In the short term, stocks aren’t a cakewalk.

Long-term… they kind of are. That’s what history shows us. Over time, the stock market generates a 10% annual return, on average. You can check the long-term returns for the S&P 500 and related index funds like VFINX and SPY. The average return is right around 10%.

That’s right—historically, investors can expect to average a double-digit gain, year after year.

A basic low-cost broad market index fund, like VFINX or SPY, should deliver it.

While 10% isn’t something to sneeze at, there’s a way to do much, much, better.

I call them outliers. Let me explain…

One terrific academic study showed that just 4% of stocks were responsible for nearly all of the stock market’s gains. And half of those gains came from an even smaller group—just 1% of all stocks!

In other words, the biggest gains come from a few “outlier” stocks. They’re the “holy grail” of the stock market… and every investor should be looking for them.

So, what kind of company achieves such epic performance?

The answer is simple: a company that’s been in an uptrend for a very long time. A prime example is Apple, which is up more than 1,000% over the past decade… more than 5,000% over the past 15 years… and an incredible 40,000% over the past 20 years.

So, while markets zig and zag in the short-term, the key to massive wealth is focusing on the best companies out there.

But on my quest to discover these outliers, I first had to learn a few things…

The best stocks go up

It may sound simplistic, but trend-following is a big part of investing. Some traders follow fundamental trends, like earnings and sales. But the true “masters of the market” follow stock price trends.

Let me share a lesson from my trading roots…

Nothing is more important than the price trend of a stock. I learned this the hard way, when my first stock trade went against me (big time). You see, I was looking for a deal. I bought a stock that was heading lower. I thought it was cheap. As it turned out, it was cheap for a reason…

As the trade went against me, I added more money to this stinker. Finally, I sold out with a 95% loss.

Ouch.

But after this experience, I was hooked. I thought, “if I can lose this much so fast, I certainly can make this much, too.”

And so I started my first trading experiment. I found two stocks in the same sector with different-looking charts. One stock had a chart that showed it was going up over time. The other was stuck in a downtrend.

One was “expensive” and the other was “cheap.” I purchased both to see what would happen.

You can probably guess how this experiment turned out. The stock in an uptrend kept climbing. It left the lagging stock in the dust. This was my first realization that price action matters.

I’ve built my trading strategy around one basic idea: Buy the shares of leading companies in an uptrend.

And there’s another lesson in this story: Great stocks are almost never cheap.

There’s a good reason for this. If a company is continually growing, it’s likely a quality stock—the kind of stock that looks expensive based on valuation metrics like the price-earnings ratio (P/E).

I’m not discounting the importance of valuation. My point is that price action is more important than basic valuation.

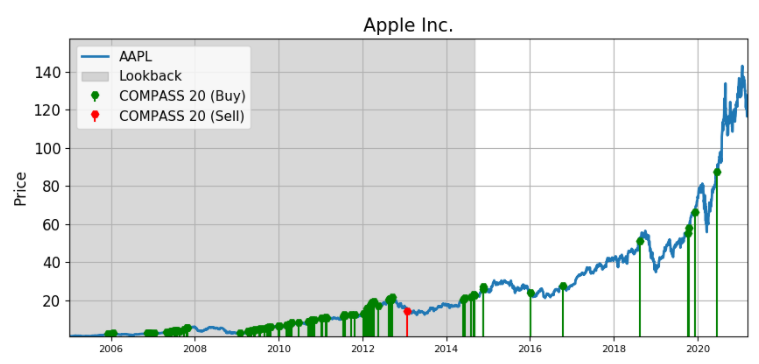

Let’s go back to Apple as an example. Below, I’ve included a chart from 2005 through today. Each green bar represents a day when Apple generated a strong buy signal based on my Big Money system. In other words, the stock went up on big volume—the kind of buying that comes from big, institutional investors. In short, it’s my Big Money signal.

That chart might not look steep, but it is. Since 2005, AAPL is up 5,367%. If you bought $20,000 worth of Apple shares back then, they’d be worth over $1 million today!

The lesson is simple: Respect the long-term price action.

It’s one of the pillars of sound investing.

The best stocks go up… a lot. So, while the stock market jumps around day to day, use that noise to your advantage. The daily up-and-down movements are senseless. But selloffs in great stocks create opportunities to buy.

Keep your game plan simple… and you’ll win in the end.

Next week, I’ll explain how to use fundamentals to help separate the contenders from the pretenders.

Editor’s note:

Price action matters… but that doesn’t mean you can’t benefit from falling stocks…

Earlier this month, members of Genia Turanova’s Moneyflow Trader had the chance to collect a quick 40%-plus gain on the market pullback. And this is far from the only winning hedge in the portfolio. Throughout 2020, Genia has helped subscribers lock in gains like 220%… 265%… and even 508%.

If you’re not already following Genia’s “market insurance” strategy, here’s how to sign up today… and protect yourself in any market.