Right before the dot-com market crash of the late ‘90s, there was an enormous warning sign…

A manic surge of day trading.

Investors were buying eGain, or NetBank, or Pets.com in the morning, selling before lunch, then repeating this process a few more times before the trading day was over.

Buy low, sell high—and damn the torpedoes.

In the 90s, I had a friend (we’ll call him Joe) who day traded Xerox (XRX)… He’d buy shares in the morning only to sell the entire position as soon as his price target was reached. Then do it again.

Joe was relatively conservative, and Xerox seemed a safer choice than say, Pets.com, or one of the many other small, non-revenue generating companies investors were buying up simply because they had “dot-com” in the name.

His strategy worked well for a while… Despite some fluctuations, Xerox always rallied.

Until it didn’t.

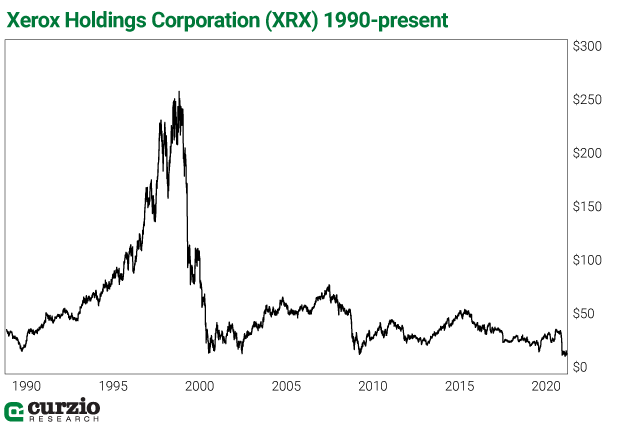

When the dot.com bubble burst in 1999, Xerox fell by more than 90% top to bottom.

The strategy had to be abandoned… and Joe graduated from day trading to investing.

He could’ve even stayed with his Xerox position for a while and recovered some of the losses. Unlike Pets.com, Xerox represented a real business… and the company survived the dot.com bust. But it was overvalued… As you can see in the chart above, the stock still trades well below its 1999 highs.

Today, we’re seeing a resurgence of late 90s-style day trading in companies with little to no revenue—like the already-bankrupt Hertz—in the hopes of unloading them tomorrow.

Thanks to the Fed’s unlimited QE, bond buying, and zero-percent interest rates, many investors have been lulled into thinking valuations no longer matter… that the Fed will continue to backstop the market…

But even if this were true, investing hasn’t stopped being a risky affair. So today, I’m going to give you three ways to play good defense… and avoid Joe’s mistake.

Day trading can be a profitable venture, especially in an extremely volatile market like we have today—but it’s not a game.

Even a day-traded stock needs to have value. If you can’t unload a position, you’d better be ready to hold long term… and hope the company had inherent value.

Today’s valuations assume that economic recovery will be sharp and fast… but that’s not a given. We’re a long way from even reopening fully, not to mention defeating the virus. As best I can see, the path to economic recovery will be uneven.

Plus, with bonds yielding next to nothing, investors are forced into stocks for income… and can take on too much risk relative to their age, risk tolerance, or the size of their portfolio.

The following three rules will help protect you from volatility—or worse, another market crash…

No. 1: Diversify your investments

Joe’s biggest mistake wasn’t the choice to trade vs. invest… his biggest mistake was the failure to diversify.

Of course, he could’ve owned a bunch of high-flying internet names… in which case, his portfolio would’ve been equally vulnerable.

But that wouldn’t be proper diversification.

If you own a basket of different sectors and companies, a single stock or sector tumble isn’t likely to bring the entire portfolio down.

Studies show that owning 25 to 30 stocks is enough… But these studies are often misunderstood.

For one, stocks must be unrelated. Owning 30 dot-coms in 1999 would have done very little to help protect a portfolio from the bust. But owning a dozen stocks from different sectors of the market would have helped tremendously.

Studies show the effect of extra diversification from each new position is reduced when you hold more than 30 stocks.

Often, even half that number is sufficient if the positions aren’t too closely related.

Diversification isn’t as easy as just picking a few different sectors and clicking “buy”… but the risks of insolvency, dividend cuts, profit warnings, and inflated valuations are diluted in a well-diversified portfolio.

No. 2: Control your leverage

The use of leverage—or borrowed money—is commonplace in investing.

