Frank note: Today I’m excited to welcome our newest analyst to the Curzio Research family, Genia Turanova. She has nearly two decades of Wall Street experience as a portfolio manager and editor for multiple advisories, including award-winning Leeb Income Performance and The Daily Paycheck.

Genia also has a remarkable track record for making her subscribers money. And not just over the past few years (during one of the most bullish markets in a generation)… I’m talking over the course of nearly 20 years.

Genia’s proven performance through both bullish and bearish times makes her a stand-out in an industry full of hype… and it’s one of the main reasons I’m ecstatic to have her join our family.

In the coming weeks, Genia will show you the best places to find income in a low-rate market… which income stocks to avoid… and how to create your own “dividend.”

It’s all come down to soybeans…

Although the U.S. has been imposing tariffs—in essence, extra taxes—on China-made goods since January of last year, the first truly large salvo of this trade war was felt last July. That’s when tariffs on as much as $34 billion of Chinese goods went into effect (and China retaliated with its own tariffs on U.S.-made products).

Peak Pegasus, a dry-bulk ship, experienced this tariff battle firsthand. Carrying 70,000 tons of soybeans, the ship left from Seattle for Dalian, China, in early June 2018. The ship raced to port at the end of its month-long journey—trying to unload before 25% tariffs on soybeans took effect. But the Peak Pegasus arrived off the coast of China on July 6, 2018—the very first day of tariffs—adding about $6 million to the cost of its cargo.

Peak Pegasus’ journey is symbolic of a new reality: trade war uncertainty. And while tariffs have impacted many sectors, soybeans should be at the center of investors’ attention.

Today, I’ll explain why soybeans are a gauge for trade negotiations… and two ways to play defense against the uncertainty.

In 2017, China accounted for more than 60% of all U.S. soybean exports—about 33 million tons. It’s one of the top buyers for U.S. soybeans, and many analysts view the commodity as one of the most important factors in the current trade dispute. As soybeans go, they figure, so will the larger trade deal.

Despite a recent drawdown, China is reportedly buying large amounts of soybeans from us again. From the last week of September into early October, according to the Wall Street Journal, China has accelerated its soybean purchases.

An increase in exports to China is a very good sign for the ongoing trade negotiations. If this trade conflict gets resolved soon, a relief rally for U.S. stocks is quite possible, on top of the already strong year-to-date performance (the S&P is up 18.5% so far this year).

But a trade dispute, which often results in added costs for manufacturers and consumers, creates uncertainty. Smaller companies, which are less flexible and less financially strong than their larger peers, can be especially vulnerable.

Companies in tariff-impacted sectors or with significant international exposure are also at risk. (It’s no wonder the market sold off 14% last year in the fourth quarter [Q4] alone.) One major soybean processor and trader, Bunge (BG), was absolutely decimated: the stock was down more than 22% in the Q4 of 2018. BG also lost 17.4% of its value in the past year, while the market gained 8%.

Remember: it took the promise of a rate cut, the first in 10 years, to stop and reverse the market’s Q4 2018 slide. Today, after two interest-rate cuts from the Fed, the market has the power of cheap money behind it.

A trade conflict resolution might help companies like BG recover, but it should also help the rest of the market push higher toward year-end.

Of course, anything can happen. If the trade war drags on, soybeans may turn out to be a less reliable indicator than the market now thinks. And while this “soybean indicator” looks reliable today, we can’t ignore the threat of a prolonged dispute.

For now, though, investors are optimistic. They continue to buy stocks which, especially after the rate cuts, remain attractive. And many cash-rich companies are likely to continue supporting the market by buying back their own shares when prices dip.

Stocks are also the best game in town for income. Case in point: stocks that can deliver strong yield—like utilities or real estate investment trusts (REITs)—are at the forefront of investment returns today.

