It’s hard to believe that just two weeks ago, the S&P 500 set a new record high… and today, many are worried about an impending market crash.

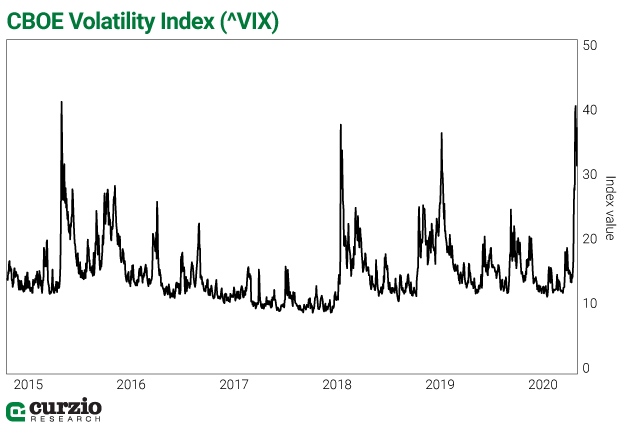

So much has happened since February 20 as a result of the COVID-19 outbreak… including the market’s fastest-ever decline into correction territory… 1,000-point swings on the Dow Jones Industrials… and the sharpest volatility spike since the summer of 2015.

But don’t discount the market’s resilience…

The Fed just executed an emergency 0.5% interest rate cut (and promised more if needed). And U.S. lawmakers just agreed to an $8.3 billion response to the coronavirus. Lower interest rates and massive government spending should help stocks.

Still, as they say, hope for the best but prepare for the worst.

To benefit from the market’s long-term uptrend, stick to your best long-term investments…

And to protect yourself from decline, invest in some market hedges—positions that would benefit if the market weakness returns.

A good hedge is like insurance: You don’t need it unless things get really hairy. But if they do, you’ll be glad you’ve spent money.

Market insurance—hedging—won’t pay if everything is great and stocks are rallying. In that case, you’ll be rewarded by your long investments—those that rise together with the market.

But considering the challenges—and uncertainties—that the coronavirus has brought to our lives, chances are the market rout isn’t over. And if so, you’ll be happy you have insurance.

If you’re one of the many investors who don’t hedge because you’re uncomfortable shorting stocks, or trading options, there’s a simpler way to do it…

Thanks to the proliferation of exchange-traded funds (ETFs) I’ve discussed recently, buying a hedge is now easier than ever.

In essence, an ETF is a basket of stocks or other instruments that trades as one. With just a single trade, you can do lots of things. You can go long the S&P 500 Index… invest in a specific sector… buy a variety of commodities or trade currencies…

Or hedge.

Some ETFs are designed to generate positive returns when the market (or a specific sector) declines.

These are called inverse ETFs.

These ETFs are constructed with one thing in mind: to create inverse exposure to the market or sector.

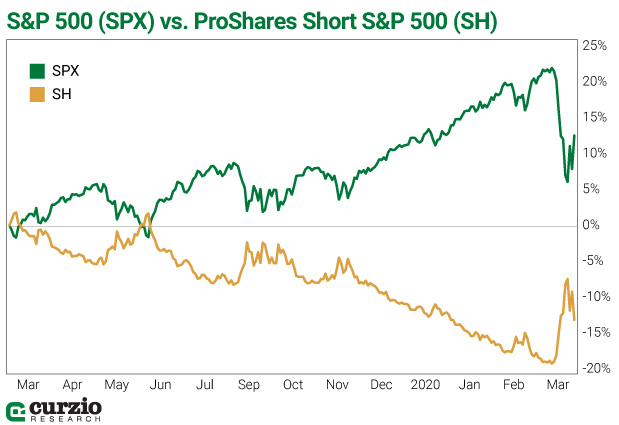

For example, ProShares Short S&P 500 (SH) is designed to mirror the daily moves of the S&P 500. When the S&P is down, SH is up. But when the S&P is up, SH is down—by approximately the same percentage.

ProShares Short Dow 30 ETF (DOG) is designed to go up when the Dow is down… and ProShares Short Russell 2000 (RWM) does the same, only for the small cap index.

On Wednesday, March 4, markets jumped 4.2%… and SH declined 4.2%. The Dow 30 was up 4.5%… and DOG declined 4.5%. The Russell 2000 small cap index was up 3%… and RWM was down 2.9%.

As you can see, these inverse ETFs track the daily moves in their respective indexes quite closely—both in the short-term and longer term.

From its highest point on February 19 until month-end, the S&P 500 declined by 12.8%.

At the same time, SH rallied 14.2%.

By simply buying the SH ETF, you’ve hedged the market without applying for option trading.

Note that hedging with ETFs still involves leverage… only in this case, it’s the ETF that applies leverage (by using derivatives such as options)—and thus you need to be mindful of the risks.

An inverse ETF that is created to be a mirror image of the market—like SH—is the least risky of the group.

But there are now ETFs that allow investors to benefit from market or sector declines by a factor of two times (2x) or even 3x.

For instance, if you buy the ProShares UltraShort S&P 500 (SDS), you’ll be positioned to inversely double the daily returns of the S&P 500. When the market is down 1% in a day, SDS will be up 2%… but when the market is up on a day, SDS will be down 2%.

This extra leverage makes it easier to hedge with just a small ETF position.

But this unique feature of doubling the inverse of the S&P 500 makes SDS a riskier hedge than, say, SH. Market losses are magnified as SDS gains, but market gains are magnified as SDS losses.

And here’s another risk specific to leveraged/inverse ETFs: Because such ETFs are designed to only reflect daily moves of the market or sector they’re tracking—and they reset daily—the losses can compound even faster. Moreover, because of these quirks, such ETFs tend to underperform the expected 2x inverse returns if held for a long time.

For instance, over the past 52 weeks, the S&P 500 was up 12.2%—but SDS lost more than double that, or 25.5%.

And volatility only exacerbates this problem. While year-to-date (as of March 4), the S&P 500 lost 3.1%, SDS gained—but only 3.4% (much less than the expected double).

It’s a similar story with the rest of leveraged ETFs…

The risks are even stronger for 3x leveraged inverse ETFs, such as the ProShares UltraPro Short S&P 500 (SPXU). SPXU is designed to deliver 3x the opposite return of the market. Just like SDS, it’s not suitable as a buy-and-hold investment… it’s better used as a trading instrument.

Had you held SPXU in 2020, it would’ve made money for you. But because of the particularities of leveraged ETFs, it wouldn’t have profited 3x the decline in the S&P. As of March 4, it only shows a year-to-date gain of 3.2% (vs. the decline of 3.1% for the market).

If you’re thinking about a long-term hedge, I recommend 1x inverse ETFs. These are less risky and can work wonders for your portfolio health.

Just remember that leveraged ETFs could lose more money than they make as hedges. Use them wisely… monitor them daily… and try to avoid 2–3x leveraged ETFs unless you understand their limitations and accept the heightened risks.

Next week, I’ll talk more about hedging with ETFs… including ETFs to benefit from market volatility.

P.S. Last week, my colleague Frank Curzio released a special report containing all the details he uncovered in his coronavirus research.

It includes some names and sectors to avoid… the frightening virus data China is trying to keep under wraps… plus two MORE ways to protect your portfolio in the face of global virus uncertainty. (These names are already turning a profit.)

You can access this coronavirus special report—including two actionable ways to protect your portfolio and profit—with a risk-free $49 subscription to Curzio Research Advisory.