Everyone understands how investing is supposed to work.

You buy the stock of a great company… the price goes up over time… you sell the stock for a profit. Easy, right?

It sounds simple, and as a general strategy it works well enough.

But even investment professionals get beaten by the market. According to the latest data from analytics firm Morningstar, in June 2019, around 56% of active funds lagged their “buy-and-hold” peers over the 12 months prior. Over time, the difference is even more striking: Only 23% of all active funds outperformed their buy-and-hold rivals over a 10-year period ending June 2019.

If you have the time and patience for it, buying and holding is an effective, low-risk strategy. A long enough time frame can ease the pain of even the worst market crash or disaster…

The question is, how long will that take? And how much are you willing to watch your portfolio fall in the meantime?

Some investors get around this by trading options. Buying puts on a stock you own can act as insurance and limit your downside.

But there’s another tool to consider. It’s a strategy that has a bit of a bad reputation, but it’s not as complicated as you might think. And it can really juice your returns in a falling market…

I’m talking about short selling.

When you short a stock, you borrow shares from your broker and immediately sell them in the market. Then, at some point in the future, you buy those shares back and return them to the broker.

The difference between the price at which you sell your borrowed shares (step one) and the price at which you buy the shares back (step two) is the profit or loss.

Your goal is to buy those shares back at a lower price and keep the difference. For that, you need the stock to decline. If the stock goes higher, you’ll lose money when you buy back your borrowed shares.

You can use this strategy to make money on stocks that are overvalued or in distress, like the department store giant Macy’s (M).

Say you wanted to sell short 100 shares of Macy’s a year ago when it was about $33 a share…

First, you’d borrow the shares and sell them at the $33 market price. This would initiate the short sale and generate $3,300 into your margin account.

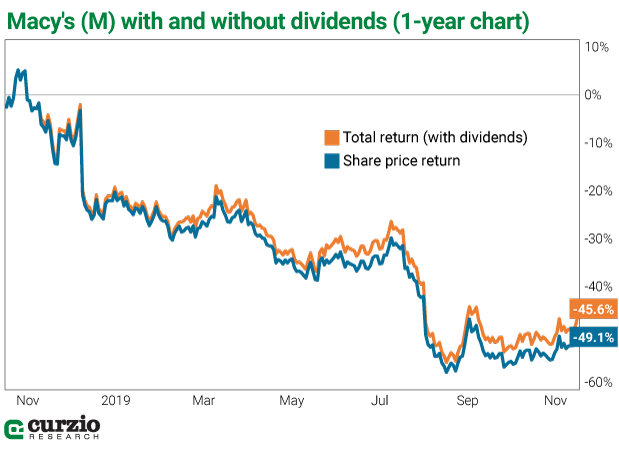

Fast-forward one year… Sure enough, M has fallen to about $17 per share—a 49% decline.

You can now buy back the borrowed shares at a much lower price.

Buying back 100 shares of M would cost you $1,700, and your profit would be about $1,600 ($3,300 from the initial sale minus the $1,700 you spent to buy back the stock).

You see how this works, right? If the stock price goes down, it’s good for the short. You sold the borrowed shares at the higher price ($33), bought at a lower price ($17), and pocketed the difference ($16).

If the stock price goes to zero, you get to keep the entire $3,300—a 100% return on the trade. This is the maximum you can potentially make.

And what if the stock goes higher? Well, the sky’s the limit. There’s no ceiling to stop a rising share price. If your $33 Macy’s stock soared to $50, $80, or even $100, you’d owe your original $3,300 plus the difference.

Understanding the risks

Borrowing shares creates a liability for you, so it’s important to remember all short sales must take place in a margin account. In this account, you must maintain the minimum equity required by the terms of your agreement. In most cases, the margin requirement for a short sell is 35%… But, depending on the stock involved, your broker could raise that requirement to as high as 70%.

If market fluctuations reduce the value of the equity in your account, your broker may issue a margin call, which you must meet by adding funds to your margin account.

Failure to pay could result in your broker either selling securities in your account or buying back your short position, effectively covering it, without consulting you.

If you’ve never shorted a stock before, take baby steps… only invest what you can afford to lose and still sleep well at night.

Unlike buying puts—where the risk is limited to the amount you invest—shorting has unlimited downside risk. The stock could go much higher. So theoretically, there’s no limit to the amount you could owe if your short sale goes bad.

That’s a scary thought.

You could be wrong on the fundamentals. Your stock could rise with its peers… Or it could be driven sharply higher by the market. A rising tide lifts all boats—even the worst companies can be kept afloat if conditions are right.

Furthermore, if you’re shorting an income stock like Macy’s, which a year ago yielded 4.6%, you’re not entitled to the dividend. It goes to the person who lent you the shares. Your per-share overall return—whether a gain or loss—will be less by the total amount of dividend.

Then there are acquisitions to consider… Could the company be acquired? Is it likely? Anything is possible… But if it’s trading at a very rich multiple, that reduces the chances of acquisition. If not, what would an acquirer pay?

Also, think about any scenario where the company can turn around and become more attractive. Are there any acquisitions the company could make to boost earnings? Can it sell an underperforming asset? Can it take other steps to boost profit margins or revenues?

If you do decide to short a stock, do your homework. Start small. The risk of loss is real.

Selling short vs. buying a put

In many cases, selling a stock short can make more sense than buying a put option.

Unlike a put option, which has an expiration date, selling a stock is less time sensitive. It can be a good strategy when you’re betting on a decline, but not on the timeline for the decline.

Also, many smaller stocks simply have no options available. Or the options might not be liquid enough.

In some cases, buying a put is better. Sometimes, the market is so negative on a stock that its shares might not be available for borrowing. And as I mentioned above, your downside risk is limited with a put.

Understanding your potential upside and downside will be critical when selecting a method to play a stock’s or the market’s decline.

But when you’re right, your profits can be significant.

Had you owned Macy’s over the past year and reinvested its dividend, you’d still have lost more than 45% on the position.

If you’d recognized the dangers and sold this stock a year ago, it would have saved you a lot of money.

But if you took it a step further and turned around and sold M short, you could have made up to $16 per share (minus the $1.51 of per-share dividends, of course). The net result: $1,450 in gains on a 100-share short position (before margin costs and commissions). That’s a 46% return in one year.

Every investor should be prepared for a downturn. By understanding the investment tools at your disposal—including short selling—you’ll be prepared to benefit from shifts in the market that send most buy-and-hold investors running for the exits…

Until next time,

| Genia Turanova Editor, Moneyflow Trader |

Editor’s note: If you’ve never played the short side of the market, Genia shows you how—step-by-step—in Moneyflow Trader—a service designed to help you build your defenses against a market decline. The November issue—with two new ways to profit as stocks fall—releases Wednesday. Go here to gain access.