Game-changing companies do one thing well: They make a lot of money.

In last week’s piece, I explained how a stock’s price is a key component to finding the few names that generate most of the stock market’s gains. These outliers are the “holy grail” that every investor should be looking for.

Put simply, great stocks have prices that keep going up over time. But price action isn’t the only factor to look for.

Today, I’ll show you the other piece of the puzzle…

The best businesses are the ones that grow their profits year after year. Why? Because earnings are the reason businesses exist. They’re literally the “bottom line” on a company’s financial statements.

Think about it. If a company makes a ton of profits, they can do a number of beneficial things for investors. For example, they can reinvest those profits into the company, in the hope of generating even more profits. Another option is to share the profits with investors by issuing dividends. A dividend is a payment that a company distributes to shareholders, usually every quarter.

Dividends are awesome because investors can reinvest them back into the stock. It’s a great way to turbo-charge your stock returns.

I call this the “bonus level” of investing. If you want to see me discuss the power of dividends, check out my latest Lessons with Luke video.

Needless to say, I’m pretty picky when it comes to buying stocks. I only want the best. And the greatest businesses are the ones that print money.

Dividends supercharge portfolios

Let’s look at a great example of a stock that has both “holy grail” components—a long-term, rising share price and earnings growth resulting in a growing dividend.

The stock is Home Depot (HD).

It’s one of the best-performing stocks ever. Today, it’s regarded as more of an established, blue-chip name, but it used to be a hyper-growth stock.

So, how do investors know Home Depot is a winner? Well, they could start by looking at its earnings per share (EPS). That number will increase over time for great companies.

Back in the first quarter (Q1) of 2006, Home Depot’s diluted EPS was $0.70 and it paid a quarterly dividend of $0.15.

Fast-forward to today: In Q4 2020, its diluted EPS came in at $2.65 and its quarterly dividend reached $1.65 a share.

The increasing trend is what’s important.

Now, these dividend amounts may seem like chump change, but look how important they are to a stock’s performance…

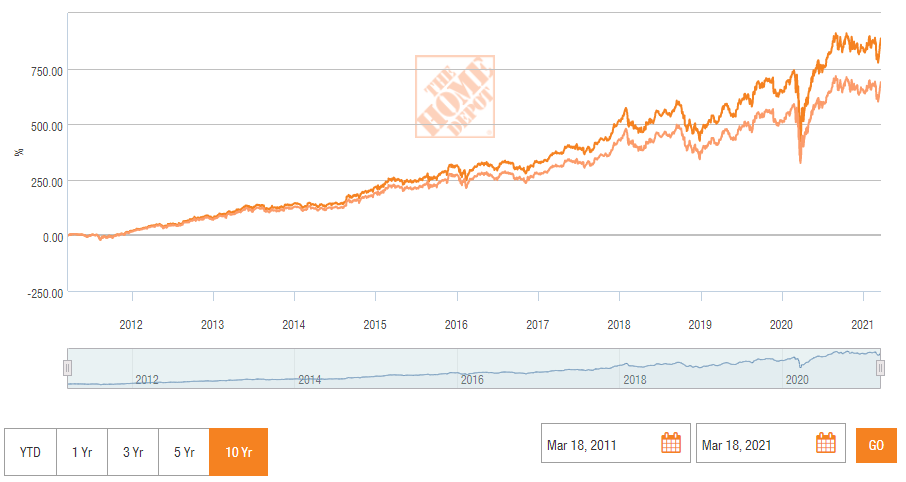

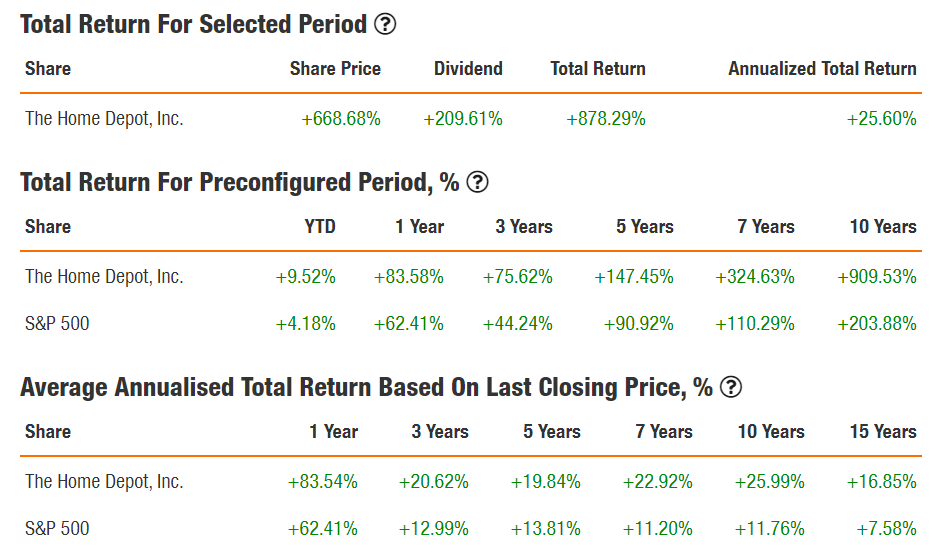

Below is the 10-year chart of HD. The bottom line is the simple share price return. The top line is similar, but it includes the gain you would have made from reinvesting the dividends.

