Most people think I’m solely a growth investor.

Don’t get me wrong—I love growth stocks. They’re my main focus, without a doubt.

Why? Because that’s where the Big Money tends to flow.

But right now, with interest rates stuck near zero, institutional investors are thirsty for yield.

In a low-yield environment, income—in the form of dividends—becomes all the more important for most investors… including Big Money players.

And one sector in particular is attracting Big Money in droves for its high yields and incredible performance…

But first, let’s talk about dividends…

As you may know, dividends are distributions of a company’s earnings to investors based on the number of shares they own.

Say a company pays a 2% dividend every year. As a shareholder, you’d receive dividend payments equal to 2% of the share price multiplied by the number of shares you hold. If the stock’s price were $100, you’d receive $2 for every share.

Dividends are often paid on a set schedule, like every quarter. But sometimes, companies issue non-recurring dividends too.

These dividend payments can add up, which is why they’re important for income investors. Years ago, we could largely rely on government bonds to obtain good yields. But the Federal Reserve and other central banks around the world have kept rates low for a long time.

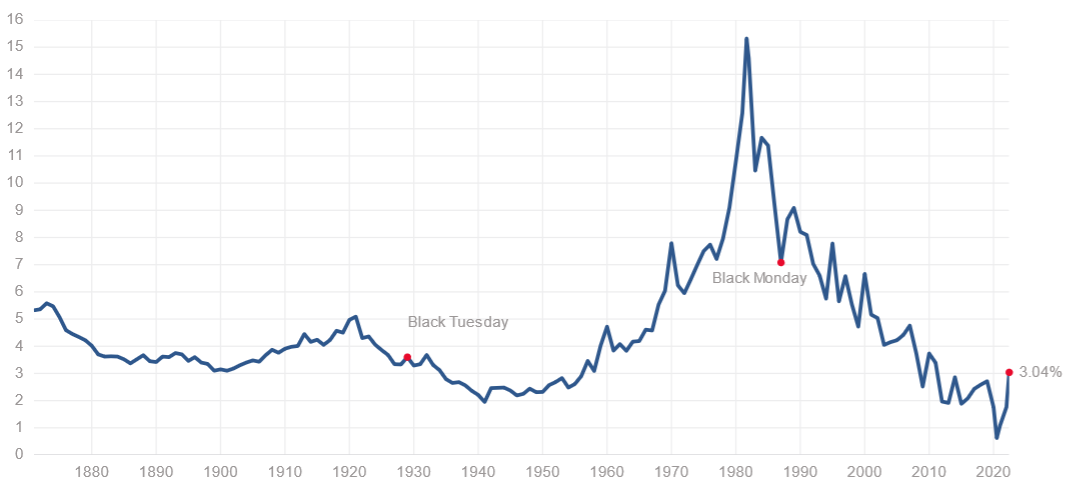

That means there’s less yield available from safe government bonds. Just look at the 10-year Treasury rate and you can see what I mean:

10 Year Treasury Rate

At 1.52%, there must be better options. And there are…

One yield sector that was on fire in 2021 is real estate investment trusts (REITs). These public companies own, run, or finance different types of income-producing real estate. Some REITs focus on residential real estate or office space, while others focus on warehouses or infrastructure like cell towers.

I’ve been a believer in REITs for a while. I wrote back in April 2021 how REITs can negate worries about higher capital gains taxes… and how Big Money was buying them up.

The beauty of REITs is that they give you exposure to real estate without the risks of owning actual property. Plus, they’re required to pay out at least 90% of their taxable earnings to shareholders. That means they tend to have high yields.

One way to play the sector is with REIT exchange-traded funds (ETFs)—like Real Estate Select Sector SPDR Fund (XLRE).

I like XLRE because it’s well-rounded—It holds companies involved in cell towers, fiber optic networks, logistics, storage, data centers, shopping/entertainment, apartments, and more.

And in terms of performance, it has JUICE!

The green bars in this chart represent every time Big Money rushed en masse into XLRE over the last year. See how the price usually rises when that happens?

XLRE holds great stocks. One is American Tower Corporation (AMT), a REIT focused on communication real estate, like cell towers.

Another is Prologis, Inc. (PLD), which focuses on modern logistics facilities.

A third is Crown Castle International Corp (CCI), another cell tower and communications infrastructure company.

A common knock against REITs is that they don’t appreciate in value since they have to pay out 90% of income to investors.

But the truth is they can appreciate quite a bit in the right environment…

In 2021, XLRE gained a staggering 46%. Plus, it pays a 3.04% dividend.

As my colleague Genia explained, even if the Fed hikes interest rates this year, the case for income stocks remains strong, as they’ll continue to out-yield bonds. Plus, hard assets like real estate tend to do well in inflationary environments.

I’ve invested in REITs for years. They’ve been a great way to diversify and round out my portfolio. They can provide asset appreciation and regular income, often uncorrelated to growth stocks.

And if you look at recent institutional buying, I’m in good company.

If you’re looking for exposure to a broad basket of high-quality real estate and a solid dividend, take a look at XLRE.

P.S. Hey guys, end-of-year market pullbacks have given us a window of opportunity to scoop up great stocks at bargain prices… before they bounce higher.

Join us at The Big Money Report, and get immediate access to a portfolio full of companies I’ve selected to help you build long-term wealth.