Even novice investors know two stocks are better than one…

That’s because pinning all your hopes on just one company—as good as its outlook might be—is dangerous. You’re risking all of your future profits on its ultimate success.

You win if it wins… but you have no backup plan if it loses.

This is why we need to spread our long-term bets across a few stocks. This method, called diversification, results in a less volatile portfolio—and the ability to generate higher returns for the same amount of risk.

“Spreading your bets” also works in trading.

One popular technique is “pairs trading,” or trading two stocks at the same time. But not just any two stocks…

Today, I’ll show you how pairs trading works… and when to use it to your advantage.

For that, I have to start with a boring statistical concept.

But if you’re serious about investing or trading, it’s a concept you must understand.

It’s called “correlation.” Using the correlation coefficient, we can measure how closely two stocks (or other assets) follow each other. The higher the coefficient, the more closely they follow one another, and vice versa.

The coefficient can range from 1 down to -1. If two stocks have a correlation of 1, it means they’re perfectly correlated—they move up and down together. If their correlation is 0, it means there’s no relationship between the returns. And if they have a correlation of -1, it’s a perfectly negative correlation. In other words, they typically move in opposite directions from each other.

Let’s look at an example of two highly correlated stocks.

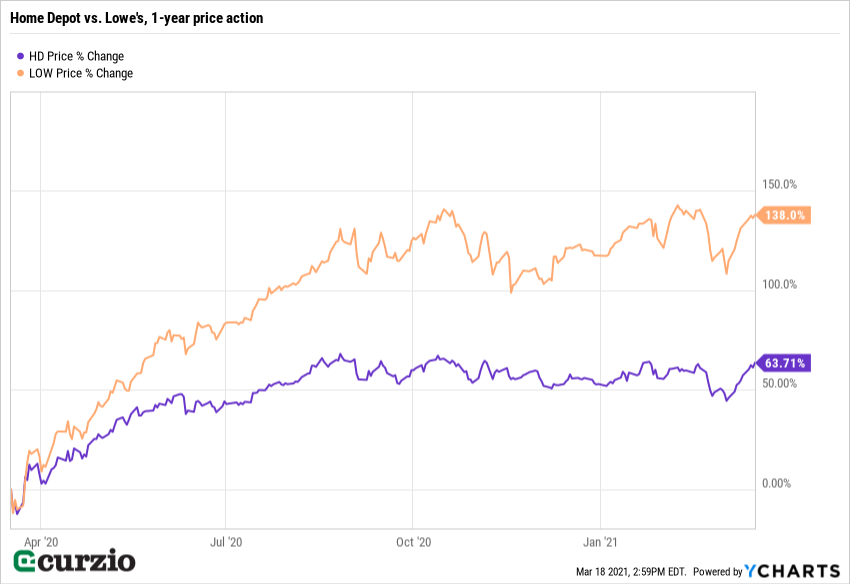

In the chart below, I plotted the past five years of price action for the nation’s two leading home improvement retailers: Home Depot (HD) and Lowe’s (LOW).

Notice how similarly these stocks move? It shouldn’t surprise you. They’re in the same industry and have similar business models.

We can measure the relationship by checking their correlation coefficient…

Since 2016, the correlation coefficient between HD and LOW is 0.82.

This is very high (remember, the maximum for this coefficient is 1). This number tells us that, on average, when HD rises, so does LOW… and when LOW falls, HD usually follows.

Their ups and downs are related to the same economic factors (GDP, home ownership, personal consumption levels) and the same consumer trends (the DIY craze)… So revenue and profits for these two companies tend to fluctuate together.

But this high correlation doesn’t necessarily translate into the same return…

While LOW beat HD by some 20% over the past five years, much of this lead came from the last 12 months, when it outperformed HD by more than 70%.

When a big gap develops between two correlated assets, it’s time to consider a pairs trade. There’s a good chance that the gap will close over time.

For example, when we look at HD and LOW, we see two companies in the same business. But the recent returns have diverged from their historical norm. In other words, shares of Lowe’s are up too much compared to Home Depot. We’re likely to see HD catch up soon, one way or another.

And a pair strategy is the perfect way to play this kind of situation. We’re looking to exploit a breakdown of the long-term relationships between two securities. We’re betting this breakdown is temporary, and the relationship between the two will soon return to something closer to “normal.”

To do that, you buy the undervalued stock… and short a closely-related one that’s overvalued (relative to each other).

It’s important to note that you’re not taking a directional stance. Both stocks could go up or down. The trade is set up so that we make money if the gap narrows. That’s why pair trades are generally less risky than placing a long or short bet on just one of these two stocks.

Using our example from above, we could make money whether LOW and HD both rise or fall. The only thing that matters is whether HD narrows the gap with LOW.

If both stocks rise, we’ll make money if HD rises more than LOW. And if both stocks decline, we’ll also make money if HD falls by less than LOW.

In other words, you can potentially make money on both long and short positions… if these two stocks simply return to their long-term “paired” condition…

And even if the market doesn’t cooperate and rallies sharply (pushing up both stocks) or declines (bringing both names down), you’re poised to make money on at least one leg of your trade.

Pairs trading is a powerful tool because it can be applied to different situations.

In our example above, we looked at two highly-correlated stocks that have diverged recently, creating a trade opportunity.

But we can also use a pairs trade on two competing companies whose stocks usually move in different directions (i.e., have a negative correlation coefficient) or even trade independent of each other (correlation coefficient is close to 0). I’ll show you how to play those situations in future articles.

Keep in mind that pairs trading is usually a market-neutral strategy. That means it can work in any market (up or down).

If you’re bullish on the market, you might not want to short anything… Or if you’re very bearish for the near term, going long even one stock might not be the best strategy for you.

Here’s when to consider a pairs trade:

- You’re market-neutral.

- You’ve identified a divergence in a pair of stocks or sectors.

- You’re not sure which direction the trend will go… and don’t want to take a strong stance.

Before you trade, always do as much research as you can. And remember: Shorting a stock outright can be highly rewarding, but it’s also risky—you can lose much more than you stand to gain (think of the recent GameStop saga).

To execute a successful pairs trade:

- Find two typically correlated securities (stocks, ETFs, or commodities) that are no longer trading together. There are numerous free online tools like this to calculate correlation coefficients.

- Make sure the underperforming security is undervalued. In other words, make sure there are no underlying issues with the company.

- Be sure you’re ready to take on the risk of shorting a stock.

In any market, there are trades to be made… and distortions to be explored. Pairs trades can help you benefit… and deserve to be a part of your investment arsenal.