It’s time to put on our rally hats…

We’re about to enter the mega green zone for stocks.

Yes, I realize markets got sucker-punched today, but hear me out…

Several weeks ago I wrote how August tends to be a bad month for stocks due to low liquidity. Most traders take summer vacations, which means lower trading volumes.

And September tends to be no better…

But as we near the end of the year, history tells us things are about to pick up dramatically…

And I’ll show you two of the best ways to play this expected move higher.

Historically, September is a red month.

There are a number of contributing factors… including the end of summer and the Labor Day holiday.

Month-to-date, markets are down—the S&P 500 by 0.93%… the Nasdaq by 1.61%… and the Russell 2000 by 1.52%. And these returns don’t include today’s move. As I write, major market indices are getting clobbered, down over 2% in today’s session.

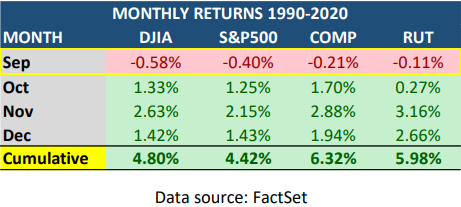

Below, you can see the average monthly performance of September–December going back to 1990:

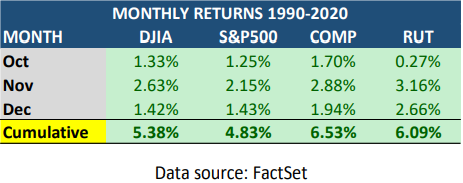

Those are already some impressive gains… But now, here’s the same chart without September:

Talk about a green zone, baby!

And with October right around the corner, we should start to see stocks boom for the last three months of the year. Already, I’m noticing Big Money pouring into high-quality stocks—companies that are growing sales and earnings at an accelerating pace.

So, how’s an investor to benefit? Well, I’ve spotted 2 exchange-traded funds (ETFs) primed for gains…

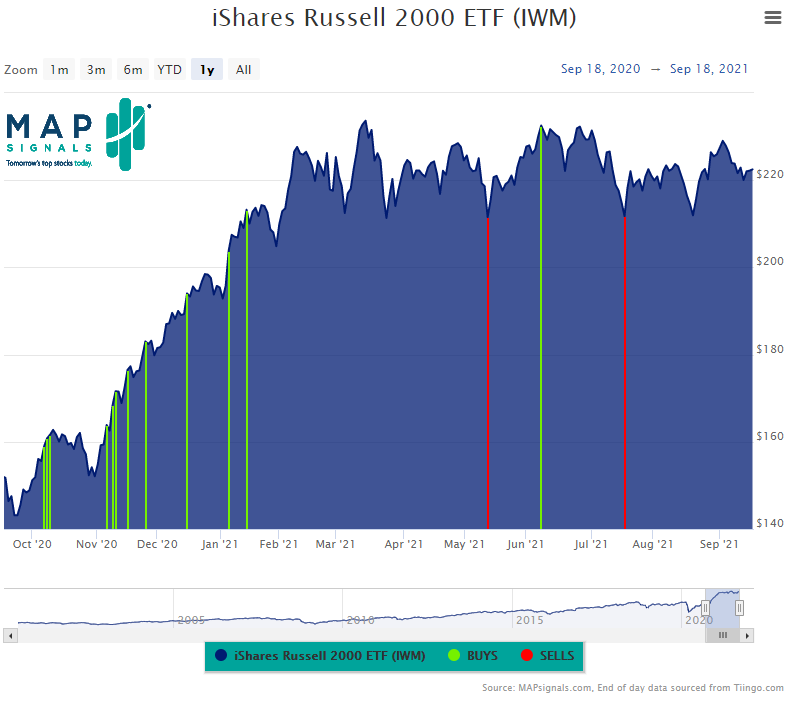

The first is the Russell 2000 tracking ETF (IWM). I mentioned this fund a few weeks ago as a great play for market upside, and I still like it… It holds many smaller-cap companies that stand to benefit in a reopening U.S. economy, like AMC Entertainment (AMC) and Texas Roadhouse (TXRH).

As you can see in the above chart, activity has been muted for months as IWM has quietly bounced around since February… But as we see an uptick in the markets, I expect this fund to perform well.

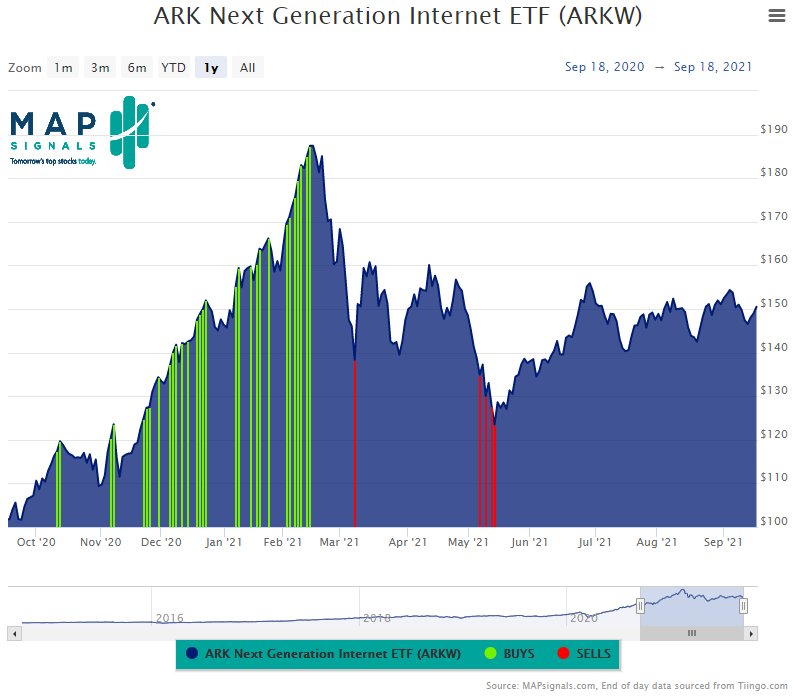

If you’re looking for something with more punch and a higher growth profile, consider the ARK Next Generation Internet ETF (ARKW). It’s a high-growth fund, full of internet stalwarts like Twitter (TWTR), Shopify (SHOP), and Twilio (TWLO).

The fund has been slowly grinding higher from big selling in May… and is primed for continued upside. (See my colleague Genia’s take on “thematic” funds like Ark—and 3 ways to evaluate ETFs.)

I like both of these funds specifically for their holdings. IWM focuses on small caps… which have lagged big-cap tech for months. But that trend could easily reverse with any positive COVID news.

And ARKW is simply full of great stocks with solid growth profiles. With markets a bit shaky in September, it provides diversified growth exposure compared to taking on single stock risk.

Here’s the bottom line: We’re about to enter the market green zone. My rally hat is on, and I hope yours is, too. October is quickly approaching, and history shows the fourth quarter is rocket launch time for stocks.

If we see a rally anywhere close to the magnitude that history suggests, you can bet more than a few stocks are set to explode higher…

And two easy ways to capture those gains are with IWM and ARKW.

P.S. For my top growth stock picks, make sure to check out my newsletter, The Big Money Report. The portfolio is on fire right now, with 9 out of 11 holdings boasting gains—many up double digits in just a few months.

And with a rally around the corner, there’s much more upside ahead…

Become a member today—and get my newest stock pick delivered to your inbox next week.