With the cost of pretty much everything going up, the Fed is increasing interest rates to cool off the economy and tame inflation.

Of course, the ripple effect of this is huge.

In short, rising rates mean savers will get more interest and borrowing will cost more—especially when it comes to getting a mortgage loan.

Mortgage rates are one of the first things affected by rising interest rates… making the “American Dream” of owning a home harder to come by.

But, as I’ll show you, there’s a way for investors to cash in on this situation…

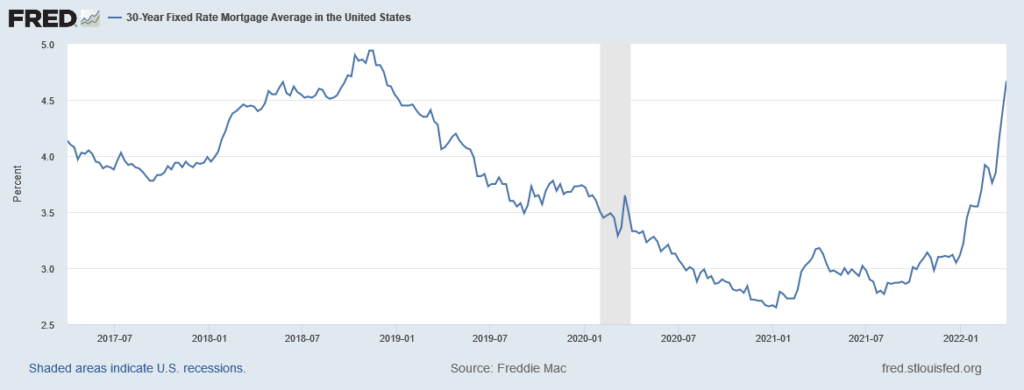

30Y mortgage rates are soaring

As you probably know, the traditional mortgage loan is the 30-year fixed. And after a massive surge over the past few months, 30-year rates are at their highest level in nearly three years.

As you can see in the chart below, the average rate sat below 3% for most of 2021… before rocketing over 4.5% recently. That’s a huge increase in a short time.

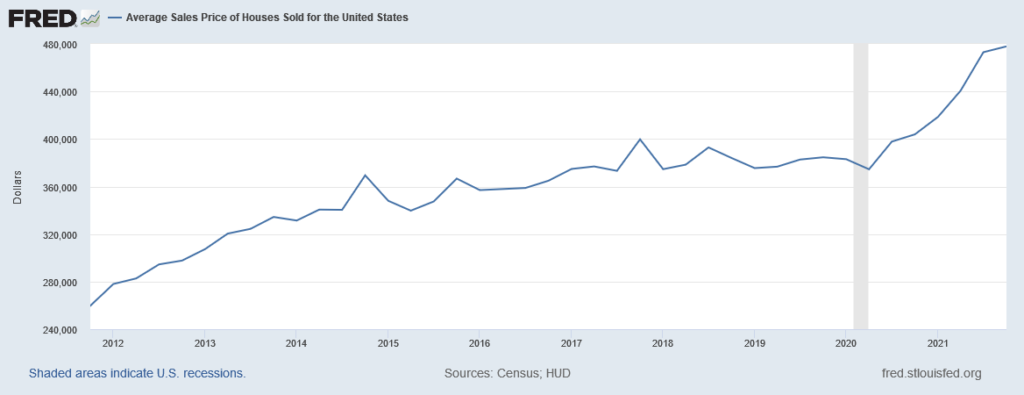

Plus, housing prices have risen sharply over the past couple of years.

Below, you can see how average home prices have done over the past decade. Notice the big jump since 2020:

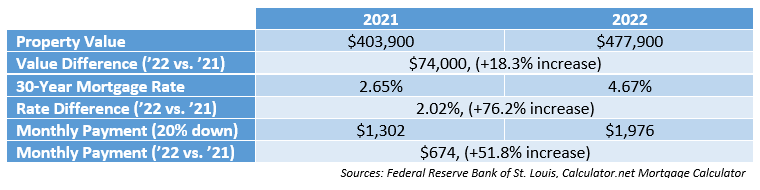

Below, I’ve charted the jump in the average home price from December 31, 2020 to December 31, 2021 (an 18.3% increase)… and the effects of higher mortgage rates. As you can see, anyone buying a home today faces an extra $674 in monthly mortgage payments (for the average house) vs. the end of 2020.

In other words, homebuyers are facing a double whammy: They have to pay almost 20% more for a house now vs. 2020… AND pay higher interest on a new mortgage.

Put simply, homeownership is soaring out of reach for many people. It’s a tough situation, with no sign of a near-term solution.

But this environment comes with a side effect: I expect we’ll see steady demand in the rental market for years to come. And there’s a simple way for investors to play it…

The beauty of REITs

A real estate investment trust (REIT) is a vehicle that lets investors partake in real estate investing without owning physical property. REITs own, operate, or finance different types of properties, including residential real estate like apartment complexes.

And with rental demand likely to keep rising, REITs are an obvious beneficiary. They’ll produce steady, rising income from collecting rents. Plus, they offer investors a way to benefit from rising housing prices.

