“The stock market is not the economy.”

I’m sure you’ve heard this a hundred times. I know I have.

It’s a common explanation for the current stock market rally—which is perplexing most investors, since it’s happening as the global economy weakens.

While the stock market and the economy are related, the market is only a chunk of the economy, as it only represents publicly traded companies.

Although publicly traded companies come in all sizes, the stock market mainly reflects the health of the biggest ones. And these companies don’t cover all the elements of a well-functioning economy.

For one thing, small businesses are a critical part of the economy—representing nearly half of gross domestic product (GDP).

As of 2008 (the last year this data is available), small businesses produced 46% of private nonfarm GDP in the U.S. But, since they’re not public, you can’t invest in them via the stock market.

Government operations and services are another huge part of the economy. Obviously, these aren’t organized like public companies. (You can’t buy stock in public transportation or the post office.)

But the stock market ignores these important parts of the economy.

When you look at the S&P 500, you’re only seeing investors’ expectations for publicly traded businesses.

In other words, the S&P 500 could keep going up… even while big chunks of our economy continue to struggle over the next year or more.

And there’s another reason I’m mentioning the split between the stock market and the economy… It’s one of my methods for finding misvalued companies—those that will benefit (or lose) as a result of current macroeconomic trends.

Today, I’ll tell you how to use these trends to your advantage.

The market is forward looking… But that doesn’t mean its predictions will ultimately come true.

The market reflects the current thinking of all investors—in other words, it represents our “collective opinion” about how public companies will do in the future. If we’re collectively wrong, the market will reverse… if we’re right, it will keep going in the same direction.

So, what does the current market tell us about the outlook for public companies?

To me, the recent market action shows a much more difficult future than you might assume by simply looking at the S&P 500.

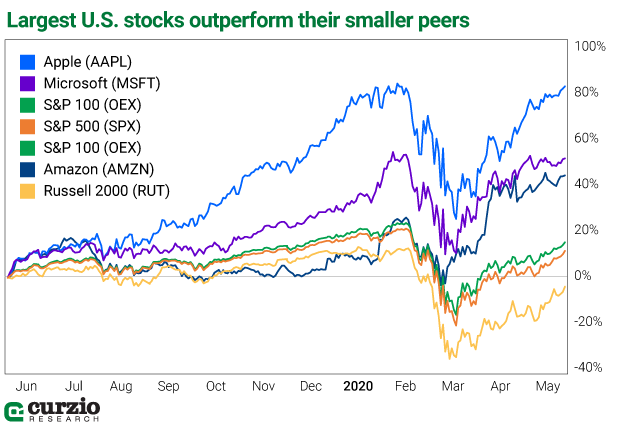

For one thing, smaller companies—represented by the Russell 2000 Index—have been underperforming their large-cap counterparts.

Secondly, mega-cap stocks have been the strongest market performers recently. You can tell by looking at the S&P 100 Index, which tracks the top 100 stocks within the S&P 500.

So far in 2020, the Russell declined more—and recovered less—than either the S&P 500 or the S&P 100.

And, while the S&P 500 is up 11.4% over the past year, the Russell lost 3.7% of its value. Meanwhile, the 100 largest stocks in the market are up more than 15%.

Lesson No. 1: In the current economy, bigger is better.

The market is giving us a clear message: the bigger a company is… the better its outlook.

The biggest companies (the leaders) will gain market share from their smaller rivals. That’s why large caps are outperforming small caps by a wide margin.

Put another way, the market is telling us we’re in a “winner-take-all” economy… where a few big names will capture the vast majority of future profits.

If you’re skeptical of this idea, take a look at the performance of the biggest stocks.

The three largest U.S. companies—Microsoft (MSFT), Apple (AAPL), and Amazon (AMZN)—have left the rest of the market far behind. MSFT is up 50.5%… Amazon is up 43.3%… and Apple rallied more than 80%, all in the course of just one year.

