Wow, what a difference a week makes…

The short seller brigade is gone. And what was setting up to be a stock market selloff turned into a nothing-burger.

As you probably know, markets rallied furiously last week. The S&P 500 (SPY ETF) surged nearly 5% from its January 29 low.

For weeks, I’ve been preparing to buy the coming dip in stocks. But the Big Money Index tells us that the buyers are back in control. It looks like I’ll have to wait a bit longer for a pullback. And that’s OK.

Why?

Because I’m an eternal optimist.

I use pullbacks for one thing only: to buy high-quality stocks at a discount.

You may be wondering if we’re out of the woods yet. As I’ll show you, the buyers are back in control… at least for the near term…

And while we wait for a larger correction that will eventually come, the best strategy to weather any storm is to own “outlier” stocks. I’ll explain more in a moment…

Selling in stocks has slowed

There’s been a huge change in the price action over the past two weeks.

Selling typically begets more selling. But as Wall Street focused on curbing buying in certain “meme” stocks last week… the selling ground to a halt.

I might be oversimplifying the story. But it doesn’t matter why the selling stopped. The data is all we need to look to for clarity.

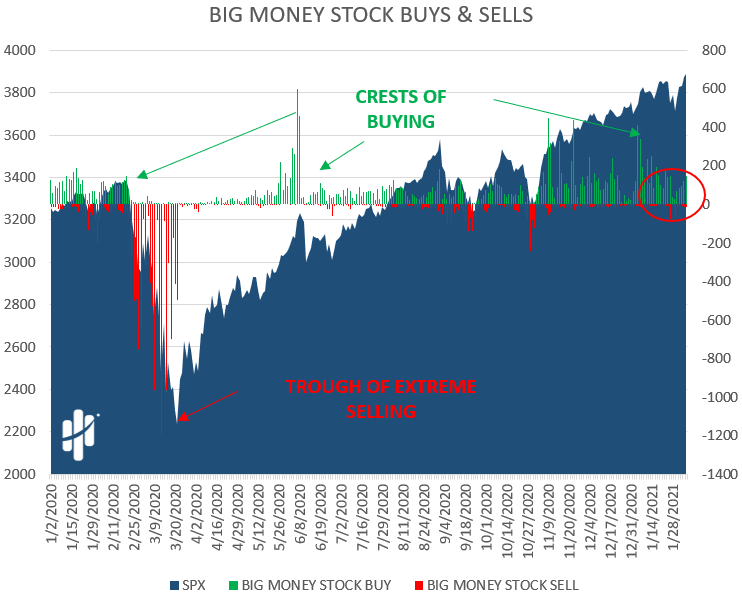

Below, I’ve included the latest Big Money Index chart. It shows the selling in stocks has slowed dramatically. And while some buyers have stepped in, we’re not at the exuberant levels of weeks ago.

I’ve circled the important stuff. The red bars that started to pop up in January have disappeared. That means that big, outsized selling is no longer pressuring the stock market. Instead, the green bars are back. The buyers have returned.

Put simply, when selling slows and buying grows, stocks should push higher. The dark clouds have faded. Instead of a selloff, we’re likely to see the market stay elevated.

That’s totally cool, too. My “core longs” are doing just fine.

Great stocks fly higher over time

So, what’s a core long?

Those are the stocks I plan to hold for years. Earlier, I described them as “outliers.” They’re the companies that stand above the rest. They’re businesses that keep growing year after year. And they can handle any kind of storm—whether it’s a market pullback or an economic recession.

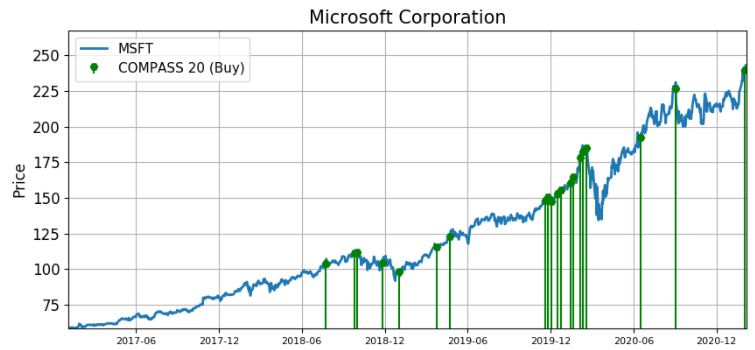

A great example is Microsoft (MSFT). I’ve owned it personally and in managed accounts for years.

It’s easy to see this company is a winner. Not only does Microsoft have amazing products… it also makes a ton of money for investors. Its recent earnings release was a stunner. During its most recent quarter, the company earned $15.5 billion in profits!

And while that’s great and all, the true tell for a stock’s trajectory is Big Money activity. And Microsoft has a lot of buyers.

Below is a chart of MSFT going back to 2017. Each of the green bars indicates a Big Money player was buying Microsoft… and pushing the stock higher.

That’s a trend you don’t want to fight.

So, while markets bob and weave, stay focused on your core longs. They’ll keep you in the game as buyers and sellers battle for control. Over the past week, we’ve seen buyers make a stand against the sellers. As a result, the stock market turned on a dime.

Put simply, the clouds have disappeared. It’s time to get bullish again.

P.S. If you’re interested in finding the best long-term growth stocks, I’m weeks away from launching the next big newsletter from Curzio Research. It’s called The Big Money Report.

You can follow every move as I go through my process of finding tomorrow’s winners.

Keep an eye open for it!