It’s been a rough few months for growth stocks.

Portfolio managers have been selling them and buying value plays. And the selling accelerated last week as investors focused on some eye-popping inflation numbers.

But last week also gave us the first sign of a trend reversal.

In short, the selling appears overdone in the short term. And there are signs that inflation fears have peaked… for now.

This “trend reversal” creates a huge opportunity in growth stocks… including a beaten-down fund in the sector.

But first, let’s take a closer look at the latest stock market action…

The selling in growth stocks is starting to fade

As I explained last week, there’s been a big rotation out of growth stocks and into dividend stocks—a trend that’s been building for months.

Back in March, I noted institutional investors were pushing into dividend stocks. And I highlighted real estate stocks as another area seeing strong buying.

In short, the “sell growth, buy value” theme has been going strong for over a month. And we can see it in the Big Money data.

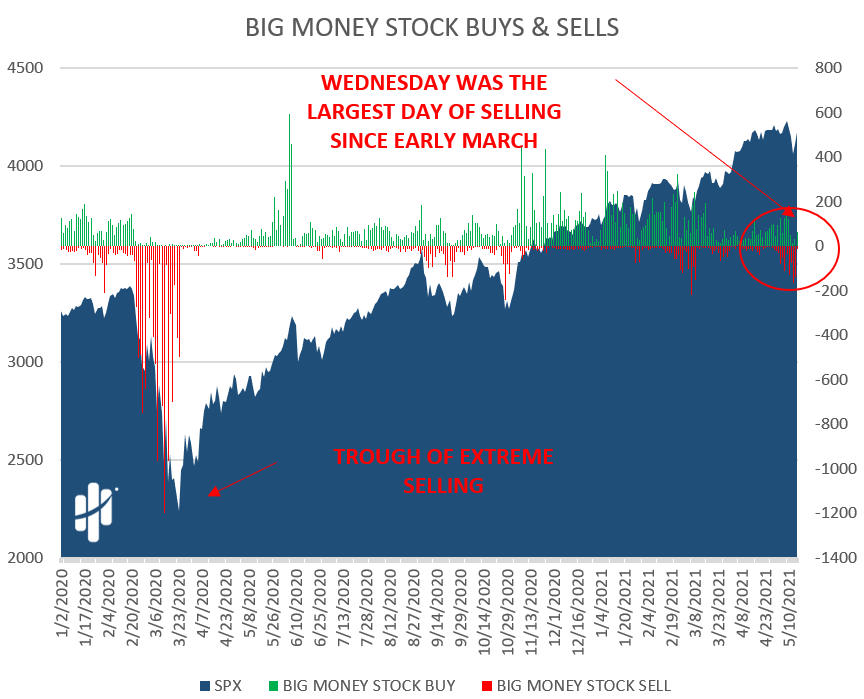

Below is the Big Money Stock Buys & Sells chart, which tracks the daily buying and selling across thousands of stocks. Green bars indicate lots of buying on a particular day, while red bars show more selling. Take a look…

As you can see, the red bars have been increasing over the past few weeks. The rising green bars show money going into value stocks. And the red bars indicate big selling in growth-heavy sectors like technology and healthcare.

And last Wednesday was the largest day of selling since early March. It lines up with the release of the latest inflation data…

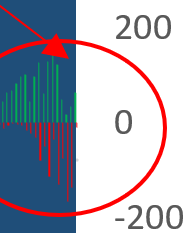

Let’s zoom in on what stuck out to me at the end of last week. On Friday, the selling slowed dramatically and there was a surprising amount of buying…

Notice the last piece of data: the small red bar on Friday. It was the lowest amount of selling in over two weeks. Meanwhile, there was a decent amount of buying, which shocked me. In other words, the sellers vanished.

In short, last week looked like a possible peak in selling. Friday’s action was very bullish… and could be the first sign of a reversal in the “sell growth, buy value” trend.

This could be the near-term low for many unloved growth stocks, as they start the bottoming process…

Inflation fears could fade over the next few weeks

Unless you’ve been living under a rock, you know inflation is ramping up.

Inflation concerns have been one of the biggest issues for investors in recent weeks. And for good reason… Prices for goods around the globe have been rising.

On Wednesday, the U.S. Bureau of Labor Statistics released the latest Producer Price Index data. The numbers showed a 0.6% jump in prices from March to April. That’s a huge increase, especially compared to consensus estimates for a 0.3% increase.

The news sent growth stocks plunging. The Nasdaq Composite index fell 2.6%. The bears were out in full force.