As you can see, Home Depot’s dividend growth dramatically increases the performance. The stock did well by itself, rising 668.68% in 10 years. But by reinvesting dividends, your total return on HD would have been 909.53% during that same time period!

When you reinvest dividends, you buy more shares. Those shares generate more dividends (since you own more of the stock than when you started)… which turn into more shares over time… and on and on. This wonderful process is called “compounding.”

And as most experienced investors know, it’s the power of compounding that generates incredible wealth!

Now let’s compare HD’s performance to the S&P 500.

As you can see, the 10-year performance of HD (including dividends) is over 900%, compared to the S&P 500’s return of just over 200%.

In other words, if you bought Home Depot and held it for 10 years, you more than tripled the return of the overall stock market. Another way to compare the two is by looking at annualized returns. (Annualized means we “condense” the total return and express it as a single, one-year number.) Over the past 10 years, Home Depot generated an annualized return of 26% vs. just 11.76% for the S&P 500. That’s serious outperformance, folks!

When you find a stock like HD with both “holy grail” characteristics—a rising stock price and increasing earnings (along with dividend growth)—you’d better make a note of it.

And the best way to profit from this setup is to find these outlier stocks as early as possible. That’s what I’m looking for on a daily basis. It’s why I’m constantly following the Big Money.

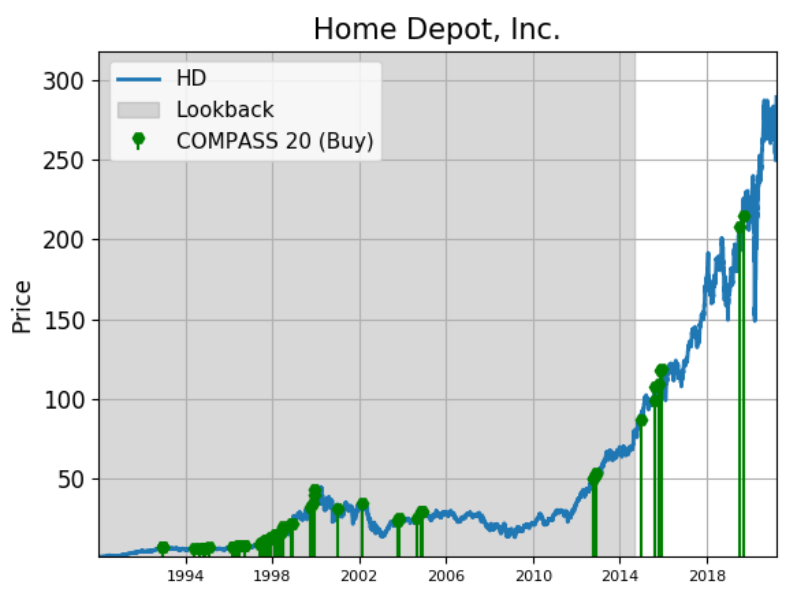

I designed a system to look for these technical and fundamental qualities. And I boiled it down to a single indicator that I call my Big Money signal.

Years of Wall Street trading taught me that institutional investors have vast resources to help uncover the best companies. They continually buy the best stocks year after year.

Fortunately, they leave footprints of their activity.

For example, we can look at the Big Money chart for Home Depot (shown below). Each green bar indicates a day when there was Big Money buying in HD…

Since 1992 (backtested in gray), Home Depot generated a Big Money buy signal 66 times, with the first one appearing in December 1992.

For me, the key to tomorrow’s “holy grail” stocks lies in these simple qualities: stocks going up over time with growing earnings (and dividends). My Big Money signal helps me spot them.

There are thousands of stocks out there. But only a handful can fit my strict criteria. Be selective. That’s how you win.

And if you’re interested in finding out which stocks the Big Money is buying, keep an eye out for The Big Money Report. It’s the next newsletter service—devoted entirely to growth stocks—from Curzio Research.

In it, I’ll be hunting for the next crop of winners.

P.S. My colleague, Genia Turanova, has a history of finding exactly the kind of growth and income stocks I’ve described today.

Become a member of her Unlimited Income advisory… and start building a reliable source of wealth.