They say the trend is your friend… and right now, my data is showing one trend continues to gain momentum: dividend stocks.

I told you about this theme over a month ago. I noted, “high-dividend stocks are pulling ahead while growth sectors—like technology stocks—have taken it on the chin.”

And my data shows the rotation into dividend stocks is only getting stronger. If you haven’t positioned your portfolio for this trend yet, I have two great ways to play it.

But first, let’s take a peek under the hood of the market…

Dividend stocks see a surge in buying

The strongest trends reveal themselves whenever volumes pick up.

In other words, whenever there’s a big jump in trading volume, you should look closer to see what institutions are doing.

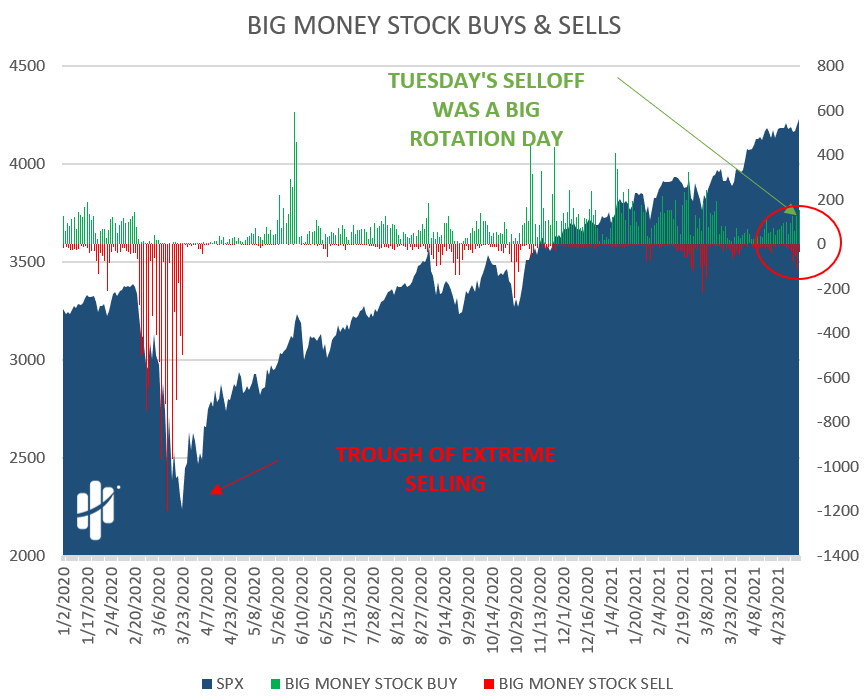

Last week, trading volume hit its highest level in over a month. The graph below shows the daily Big Money trading volumes. I’ve circled Tuesday’s activity because it was the single largest day of unusual trading in six weeks. (I use the term “unusual trading” to measure the number of stocks that saw higher-than-usual trading volumes relative to recent history.)

When there’s a lot of trading activity, we can see which stocks are getting bought… and which are getting sold. We can then use this data to pinpoint that bigger trend.

The chart below shows the daily tally of stocks being bought and sold by Big Money. Green indicates buying and red indicates selling. I’ve circled last week’s rotation:

Let’s zoom in even closer…

See all of the green and red? That’s the rotation I’m talking about.

The easiest way to prove this idea is by splitting up the buys and sells, then looking for differences.

In this case, the biggest difference between the two groups is their average dividend yield. Of the 570 stocks that were bought, the average dividend yield was 1.52%. This group includes sectors like materials, energy, industrials, and financials.

Meanwhile, the 310 stocks in the “sell” group had an average dividend yield of just 0.25%. This group includes growth-heavy sectors like technology and healthcare.

In other words, investors are taking their money out of growth stocks and putting it into dividend stocks.

The best—and easiest—way to play this trend is by buying dividend-focused funds. My two favorites (which I highlighted in early April) are the Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) and the Energy Select Sector SPDR Fund (XLE). SPHD has a dividend yield around 4%. XLE focuses on stocks in the energy sector, and has a yield above 4.2%.

Since I first highlighted these exchange-traded funds (ETFs), SPHD is up about 6% and XLE is up more than 9%. And based on last week’s trading activity, it’s still a great time to be buying these funds.

Dividend stocks are where the “juice” is right now… If you haven’t positioned yourself for this trend yet, SPHD and XLE are some of the best funds to own.

P.S. For the best high-yield plays in the market… make sure to check out my colleague Genia Turanova’s Unlimited Income. Genia’s shown over and over that you don’t need to sacrifice growth to earn income. I’m talking about stocks that deliver market-beating dividends… AND quick double- and even triple-digit capital gains.

Become a member of Unlimited Income today for a 66% OFF discount.