The year was 1982. President Reagan was in the second year of his first term… Olivia Newton-John and Survivor were rocking the billboards… E.T. and Indiana Jones were raking in millions at the box office… the S&P 500 stood at 140… and oil companies were ruling the Fortune 500.

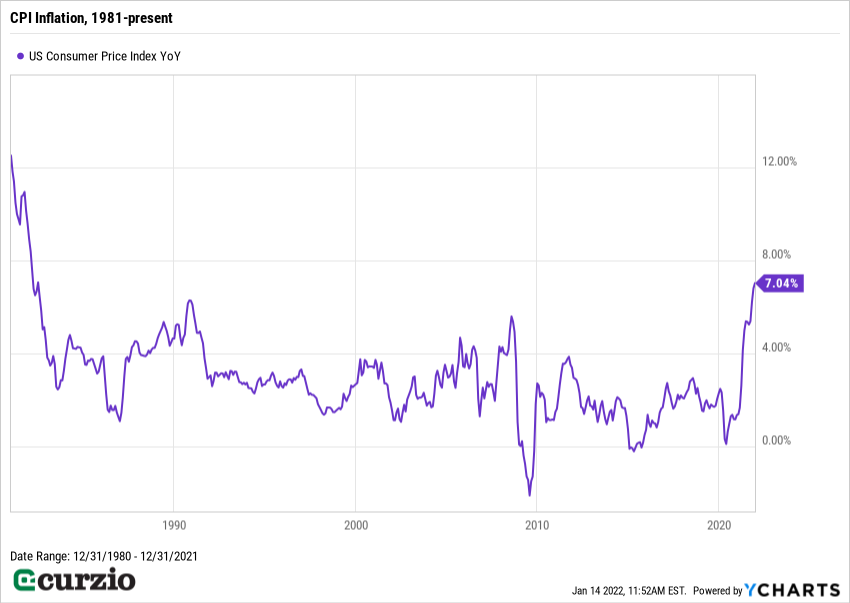

That was also the last time we last saw inflation at 7%…

Until now.

Earlier this week, we learned that in December 2021, consumer prices were higher by 7% year over year (inflation is measured by the rate of price increases). It’s a sharp jump from the recession-like 1.4% of December 2020… and much higher than the Fed’s stated goal of 2%.

This inflation resurgence is troubling. And the Fed, charged with keeping inflation in check, isn’t fighting it with all–or even some–of its available tools.

Today, I’ll tell you why we should continue to expect a tame Fed and high inflation in the months ahead… and how to invest for maximum benefit.

First, let’s review why today is not at all like the 1980s… despite the same levels of inflationary pressures.

The chart below shows the Consumer Price Index (CPI) from 1980 to today—in other words, it shows how hot the recent inflation is… and how fast it’s been accelerating.

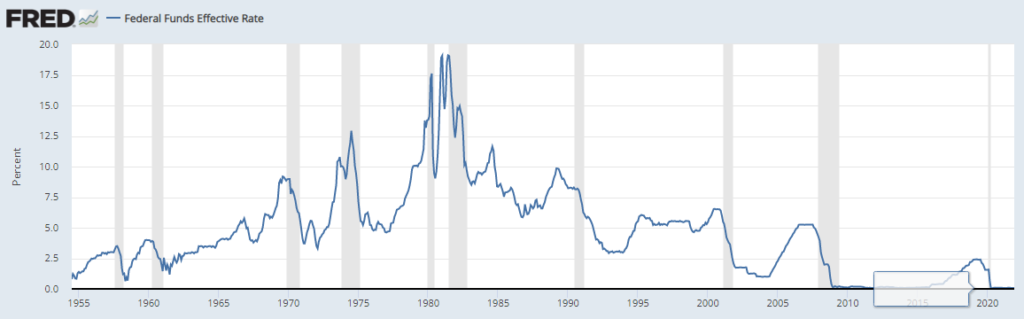

But the next chart is even more important. It shows the Fed funds rate—the only interest rate the Fed actually controls.

In the early 1980s, it was as high as 18%… declining to “only” 9% in December 1982. In other words, the Fed funds rate stood at about two times the rate of inflation.

Keeping the Fed funds rate high was an important tool to fight abnormally high prices. It made borrowing money more expensive, which cooled the economy… and defeated inflation. By the end of 1982, CPI inflation declined to 3.8%.

