Last month, I explained how focusing on stocks with rising dividends is a winning investment strategy… even in bear markets.

But there are hundreds of dividend stocks to choose from—and they’re not all created equal.

For newer investors, it’s easy to focus on dividend yield (how big of a payout you can expect over the next 12 months)…

But that’s usually a big mistake: Higher yields can be enticing… But they’re often a sign of stress.

For example, if a stock is trading at $10 and pays a $0.40 annual dividend… its yield is 4% (since $0.40 divided by $10 equals 0.04, or 4%).

However, let’s say the company runs into trouble and its share price declines…

Suddenly the same annual dividend looks like a much higher yield, percentage-wise. But in reality, there’s a good chance the company will have to slash its dividend soon… as it adjusts for the tougher business outlook.

Especially in today’s uncertain environment, it’s critical to focus on best-in-breed dividend stalwarts—businesses strong enough to weather a market storm while maintaining their dividends.

To find the best dividend stocks, there’s another number I like to check first. This critical metric helps us size up a company’s ability to keep paying out its current dividend rate…

It’s called the dividend payout ratio (DPR).

Put simply, the dividend payout ratio tells us how much of the company’s profits are being used to pay its dividend. In other words, it takes the annual dividend and divides it by the company’s net income. The result is a simple percentage.

And the lower, the better!

A high payout ratio means the company is using up most of its profits to pay its dividend. That may sound like a good thing… but it can spell trouble if earnings decline. If the company runs into headwinds, it might not have enough profit to maintain the business AND keep paying the dividend.

In short, a high DPR increases the chances of a possible dividend cut in the future.

On the flip side, a low payout ratio means a company isn’t using much of its net income to pay its dividend. That means there’s ample room to maintain—or even grow—the payment… even if business is a bit slow.

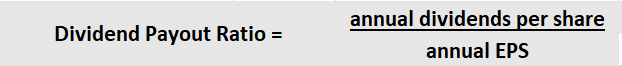

To calculate the DPR, we start by taking the dividends (per share) paid over a year… and divide that number by the company’s annual earnings per share (EPS). Here’s the formula:

Let’s look at an example…

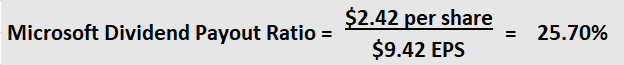

I’ve owned shares of Microsoft (MSFT) for years. Everyone knows this software giant. It’s one of the steadiest performers in the entire tech sector.

Over the past 12 months, MSFT has paid $2.42 in dividends per share. Over that same time period, EPS is $9.42.

As I mentioned above, we just need to divide those two numbers.

Generally, a DPR under 50% is considered healthy. Once you start going above the 50% level, it means the company is using most of its earnings to pay the dividend.

If that’s the case, you’ll want to investigate further by looking closely at the business and competitive landscape. If there’s a ton of competition (or other factors that could cause a decline in profits)… it’s safer to avoid the stock.

In this case, Microsoft is well below the 30% threshold, so we can be confident in the company’s ability to keep paying the current dividend—and possibly grow it in the future. Even if earnings fell by 70%, the company would still be able to cover the dividend payment without dipping into the cash on its balance sheet.

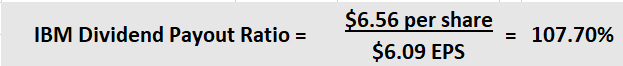

Next, we’ll look at a company with a higher dividend payout ratio: International Business Machines (IBM)—another technology giant with a long history of paying dividends to its shareholders.

However, it hasn’t been growing like Microsoft. Over the past 10 years, IBM’s revenue has fallen 46%… while Microsoft’s revenue has soared 140%.

IBM has prioritized keeping its dividend stable… Nevertheless, the company’s lack of growth translates to a high DPR.

Let’s do the math. Over the past 12 months, IBM has paid $6.56 in dividends per share, while delivering EPS of $6.09.

IBM’s DPR of over 100% means the company is using all of its earnings (and more) to pay its dividend.

Is there a chance IBM’s dividend could be in jeopardy… especially if the business faces a downturn? Possibly. The company has paid and raised its dividend for 26 consecutive years. That’s an impressive track record… but the high payout ratio makes me a bit wary. Either way, it suggests there’s little room to increase the dividend.

Hopefully, IBM starts growing its bottom line in the near future. Higher earnings would push down the dividend payout ratio… and give us confidence about its ability to maintain the $6.56 annual dividend payment.

But as you can see by the numbers above, Microsoft is the clear winner between these two choices.

Here’s the bottom line: All dividends are not created equal. By understanding the dividend payment ratio, you’ll be able to gauge a company’s ability to maintain and increase its future payouts.

Be careful with companies that have a high DPR… They’ll likely be the first ones to cut their dividends during a downturn.

To learn more, check out this Lessons with Luke video on dividends, where I show you how to quickly check the DPR of your favorite stocks using Yahoo! Finance.

And if you’re eager to dig into other companies, email me some dividend stocks on your radar.

Editor’s note:

You don’t have to sacrifice growth to find income in this market…

In Unlimited Income, Genia Turanova uncovers safe, inflation-ready assets that deliver market-beating dividends… AND quick capital gains.

For that rare balance of income and growth… join Unlimited Income—risk-free.