Tomorrow is the first Friday of the month… a day when a critical payroll report is released.

These days, though, “critical” might be an overstatement.

With the Fed not willing to endanger the economic recovery by tapering—or reducing its bond purchases—too soon, even bad news is good news. As a result, investors might not feel the need to know exactly where the labor market stands.

That’s why last week’s “slow taper” guidance from the Fed is more important than anything we can learn from the Labor Department tomorrow.

As a recap, during the Fed’s annual Jackson Hole meeting—which was held virtually this year—Fed Chair Jerome Powell discussed COVID-related economic challenges… guided for a taper to begin as early as this year… while making the case for reducing the purchases at a slow pace. Powell also promised not to hike short-term interest rates—they’re set to stay low even after the central bank is done with the taper.

The market took this as good news, rising to new highs… But don’t become too complacent…

Historically, stocks have often sold off soon after doubling… and we’re in a similar situation today. The S&P 500 is now sitting 103% above its March 2020 lows. And it got here without a single 10% correction… A significant bout of profit-taking is well overdue.

Plus, despite the market cheering the Fed’s “slow taper” news, ultra-low rates and easy money policies aren’t set in stone.

For one, Powell, widely regarded as an architect of the post-COVID easy money policies, is approaching the end of his term. In 2022, when it’s time for the Fed to decide whether to keep buying bonds and just how much, he might not be at the helm.

More importantly, the Fed doesn’t directly control most of the interest rates.

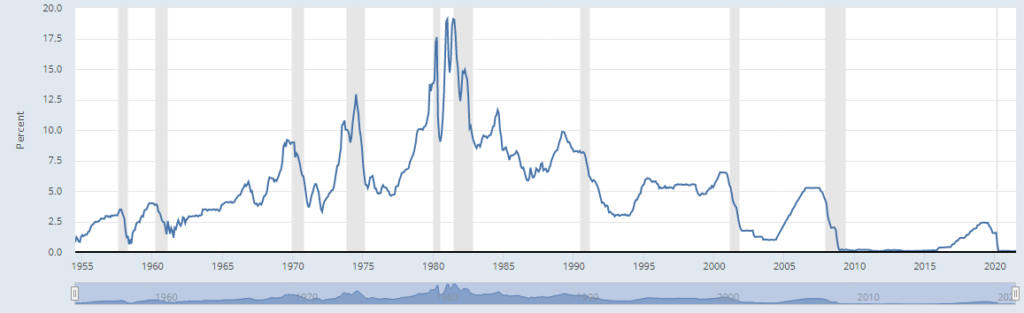

The only rate the U.S. central bank gets to set is the so-called Fed Funds rate, a very short-term interest rate… And even then, the Fed uses a narrow range instead of setting this rate directly.

Before the Great Recession, we never had Fed Funds rates set this low. A feeble attempt to raise this rate to 2.5%—still nothing by historical standards—was met by the market’s resistance in 2019… and then, the COVID crisis last spring set this rate to near zero again.

Effective Fed Funds rate, 1954-present

Click to enlarge

The Fed doesn’t directly control the longer end of the interest rates…

Normally, it’s the market that regulates interest rates according to the laws of supply and demand.

The story with longer-term rates is different.

For U.S. Treasuries, the more supply there is, the lower the price should be… and the higher the rate. Remember: bond prices and interest rates always move in opposite directions.

But that’s without the extra demand brought on by the Fed purchases.

This is the genius of quantitative easing (QE): By being a buyer of government and other debt, the Fed gets to control interest rates on the longer side.

The more they buy, the lower the rates (for a given supply).

And removing the Fed as a buyer of the U.S. Treasuries and mortgage bonds would mean lower prices… and higher rates.

This is why “taper” is a feared word.

And this is why even a slow taper—as promised by Powell last week at Jackson Hole—is not to be ignored.

By tapering, albeit slowly, the Fed removes a lot of the buying pressure from long-term bonds… leaving their prices vulnerable. Long-dated interest rates—the basis for mortgage rates—can rise. And higher rates mean higher costs of borrowing for the government… which comes with budget pressures.

So why is the market flying to new highs following Jackson Hole?

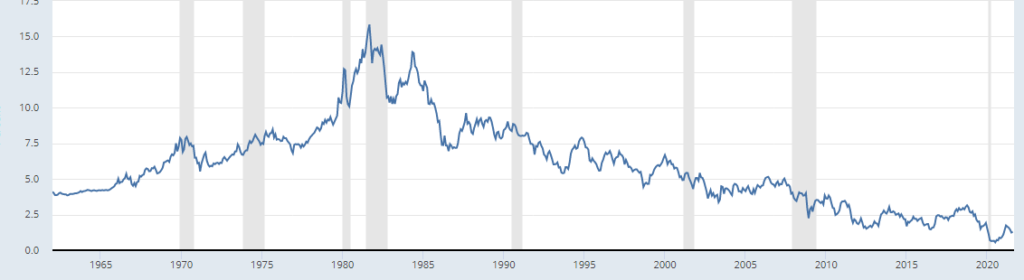

And why is the benchmark 10-year rate so low?

10-year Treasury rate, 1962-present

Click to enlarge

Simple answer: because the market doesn’t believe the Fed is in a position to taper… It knows the Fed doesn’t even want to begin tightening… and expects easy money to continue flowing uninterrupted.

Now, that doesn’t mean tapering risks are gone…

Out-of-control inflation or a strengthening economy might leave the Fed no choice but to act more decisively… putting the breaks on the market’s ascent.

And don’t ignore the forces of supply and demand: If the U.S. issues more Treasury debt than the market can handle, long-term rates can begin to rise. This is a possibility even if the Fed continues its monthly purchases.

Enjoy the bull market… but keep your back-up plan updated and your hedges ready. You might need them sooner than you think.

P.S. In my investment advisory, Moneyflow Trader, I use a powerful strategy to reduce risk in tumultuous markets… And it works.

Since the onset of the COVID pandemic, members have closed out gains like 220%… 265%… and 508%—all on market hedges.

Don’t wait until the market turns against you to start hedging your portfolio.