Income investors have a lot to look forward to…

A year ago, the S&P 500 started its rebound off the 2020 lows.

So far, so good… The market is up 73% over the past 12 months.

But this rebound has come at a price… especially for income investors. Thanks to aggressive monetary policies by central banks, bonds yield much less than a year ago.

Thanks to higher prices for some dividend stocks—and payout cuts for others—dividend yields on many stocks have declined, too.

But I’m about to show you why dividend investing isn’t dead… and the situation will get better in the near future.

But first, let’s go over a few basics about dividends.

Companies pay dividends because—once they become consistently profitable—they need to pay their shareholders. It’s also a bad idea to let cash accumulate on the balance sheet. Historically, a large cash position makes a company vulnerable to takeover attempts.

Think of a dividend as a return on your investment—a return you get without having to sell a stock.

Mature, slower-growing businesses tend to pay higher dividends. Younger, faster-growing businesses tend to pay out a relatively small dividend (and many don’t pay a dividend at all).

The best way to measure a company’s dividend is to look at its dividend yield. To calculate the dividend yield, we simply take a full-year of dividend payouts (for one share) and divide by the company’s current stock price.

For example, Microsoft (MSFT) pays a quarterly dividend of $0.56. That means MSFT will pay us $2.24 in dividends over 12 months (4 times $0.56 = $2.24). When we divide $2.24 by $233 (MSFT’s recent price), we get a dividend yield of 0.96%.

Dividend yields are an important number to pay attention to. They help investors compare the annual returns from different investments. A 0.96% dividend yield may seem low, but it’s much higher than the rate you’ll get from a savings account (likely below 0.10%) right now.

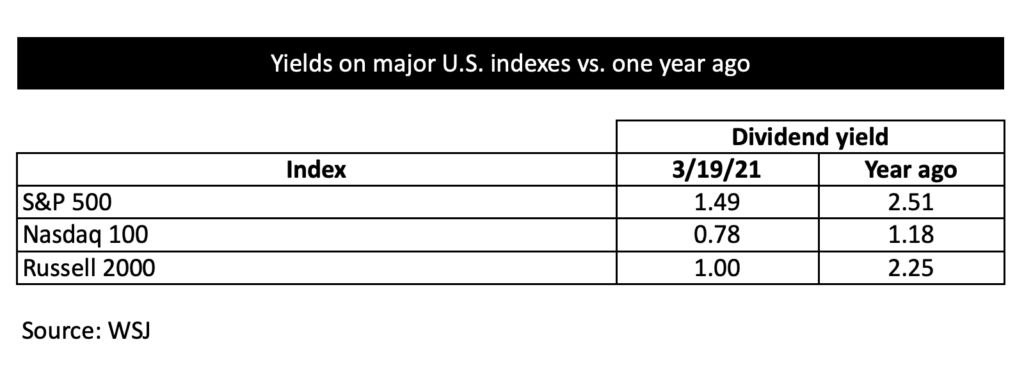

Thanks to the market rally, dividend yields for most stocks are sharply lower than they were a year ago.

As you can see below, the dividend yield for the S&P 500 is just under 1.5% right now. A year ago, it stood at 2.5%.

Even utilities—a sector that traditionally pays a 5%-plus dividend yield—currently yield just over 3.1%. That’s down from 3.9% a year ago.

Nevertheless, stocks are a much better deal than bonds today. Here are a few key advantages:

- Stocks can increase their dividends over time. Bonds fall into the category of “fixed income”—meaning they pay a fixed interest payment that stays the same throughout the life of the bond.

- Stock investors can reinvest their dividends to benefit from the compounding effect—a powerful money-making tool my colleague Luke Downey discussed earlier this week.

- Many stocks pay “qualified dividends,” which enjoy preferential tax treatment. The tax rate on qualified dividends tops out at 20% (and can go as low as 0%, depending on your taxable income). Bond income gets taxed as regular income.

As you probably know, dividends weren’t immune to COVID-induced business disruptions.

According to a recent Janus Henderson study, global dividends declined by more than 12% last year. However, about two-thirds of all companies either maintained or even increased their dividends during 2020.

That’s much better than we all feared a year ago.

And for investors looking for more income now, here’s more good news: Janus Henderson only sees a slight dividend decline in 2021 as the worst-case scenario. Their best-case scenario is for a 5% increase in total dividend payouts this year.

In fact, the trend is already heading in the right direction. I’ve found a handful of companies that recently hiked their dividends by double-digits. It’s a broad trend that includes retailers like Dicks Sporting Goods (DKS) and Williams Sonoma (WMS), as well as tech giants like Microsoft (MSFT) and Oracle (ORCL). The latter just announced a 33.3% dividend hike… You won’t get this kind of income growth from bonds.

There’s also a strong recovery happening in beaten-down sectors like energy. For example, oil giant Royal Dutch Shell (RDS-A)—which slashed its dividend 80% last spring—recently increased its payout (although its total annual dividend is still much lower than it was before COVID).

“Variable dividends” are another trend investors should keep an eye on.

Companies with a variable dividend policy set their dividend payout as a function of their financial strength. In other words, investors automatically get a bigger dividend when business is booming… and a smaller payment when profits decline.

Keep in mind, cancelling or reducing a dividend is bad for a company’s share price. Dividend cuts are usually a “last resort” measure when a business is struggling. They can trigger a panic among investors… who assume the company is a few steps from bankruptcy.

Variable dividends could be a perfect solution for companies worried about establishing a dividend policy because their profits are variable.

If variable dividend policies gain in popularity, we’ll likely see more—not less—dividends down the road.

Some companies already take a variable approach to paying dividends, but without a formal “variable” policy. Instead, they issue a “special dividend” when profits are high. The effect is the same—special dividends generate income for investors while giving management some flexibility in running the business. This flexibility is especially important for cyclical businesses that struggle whenever the economy gets tough.

In theory, special dividends are paid only occasionally, when a company has a cash windfall. But many companies have been paying special dividends consistently over the years, including Diamond Offshore (a now-bankrupt oil driller), insurer RLI Corp. (RLI), and financial company Main Street Capital (MAIN).

Pioneer Natural Resources (PXD), an oil and gas company, recently told investors about its plans to move to a variable dividend policy by 2022.

I expect to see variable dividends gain in popularity over the next few years.

That’s because variable dividends will make it easier for many companies to survive difficult operational environments—without having to choose between cutting the dividend or cutting spending on the business.

Although some investors may prefer the stability of regular payouts, special and variable dividends will help get more money into investors’ pockets.

I predict many companies that might otherwise be reluctant to establish, restore, or increase dividends will join the fray… and income investors as a whole will benefit.

Keep your eyes on this new trend… it might mean more dividend opportunities in the near future.

P.S. Every month, Unlimited Income members receive my favorite dividend idea on the market.

But in the latest issue, there were two: a unique ETF designed to benefit from higher inflation… and a high-yielding stock set to soar on higher commodity prices.

Sign up here for immediate access to these names—along with many other carefully selected assets that will grow your income year after year…