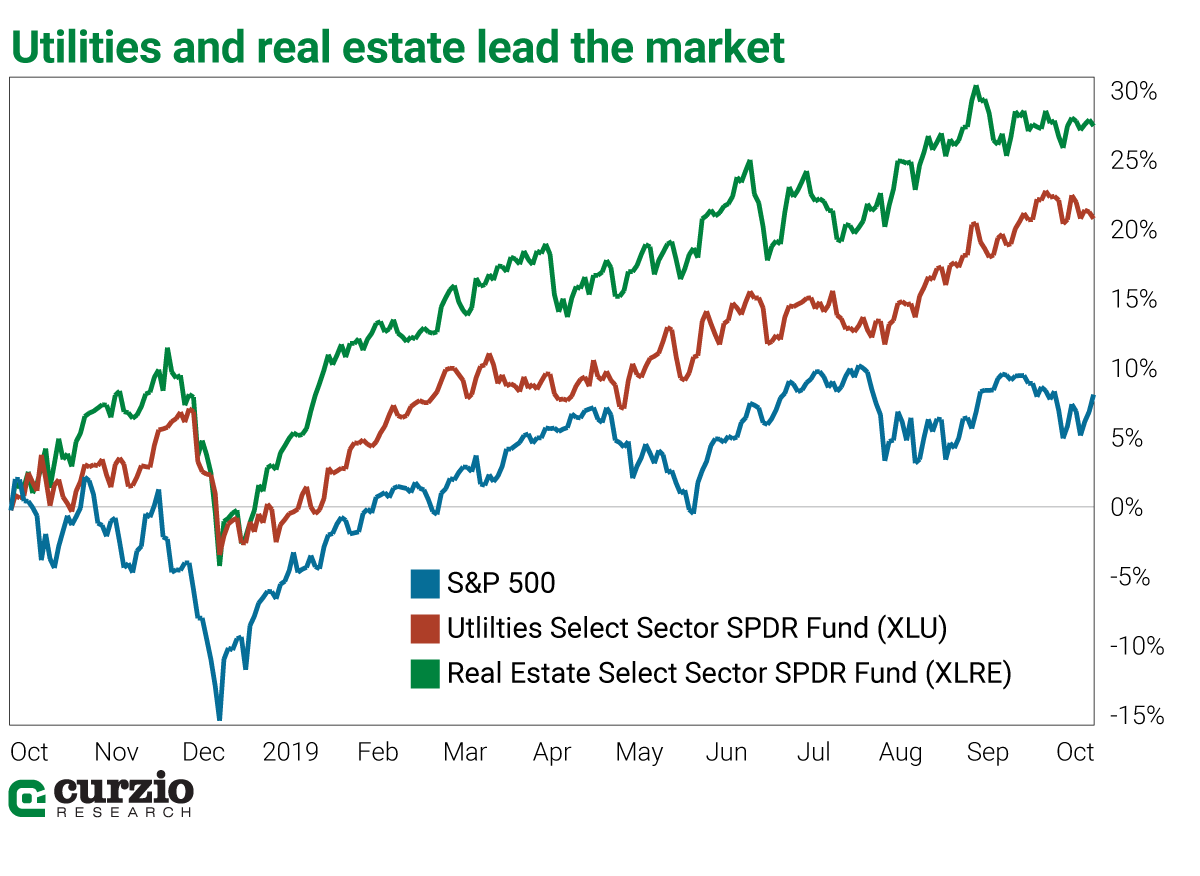

Investors flocked to these two sectors, driving their one-year returns to market-beating levels. These are, in fact, the two best-performing sectors in the past year. Both also outperformed the market by a very wide margin.

Utilities, represented by the Utilities Select Sector SPDR Fund (XLU), returned more than 20% in the past year, and REITs, as represented by the Real Estate Select Sector SPDR Fund (XLRE), delivered a mind-blowing 26.6% return (not counting dividends). This is better than the S&P 500’s 8%, and better than every other single market sector, too.

It’s a solid defensive strategy. Clearly, investors needed income. Declining yields—and the two interest-rate cuts this year—make this need even more urgent than ever.

But there’s another reason why REITs and utilities have done so well…

Both are largely domestic sectors. They’re minimally exposed to trade deals and many investors see them as the best way to play defense.

In today’s uncertain market, these two sectors are far from done. Declining bond yields across the board have driven investors to these higher-yield sectors. And they can retain their strength longer… especially in an uncertain market.

Dividend income from other sectors, too, should not be ignored.

As a group, income stocks are quite defensive. Companies that can afford to pay dividends and share profits with investors in a declining market are a valuable asset. In good times and bad, it pays to be an income investor.

Of course, not every income stock will do…

In the weeks ahead, I’ll review the safest and best ways to play income and collect dividends in today’s uncertain market.

Meanwhile, watch your soybeans: they may help us predict the future of the entire trade deal.

| Genia Turanova Analyst, Curzio Research |