The five largest U.S. mega caps also include Alphabet (GOOGL) and Facebook (FB), up 36.5% and 37.4% over the past year, respectively.

These five giants are also among the main beneficiaries of several existing long-term macro trends, including the growth of ecommerce, the cloud, and the transition to social media.

As a group, they’re also benefitting tremendously from the lockdown conditions across several U.S. states, which have massively accelerated the growth of the “work-from-home” trend.

The strong performance of these three names is understandable. They have wildly successful businesses and rake in billions in annual profits.

But lately, it seems many investors have been following a “growth at any price” strategy. In other words, they’re plowing money into unprofitable growth businesses… and driving their stocks higher.

One example is Wayfair (W), a cash-bleeding home furnishing retailer that’s benefitted recently from the work-from-home trend, such as the need to prepare our home offices or children’s rooms for the new realities.

Although the company’s recent results show no sign of future profitability, investors applauded the revenue boost and drove up Wayfair’s stock price to sky-high levels.

At some point, valuations will matter again. That goes for both overvalued and undervalued stocks.

But right now, the market is bidding up companies that it expects to benefit in the new economy… and it’s avoiding their smaller rivals, as well as “old economy” (value) stocks.

The upward track of many recent winners—which include a slew of work-from-home beneficiaries, such as Wayfair or Zoom Video (ZM)—will eventually reverse. Unless these companies figure out how to make money, they will ultimately lose out.

But I wouldn’t try to short this group. At least… not yet.

Under these economic conditions, perceived beneficiaries of the COVID-19 economy, as well as a few giants continuing to dominate the market, can keep outperforming. That trend could easily continue for many more weeks before the market sees enough evidence to the contrary.

Lesson No. 2: Don’t fight the Fed

The current stock market rally wouldn’t be possible without the U.S. Federal Reserve’s unlimited quantitative easing (QE) and zero-rate policies.

On May 12, the Fed began purchasing bond exchange-traded funds (ETFs) through the Secondary Market Corporate Credit Facility. In just one day, central bankers purchased $305 million in bond ETFs on the open market. At the end of May, they’ve already spent $1.3 billion on ETFs.

This makes corporate borrowers more comfortable. It also makes investors more aggressive. The logic here is that if you can lend to a risky corporation, and if there’s an ultimate buyer, your risks are lower and you’ll lend (i.e. buy corporate bonds) more and/or at lower rates.

The Fed’s bond buying boosts the economy, since it improves the fiscal health of U.S. corporations. At least, that’s the idea behind the policy. And it boosts the stock market in the process.

The Fed-provided excess liquidity is another reason unprofitable—yet rapidly growing—companies are all the rage with investors today. These companies burn cash on operations costs—and yet they don’t have profitable businesses… so they need to get cash in other ways. They can get this money by either borrowing or issuing new shares. Zero-rate policies help make both sources of capital cheaper (and the stocks more attractive).

“Don’t fight the Fed” is a good strategy in any market conditions. But it’s even more valid today… our collective outlook doesn’t want the free money to end.

But even this strategy is getting riskier in the economy constrained by the coronavirus, with businesses struggling to generate revenue growth, and when nothing is certain.

So while you can benefit in the short term from growth companies, there are safer ways to play unlimited QE… such as gold (one of my favorite hedges) and bitcoin—assets with limited supply that will hold value while the dollar declines.

As my colleague Chris Gaarde said yesterday, we can’t print money forever and expect the value of the dollar to hold.

While we shouldn’t fight the market or the Fed, no trend lasts forever. We can use this time to build a variety of hedges for when the Fed’s money printer takes a well-deserved break.

Note from Frank: When this market eventually stops going up—and it will—just ONE hedge using Genia’s elite Moneyflow Trader strategy could be all it takes to counteract your overall losses.

Learn why I’m following Genia’s Moneyflow Trader advice with my own money… and how you can get access to her upcoming income advisory—a launch I’m incredibly excited about—FREE.