The first multimillion-dollar piece of art was auctioned off on the blockchain… unleashing the future of buying and selling assets through digital securities.

This auction wasn’t one where the highest bidder walked away with a physical piece of art. Instead, investors purchased security tokens, giving them fractional ownership and a portion of the proceeds if the artwork is sold again.

Security tokens, also known as digital securities, are one of the recent breakthroughs in blockchain technology. They allow you to own a portion of an asset, giving you an equity stake or a revenue stream.

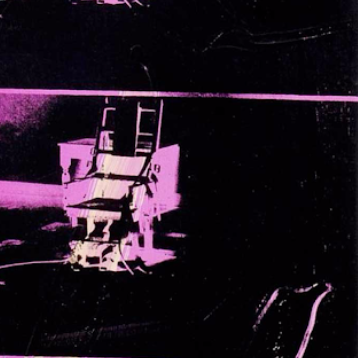

In this case, it was equity ownership in “14 Small Electric Chairs” (1980), a six-and-a-half-foot-high artwork by one of the world’s most iconic artists, Andy Warhol. The piece is part of his Death and Disaster series, based on an image from Sing Sing prison.

You’re probably familiar with Warhol, a leading figure in American “pop art” of the ‘50s and ‘60s, an avant-garde style that invoked pop culture icons.

One of his most famous pieces is the “Marilyn Diptych” from 1962, the year Marilyn Monroe died. The piece contained 50 images—all based on the same photograph of her face.

In a 2007 Sotheby’s auction, a 1964 “Large Campbell’s Soup Can” sold for $7.4 million dollars.

Warhol passed away in 1987 at the age of 58. His influence in the art market has remained significant… and the blockchain sale of “14 Small Electric Chairs” helps to highlight a huge paradigm shift in finance.

| Recommended Link | ||

| ||

| – |

Dadiani Syndicate, a fine art gallery out of London, and Maecenas, a blockchain platform for selling fine art, teamed up for this “world’s-first.”

Maecenas leverages blockchain technology to create tamper-proof, verifiable provenance and to enable real-time digital settlement of transactions—allowing buyers and sellers to create and manage their own liquid fine art portfolios and evaluate the value of their existing artworks.

In a “Dutch auction,” investors were offered up to 49% ownership of the Warhol painting. The auction was originally planned to last six weeks, but it closed two weeks ahead of schedule. In the end, 31.5% of the artwork sold for a total of $1.7 million. The ending value of the painting was $5.6 million, exceeding the reserve requirement of $4 million.

More than 800 participants placed bids using cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and ART tokens (Maecenas’ own digital currency).

After the auction concluded, smart contracts determined the final price. Winning bidders received digital certificates, claiming fractional ownership of the artwork.

Offering digital securities brings all types of investors together. For small and large businesses, it’s much cheaper to raise money through digital securities vs. the traditional high fee Wall Street route.

Selling fractional interest allows buyers and sellers to trade illiquid assets—like real estate, wine, and of course fine art. As digital security offerings expand, individual investors will have many more non-traditional opportunities to profit.

The Warhol blockchain auction was no futuristic stunt… this is the future. Over the next several years, the digitization of finance and assets could unlock hundreds of billions (even trillions) of dollars in value—across public companies, private companies, real estate, and more.

This revolution isn’t coming. It’s already here.

| |

| Frank Curzio with Daniel Creech | |

P.S. I don’t have a Sing Sing prison death chamber image to sell you… But in a couple of weeks, I’ll be offering qualified investors an equity stake in our growing business through the Curzio Equity Owners (CEO) security token. Benefits also include a quarterly dividend and access to other promising opportunities in the explosive digital securities market.

To learn more about CEO—and the latest news about digitized assets around the world—sign up here.