pay off it did! From April 2010 until recently, its share price soared more than 300%.

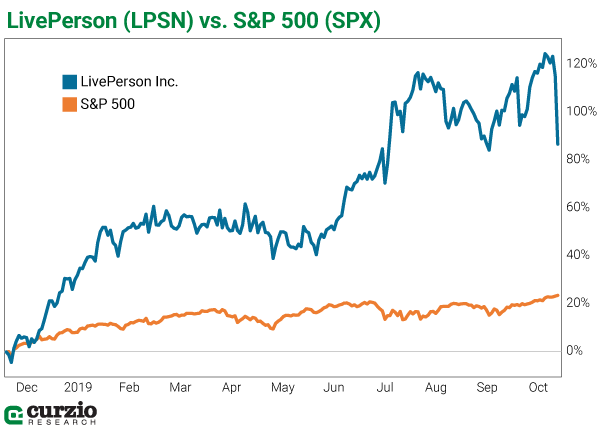

This year alone, the stock more than doubled.

But if you know how the market works, you could see this rally wasn’t sustainable.

And it created a perfect setup for the elite but surprisingly simple kind of trade I’ll explain today… buying put options.

Last week, I told you how to create your own market insurance with a “protective put”—a bullish combination trade designed to protect a stock owner against an adverse event.

But owning a put without a long position in a stock is a bearish strategy—used to benefit solely from a stock’s decline.

This is the put option strategy that’s generally associated with bear markets.

Unlike a straight short, which doesn’t have an expiration date, buying a put is a “timed” trade. If you buy a put, you have the right to sell a specific stock at a specific price within a specific time period. (Buying a call works in a similar way. But that’s a discussion for another day…)

While the losses on a straight short can be unlimited, buying a put strictly limits a trader’s downside. The losses are limited to the cost of the put (plus commissions). And the upside can be significant…

Let’s consider an example from just last week…

If you subscribed to one of my old newsletters, you’ll recognize the name LivePerson. We made more than 60% on the stock in less than six months (from November 2017 to April 2018).

This small company has made online chats—or “conversational commerce,” as LPSN calls it—cost-efficient for their clients and convenient for the customers who use it.

LivePerson’s approach saves money. It’s also modern—most self-respecting companies now have websites, and consumers expect to be able to browse a website for answers or product solutions before (or even instead of) going to a store or picking up the phone.

But nothing goes up in a straight line, including the share price of promising companies.

There are at least two big reasons a previously invincible company crashes and burns.

One reason is disappointing earnings.

The other is valuation.

Sometimes the market might seem oblivious to fast-growth, non-revenue generating companies trading at sky-high multiples. But it becomes far less forgiving the more “expensive” such a company becomes…

In 2019, LPSN was trading at more than 10 times (10x) annual revenue.

This wasn’t sustainable. It was just a matter of time before even a good quarter would lead to a selloff.

One excellent way to play the expected decline: put options.

Going into LPSN’s third quarter (Q3) results on November 7, many traders were betting the market would react negatively.

To execute such a bet, they could buy a November 15 2019 put option, despite only a week left until expiration. That’s because they expected a price-moving event to happen before that date.

LPSN was trading around $41 coming into the earnings, so one possible strike price was $40. A LPSN November $40 put would have an “intrinsic value”—the difference between the share price and strike price—if the stock declined below $40.

In the Friday trading post Q3 earnings, LPSN lost 13.2%.

Consequently, the November $40 put price jumped from $5.25 on Thursday to $11.90 on Friday… a gain of more than 120%.

In one day, this put position went up $6.65 per share ($11.90 – $5.25), not counting commissions. That’s $665 per put contract (one contract—the minimum you can buy—is 100 shares).

You could have happily sold your contract(s) on Friday and closed the trade for a tidy profit, rather than waiting until expiration.

In the example above, we were lucky—the stock did just what we expected it to do (declined post-earnings), and the put option rallied.

But what if the opposite happened?

Buying a put isn’t a riskless proposition. But again, your risk is limited. If LPSN was trading at or over $40 at expiration, this option would expire worthless. But your maximum loss would be the initial outlay (the price of the option contract plus commissions).

If you’d shorted LPSN outright, your gains could have been $5.34 per share in one day. But your potential loss would be unlimited: This company, with a bright long-term future, could have continued to rally.

As long as you don’t invest more than you can afford to lose, I recommend buying put options if you think a stock’s price is about to fall. They’re easy to execute… you can buy them a few days ahead of an anticipated decline, or up to a couple of years ahead… and most importantly, they’re a great way to boost your portfolio returns.

Until next time,

| Genia Turanova Editor, Moneyflow Trader |

Editor’s note: If you’ve missed any of Genia’s investment education, click here to access it all… including two ways to profit during the trade war and a three-point checklist for income investors.