There’s a market that’s been crashing for years… yields.

As you probably know, interest rates have been on a one-way train to practically zero. Investment yields tend to follow interest rates… so it’s no surprise that yields on everything from bonds to dividend stocks have also plunged.

For investors, the situation leaves very few places to earn a decent yield.

Today, I’ll be discussing a booming sector offering an attractive yield…

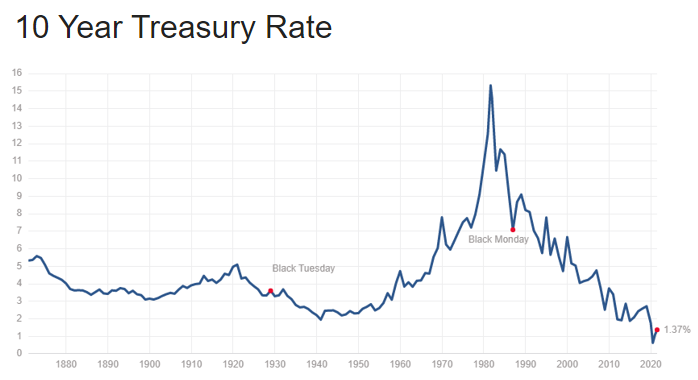

But before I get into the details, let’s check out a couple of charts that show the long-term story of interest rates.

First up is the 10-year Treasury rate. It’s the most common rate to look at whenever big-time investors discuss yields. And it’s been steadily declining since peaking in the 1980s. Today, it’s sitting near a record low of 1.37%…

That’s not too enticing for income-hungry investors. Typically, when yields are extremely low—like right now—income investors will seek asset growth in an effort to produce a higher return. This is one of the reasons the S&P 500 has steadily risen since the pandemic hit last year.

The 10-year yield hit an all-time low of 0.54% on March 9, 2020. The stock market bottomed out a couple of weeks later on March 23… but quickly rebounded. Since that day, the S&P 500 is up a staggering 99%.

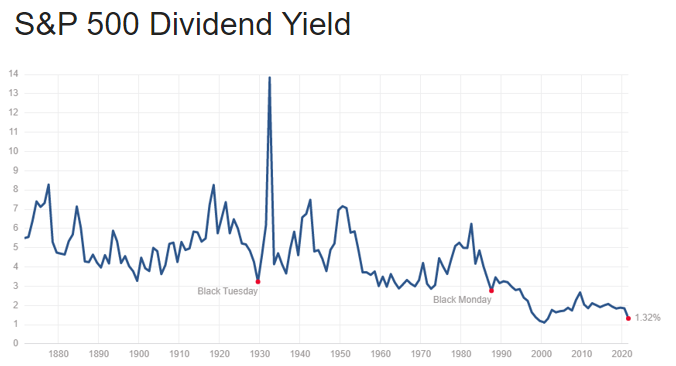

With the 10-year yield so low, a lot of folks piled into equities for dividend yields. At the end of March 2020, the S&P 500 dividend yield was more than triple (3x) the 10-year yield: 2.25% vs. 0.62%, respectively.

But that gap has shrunk back to nearly even. Both the S&P 500 and the 10-year Treasury are yielding around 1.3%.

Here’s a long-term chart showing just how low the S&P’s dividend yield has sunk:

This creates a challenging environment for anyone relying on income from their investments.

So, where can investors turn for better yields?

My favorite sector right now is real estate.

You’re probably familiar with real estate investment trusts (REITs). In short, REITs are public companies that own real estate. Most of their money comes from collecting rents from tenants. And they’re legally required to pay out at least 90% of their taxable income to shareholders.

According to Yardeni Research, the real estate sector’s 2.65% yield makes it the third highest-yielding sector in the S&P 500 (behind only energy and utilities).

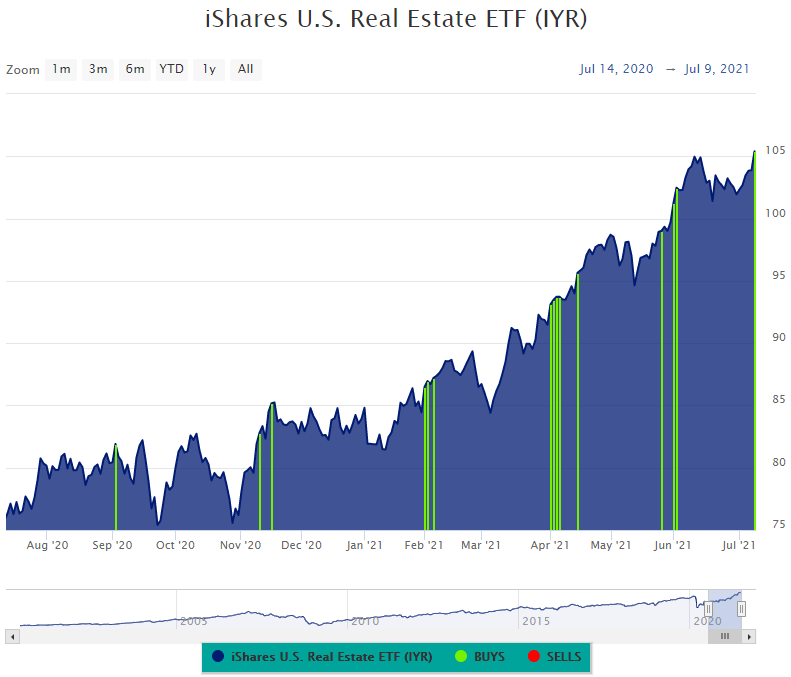

One of my favorite REIT funds is the iShares U.S. Real Estate ETF (IYR). It’s well diversified, giving investors exposure to over 80 different holdings. And it tracks the Dow Jones Real Estate Capped Index, one of the most widely followed real estate benchmarks in the world.

IYR currently yields around 2%. That might not seem like a lot, but it’s nearly 50% higher than the 1.3% yield you’d get from the S&P 500 or the 10-year Treasury.

I originally wrote about REITs back in April. Back then, I highlighted the sector as a perfect play on fears about rising capital gains taxes. Since then, IYR has easily outperformed the S&P 500—up about 7.7% over the past three months, vs. a 4.6% return for the S&P over the same time frame.

But REITs aren’t just about collecting juicy yields. My data shows they’ve been a magnet for Big Money in 2021. Below, you can see all of the Big Money buy signals (in green) for IYR over the past 12 months:

Each green bar represents a day when IYR ramped higher with big volumes… which means big institutions were buying heavily.

Like most investors, big institutions are thirsty for yield… And IYR fits the bill perfectly in this low-rate environment.

If you’re looking for a sector offering an above-average yield… that’s also cruising higher with Big Money investors… IYR belongs in your portfolio.

As always, keep it simple and follow the Big Money!