REITs are required to pay out at least 90% of their taxable earnings to shareholders, so they tend to have high yields. That’s attractive to income-minded investors.

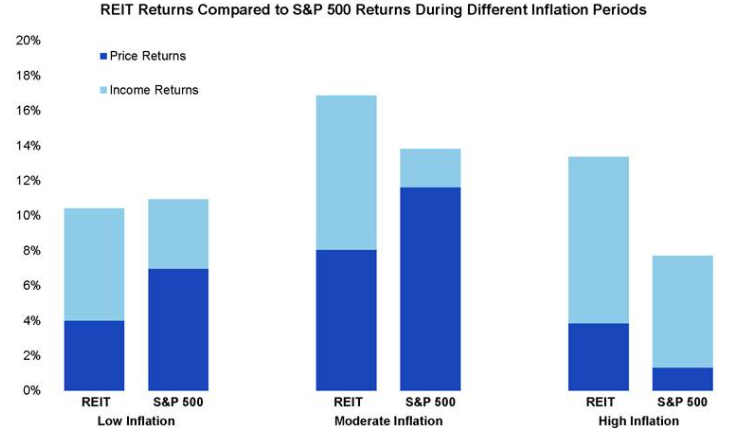

I’ve discussed them before for income and to combat rising taxes. They’re also a great inflation hedge. Below, I’ve included a chart that shows how REIT returns compare to the S&P 500 in different inflation situations:

As you can see, REITs tend to perform inline with the S&P 500 during periods of low inflation (under 2.5%). But they tend to outperform the stock market as inflation surges.

Their strong performance during inflation makes sense, when you consider that asset prices rise during inflationary periods.

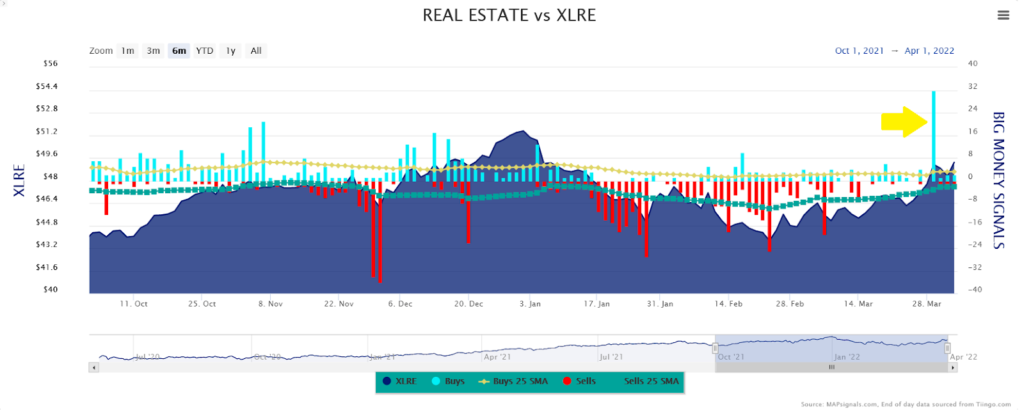

Today, market conditions are lining up for REITs again. In fact, Big Money investors are already preparing for a REIT boom. On March 29, we saw the biggest buying in REITs in more than six months.

The chart below shows the daily count of buys and sells in real estate stocks. Blue bars represent the number of real estate stocks that saw heavy buying on a certain day… while red bars tell us how many REITs saw major selling. I’ve drawn an arrow highlighting last week’s “mega day” of buying in REITs.

That big blue bar tells me one thing: Smart investors are betting on a rise in REITs.

And if you want to bet alongside the Big Money, there’s an easy way to do it…

How to quickly buy more than 2 dozen REITs

The easiest way to get exposure to this uptrend is by buying an exchange-traded fund (ETF) that focuses on real estate companies.

My favorite is the Real Estate Select Sector SPDR ETF (XLRE).

This ETF contains a basket of 29 different REITs and varied real-estate holdings, including data infrastructure, commercial properties, timberlands, storage, and residential properties. Clearly it has some diversification.

Not only does this fund have apartment REITs… it also offers exposure to multiple growth trends in real estate. For example, data infrastructure REITs play a crucial role in networking and data storage, which are big growth areas for the coming years. Also, commercial properties should keep gaining in a reopening world.

XLRE investors are basically landlords to renters all over the country. Its top three residential holdings include AvalonBay Communities (AVB), Equity Residential (EQR), and Mid-America Apartment Communities (MAA). Collectively, they account for about 8.6% of the portfolio.

As I mentioned earlier, home buyers are in a tough spot. U.S. home prices are up more than 18% over the past year… and mortgage rates have nearly doubled off their 2021 lows. As a result, the “American Dream” of homeownership is less certain for many people… which means more folks will be looking to rent over the next few years.

Investors can benefit from this trend by owning REITs. And XLRE provides exposure to a range of real estate categories, including residential properties.

Editor’s note:

For a portfolio full of high-yield, high-growth assets for any market—including REITs, commodity plays, and much more—check out Genia Turanova’s Unlimited Income.

Tomorrow, members will receive her latest recommendation—an undervalued commodity stock ready to explode higher…

Join today risk-free to access this stock as soon as it’s released.