Like clockwork, the markets always find something to worry about.

Last week, the big news was about a potential increase in the capital gains tax rate. The financial media churned out a ton of headlines highlighting this new threat.

But these fears are usually overblown.

There’s never a shortage of negative news. And yet… stocks still cruise higher over the long term.

Headlines about rising taxes don’t worry me. In short, most headline fears tend to be nothing but noise… and shouldn’t affect your long-term investing.

In particular, one sector is primed for gains… even with a capital gains tax increase.

Why I ignore the headlines

On Thursday afternoon, stocks were on track for another positive day… until a headline hit about President Biden’s latest tax proposal. It’s not public yet, but it’s rumored to include a big increase to the capital gains rate—the tax applied to investment gains. The news sent the S&P 500 down more than 1%.

On the surface, any news of a possible tax increase is unsettling for investors. The current base rate for capital gains is 20%. Biden’s plan could more than double that rate—to as high as 43.4%.

But, here’s the deal: It’s just a headline at this point. Even if it’s accurate, the numbers could get reduced as the plan goes through the legislative process. More importantly, the increases are targeting the very rich. The higher tax rates only apply to individuals earning $1 million a year or more.

Nevertheless, there’s a bigger lesson here…

Big, scary headlines rarely amount to much. In fact, they’re more likely to cause you to miss out on huge long-term gains.

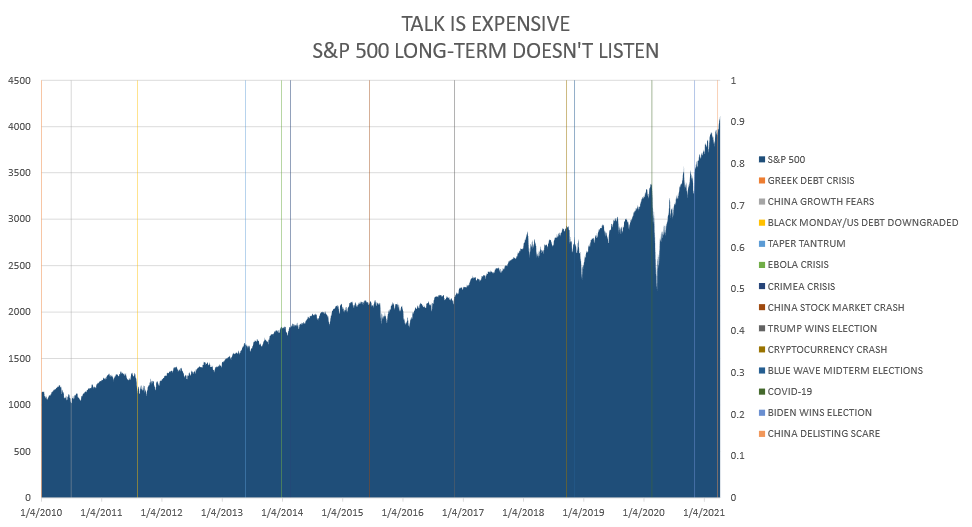

Off the top of my head, here are 13 “crises” that made headlines over the past decade:

- The Greek debt crisis

- China growth fears

- Black Monday/U.S. debt downgraded

- Taper tantrum

- The Ebola crisis

- The Crimea crisis

- The China stock market crash

- Trump wins 2016

- The cryptocurrency crash

- Blue wave 2018 midterm election

- COVID-19

- Biden wins 2020

- China delisting scare

Man, those make my head spin just reading them. What’s an investor ever to do? Well… history says you should stay the course.

Below, I’ve plotted all those scary headlines on a chart of the S&P 500. The message that I’m seeing is this: The stock market doesn’t care about headlines. There’s no sign of them affecting long-term performance.

Now, I know that’s easy to say in hindsight. But it’s true.

Each time the market faced uncertainty and scary headlines, we made it out OK.

And there’s a clear lesson for investors: Headline talk can be expensive if you listen to it.

Real estate stocks are the place to be (if the capital gains tax goes up)

If you aren’t familiar with real estate investment trusts (REITs), they’re essentially just real estate stocks. REITs are required to pay out a minimum of 90% of their taxable earnings. Because of this, they tend to have high yields.

But here’s the thing: Most of them pay out ordinary dividends (rather than preferred dividends, which are taxed at a lower rate). And ordinary dividends are taxed as regular income.

In other words, REITs don’t benefit from the lower tax rate on capital gains. They’re always taxed at the higher, ordinary income rate.

So, if capital gains tax rates rise to match ordinary income rates, REITs won’t feel the penalty like other groups. In fact, higher capital gains rates would make REITs look more attractive relative to other investment options.

REITs saw big buying last week after the headlines hit.

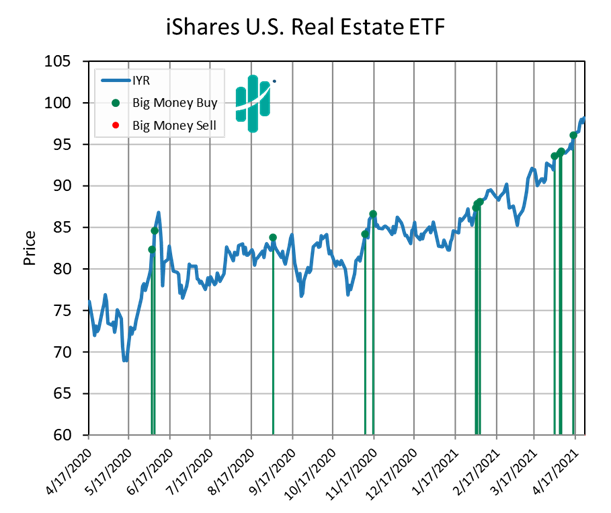

Below is a chart of the iShares U.S. Real Estate ETF (IYR). This fund tracks the Dow Jones U.S. Real Estate Capped Index. The green bars are the Big Money buy signals over the past year.

This chart shows two important things. First, you can see IYR is in a solid uptrend over the past year. And second, there are plenty of buy signals (the green bars). That means IYR has strong support from big institutional buyers.

If you’re looking for a sector that should benefit from higher capital gains taxes, real estate fits the bill. And the iShares U.S. Real Estate ETF (IYR) is an easy way to get exposure to the sector.

Here’s the bottom line: Headlines rarely amount to much over the long term. I believe the recent capital gains tax hike scare won’t amount to much either. And REITs are one group that stands to benefit.

And hey, the Big Money is grabbing these stocks too.

As a reminder, if you’re looking for stocks with explosive long-term potential to add to your portfolio, be on the lookout for the latest newsletter from Curzio Research—The Big Money Report.

Editor’s note:

If you want to take the guesswork out of finding the best dividend-paying stocks for the Biden era—including REITs—check out Genia Turanova’s Unlimited Income. Genia’s shown you don’t have to sacrifice growth to earn income—with recommendations that deliver market-beating dividends AND quick capital gains as high as 104%.

Don’t wait to start accumulating generational wealth. Become a member of Unlimited Income today for a 66% OFF discount.