Meanwhile, today, with inflation running at the same level as it was in 1982, the Fed funds rate is, for all intents and purposes, stuck at zero. Until this changes, inflationary conditions will remain with us.

Part of the problem is the Fed’s pulling out all the stops to combat COVID-related slowdowns.

While a necessity a year ago, these ultra easy-money policies are no longer needed today.

In Fed chair Powell’s nomination testimony this week, the word “transitory” was nowhere to be found… but inflation was still blamed on supply chain issues. If this is the case, logic dictates the issue will largely resolve itself.

But this logic delays any action…

The Fed’s “wait and see” approach won’t kill inflation… or even put a dent in it big enough for consumers to feel some reprieve.

And even though interest rate hikes—up to four in 2022—are now possible, these rate increases (if they even happen) won’t be nearly aggressive enough.

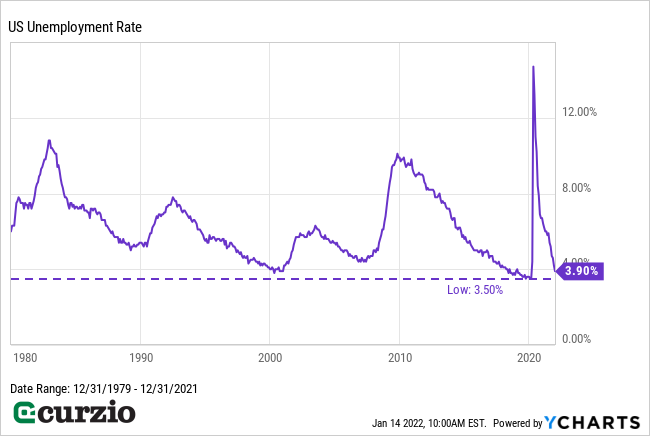

Plus, the Fed’s still buying assets with both hands in order to pump new money into the economy. As I mentioned, with unemployment near multi-decade lows and markets booming, the economy no longer needs life support.

While the tapering (reduction) of asset purchases has accelerated, “tapering” doesn’t mean “ended.” That’s slated for March. In the meantime, the Fed’s balance sheet continues to expand—and it already holds an unprecedented $9 trillion in debt.

This isn’t fighting inflation—it’s adding fuel to the fire.

If the Fed doesn’t take more aggressive action, inflation is likely to remain higher than it’s been in decades.

And stocks will remain the top asset to own to protect from inflationary threats.

However, a more aggressive Fed is also a risk… which puts the market at risk, too.

You see, the higher inflation gets, the harder it becomes for many companies to absorb the rising costs and grow per-share profits.

What’s worse, putting off the issue means there’s a greater risk of the Fed making a misstep down the line—like raising rates far too quickly… which would likely crash a market that’s gotten used to free money. We’re already seeing signs of market panic… or investors spooked by a more vigilant Fed.

Long-term, equities are the best instrument to grow your wealth amid high inflation.

But in the short-term, commodities and other hard assets are uniquely suited for inflationary conditions. In the 1970s, interest in commodities as inflation hedges surged… even as the industrial demand for copper and other raw materials was dented by a recession.

And in the early 1980s, markets were completely dominated by energy companies.

Oil is just one commodity set to benefit in the months and years ahead. Other natural resources, like copper and nickel, are also getting a boost from strengthening world economies… as well as from the newly-emerging clean energy and electric-vehicle transition trends.

Plus, we’re not in a recession today… quite the opposite.

Non-monetary assets, from industrial metals to agricultural commodities to crude oil… as well as precious metals—are set to do well.

And don’t overlook value stocks… especially those with rising dividends. Because they pay dividends, these companies can be profitable to own even if the market sells off.

As we buckle up for longer-term inflation, invest in income-generating stocks you’d be happy to own for a long time… and diversify your portfolio into inflation-proof assets.

P.S. Contrary to popular belief, investors don’t have to sacrifice growth for income.

In my Unlimited Income advisory, I uncover safe, inflation-ready assets that deliver market-beating dividends… AND quick capital gains.

If you’re looking for that rare balance of income and growth… join us at Unlimited Income. Our strategy is one of the surest paths to real wealth—with very little effort…