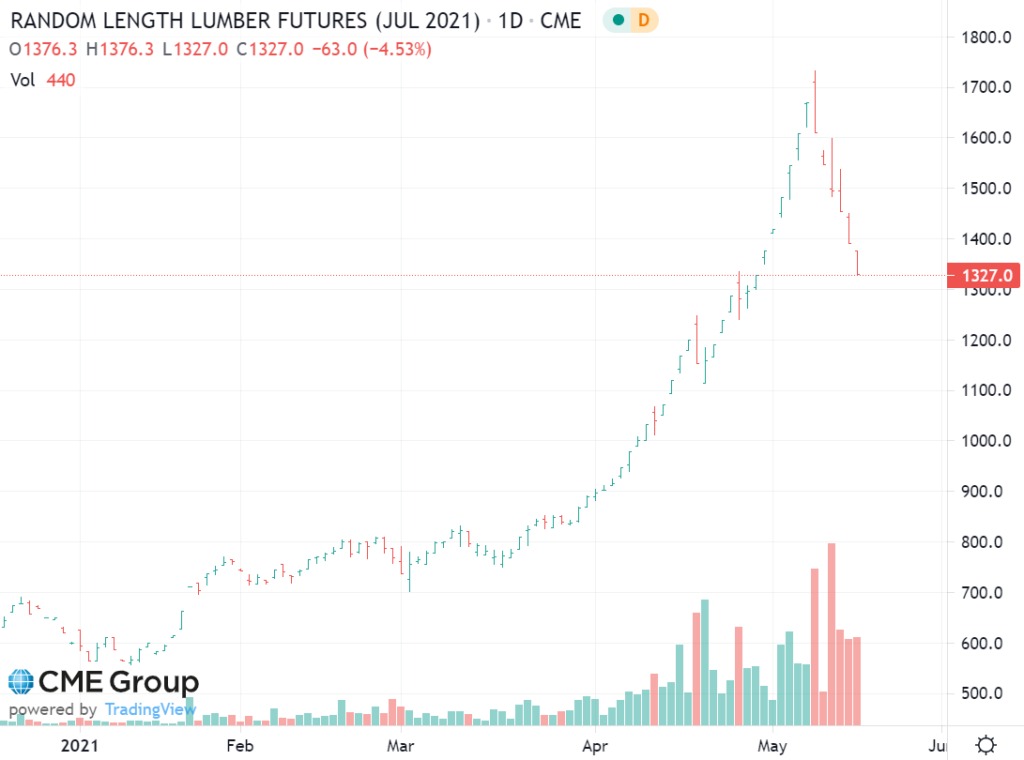

But those fears started to shift on Thursday and Friday as some inflation gauges began to fall. For example, lumber futures fell by over 20% over the past week…

Falling commodity prices sent growth stocks ripping. The Nasdaq-100 fund (QQQ) surged more than 2.2% on Friday.

Don’t get me wrong: Inflation is in an uptrend. But eventually, the stock market prices in the problem. Investors already expect big inflation numbers. And once their expectations catch up to reality, we’ll likely see a big rally.

In short, I’m expecting a big rebound in beaten-down growth names. And one of my favorite ways to play a growth rally is to bet on the hardest-hit growth stocks.

One fund in particular has been battered to a pulp during the recent growth downtrend—the ARK Innovation ETF (ARKK). It holds many of the fastest-growing tech names out there, like Shopify (SHOP) and Zillow Group (Z).

The fund has massively underperformed the market, falling 16.2% since the start of 2021… compared to a 11.8% gain for the S&P 500 (SPY).

ARKK has been caught in the crosshairs of the growth stock pain. But as the selling slows and inflation fears temper, this fund will ramp… fast.

The bottom line is this: Selling in growth-heavy areas slowed massively on Friday. Popular inflation gauges fell hard, too. This could start a big reversal for many of the hardest-hit areas of the market.

The ARK Innovations ETF (ARKK) is a great way to play the reversal. In the short-term, this fund could easily rip to the $112 level… about 10% higher than the current price.

Finally, if you’re curious about which stocks are on my radar… the ones with explosive upside potential… be on the lookout for my new advisory: The Big Money Report—launching this summer.

Editor’s note:

To get the best stock picks in any market… before Wall Street catches on… there’s no better place to start than Curzio Research Advisory…

Each month, Frank sends a new stock recommendation from a diverse range of sectors—growth, income, gold & silver, and even crypto plays.

Learn how to access the full portfolio—risk free—for 30 days.