This week, a single Chinese company caused a selloff on Monday… and a subsequent rally.

Evergrande Group—the country’s second-largest property developer—is also the most indebted company in China… and lately, the most talked-about stock in the news.

Like many property developers across the globe, the company is highly leveraged… But the size of Evergrande’s debt stands out even among its peers. It owes $300 billion… needs to deliver some 1.5 million apartments… and may even owe its employees, who were strongarmed into giving the company a loan.

Earlier this week, Evergrande missed its scheduled interest payment.

Normally an event like this would only concern a company’s bond or stockholders… But this one worried investors across the globe… causing the S&P 500 to sell off almost 1.5%—the worst market day since May.

Some fears were assuaged a couple of days later as Evergrande came to an agreement with its lenders—paying off some of its interest and rescheduling more… And the market rallied on the news.

Today, I’ll tell you why this company poses such a threat to the global economy. I’ll also give you a couple of reasons to remain careful with China… and a piece of advice for bargain-hunters.

If this is the first you’ve heard of Evergrande, you’re not alone. But the property developer is on our radar today thanks to the mind-boggling two trillion yuan—$300 billion—it owes in bonds and loans… not to mention its liabilities to suppliers, employees, and apartment buyers.

It’s also China’s biggest issuer of dollar-denominated high-interest (“junk”) bonds—which have made their way into many bank portfolios and bond funds around the world. If you own a high-yield international bond fund or two, you might still have Evergrande bonds in your own portfolio.

Evergrande was once thought “too big to fail.” The Chinese government could easily bail it out… But a full-sized rescue doesn’t seem likely.

That’s because the Chinese government has begun to enforce strict rules on indebted companies… with the goal of reducing Chinese banks’ exposure to overleveraged businesses, thereby making the financial system safer.

So while you want to be careful with Chinese investments, Evergrande’s default won’t derail the Chinese economy… otherwise, the Chinese government wouldn’t let it happen.

Remember: China’s economy is highly regulated… and no government in its right mind wants to engineer a recession.

Plus, Evergrande isn’t a bank or highly leveraged financial institution a la Lehman Brothers… Which means the potential ripple effect spreading from an almost inevitable bankruptcy should be much less impactful to the country… and outside its borders.

At the same time, given the size of the company’s debt… the amount of bonds it sold… and the importance of real estate to the rest of the economy… things can get out of control. (The Great Recession, caused by the housing bubble here in the U.S., is still fresh in investors’ minds.)

An avalanche-like event sending shockwaves through China’s economy and beyond is still in the cards…

So why is the market rallying?

Because the probability of Evergrande’s default infecting the world economy pales in comparison with the attraction of ongoing free money and cheap credit in the world’s safest markets (the U.S. and Europe).

The Fed concluded its September meeting with no change to interest rates or the current pace of its bond-buying scheme. And although the FOMC, the central bank’s decision-making committee, warned it may begin reducing (tapering) the amount of bond-buying as early as November, the market didn’t believe a word of this…

China and its Evergrande problems are one reason.

The worst-case scenario—financial contagion from the Evergrande bankruptcy—would mean ultra-low rates for longer.

The U.S. Fed will do everything it can to contain the fallout. It can do this by keeping interest rates low well beyond 2022… and delaying any meaningful taper longer. (On his podcast, Frank talks about how these inflationary measures are a bigger threat than Evergrande.)

Bad news for the Chinese market turns out to be good news for the S&P bulls.

But the Fed isn’t omnipotent… and it can’t control any China-based events.

This is why you shouldn’t just brush off the Evergrande saga. Its financial woes are far from behind it…

Its outsized $300 billion in debt means the full effects of a potential bankruptcy cannot be predicted. As long as a company of this size is in trouble, financial and economic aftershocks can still spread.

And even if they don’t… China has given investors plenty of reasons not to get too involved with its equities recently. Government crackdowns, countless investigations, and new regulations have accelerated this year.

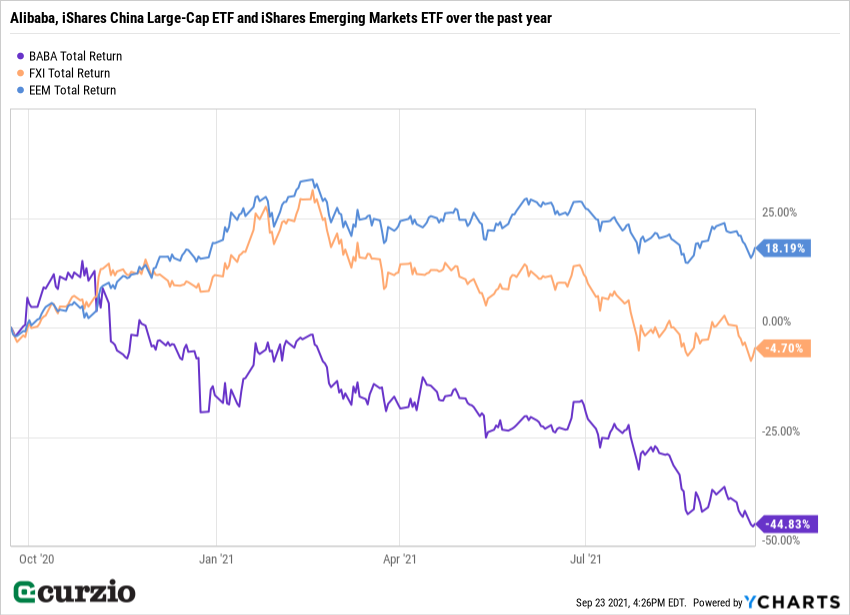

Even companies the size of Alibaba (BABA), one the largest internet commerce companies in the world, are not immune to government intervention.

As a result, China’s stock market (represented by FXI below) has been lagging the rest of the world… and even its emerging market peers (EEM).

If you’re tempted to get more exposure to China, I can’t blame you… Its stock market is becoming a bargain.

But keep a closer eye than usual on major news and economic developments coming out of China… Based on this week’s market movements alone, U.S. investors can’t “buy it and forget it.”

P.S. It’s a great time to add risk hedges to your portfolio. And there’s no easier way to do it than with the strategy we follow in Moneyflow Trader.

Frank explains how it works here… and why he follows the service with his own money…