Margin accounts, for example, are leveraged.

As you well know, buying on margin carries its own set of risks and rewards. Most importantly, margin buying allows you to invest with less money on the account. This pays off if your investment is profitable… but becomes more expensive if you book a loss.

A leveraged investment can generate higher profits (all else equal) than an unleveraged investment—and it will conversely result in higher losses vs. the unleveraged investment. Leverage cuts both ways, and investors must remember this every time leverage is used.

I often suggest using inverse ETFs as a shortcut to benefit from an expected decline in the market or a specific index.

But there are risks to ETFs, too… and these risks increase sharply for double- or triple-inverse ETFs—funds that use leverage to amplify the inverse returns of an index. This might look like the best tactic to use, but it’s risky—and such funds often lag the intended returns by a wide margin.

In short, if a product promises to deliver multiples of an index’s return or yield, it most likely uses leverage.

This is true for inverse ETFs. And this is also true for exchange-traded products that aim to double or triple the returns of a market or sector. These vehicles are designed to track daily changes only, and tend to underperform the desired return over longer time periods. And because of the use of leverage, the more volatile the action is, the more it will lag.

In sum, leveraged ETFs are designed for daily trading, and there’s no guarantee any will reach their target.

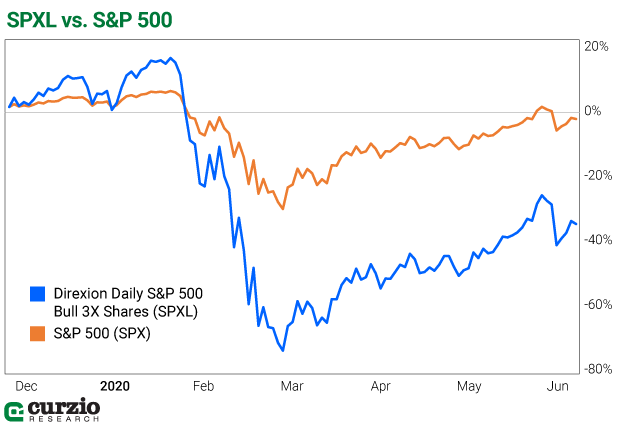

For example, 2020 has been a volatile time in the markets. The S&P 500 is down about 3.6% on the year… but holding a leveraged ETF means the damage could be much worse.

The Direxion Daily S&P 500 Bull 3X Shares (SPXL) is a triple-leveraged ETF that promises three times as much daily return as the S&P 500. But while the S&P is down nearly 4%, SPXL holders have lost more than 35% year to date. The ETF is simply not designed for longer time periods—and volatility makes it worse.

Know your investments… and be especially careful with the leveraged ones.

No. 3: Hedge your bets

Shorting the market with inverse ETFs or put options can go a long way to help you and your portfolio survive market volatility… and stay invested.

Contrary to popular opinion, hedges aren’t there to make you money. Professional investors use well-designed hedge positions to compensate for some of the risks they take in the rest of the portfolio.

Just like an insurance policy, a hedge doesn’t do much if everything is hunky-dory. But because it pays off in the case of an unexpected disaster… or when volatility rises to uncomfortable and uncontrollable levels… having a hedge allows investors to take bigger risks.

Of course, it’s possible to make money from your hedges. Owning a put option on an overvalued or otherwise undesirable stock can pay off big time… even when the market is moving higher. In fact, it’s a valid strategy that can make money in almost any market… if you know what to buy.

But generally speaking, a hedge will pay off when the rest of your portfolio suffers… And it’s why having a hedge helps weather volatility.

With the Fed as the ultimate market backstop, and with the record amount of fiscal stimulus being issued, investors might continue to throw all caution to the wind and invest like it’s 1999.

That would be a mistake.

By following the three simple rules above, you can invest safely… benefit from the market’s general propensity to move higher… and take advantage of more Fed free money policies.

Editor’s note: Right now, investors of all stripes are blindly diving into the market like it’s 1999… and the result for many will be just as catastrophic.

Subscribers to Genia’s Moneyflow Trader advisory have already seen triple-digit gains in a handful of defensive positions this year… all during extreme COVID-19 volatility. And with the market still swinging wildly, the odds are good these winning hedges won’t be the last…

Listen as Frank explains why Genia’s Moneyflow Trader option strategy is the best way to play defense.