The pandemic isn’t over yet… but you’d never know it from the action in commodities.

For instance, China’s livestock has been gobbling up corn faster than farmers can grow it—and the price of corn has more than doubled over the past year. As a result, some farmers have no choice but to feed their livestock wheat, a grain long reserved for human consumption.

And it’s not just corn.

The price of lumber is up four times (315%) in a year. And oil, the most important commodity of all, has rallied more than 230% over the same period.

You might say it’s not a fair comparison—after all, oil prices went negative just a year ago. But that anomaly was a direct result of significant overproduction and sharply lower demand… coupled with crisis conditions and futures expiration.

Today, the oil story has made a 180-degree turn from last year…

Below, I’ll tell you why oil will continue to rally in 2021… and give you a couple of my favorite plays with significant upside potential.

But first, let’s rewind to a few years back…

Oil prices have been weak for years—long before bottoming out in April 2020.

Today, West Texas Intermediate (WTI) oil is 12% lower than it was 15 years ago… and a whopping 55% below its 2008 peak.

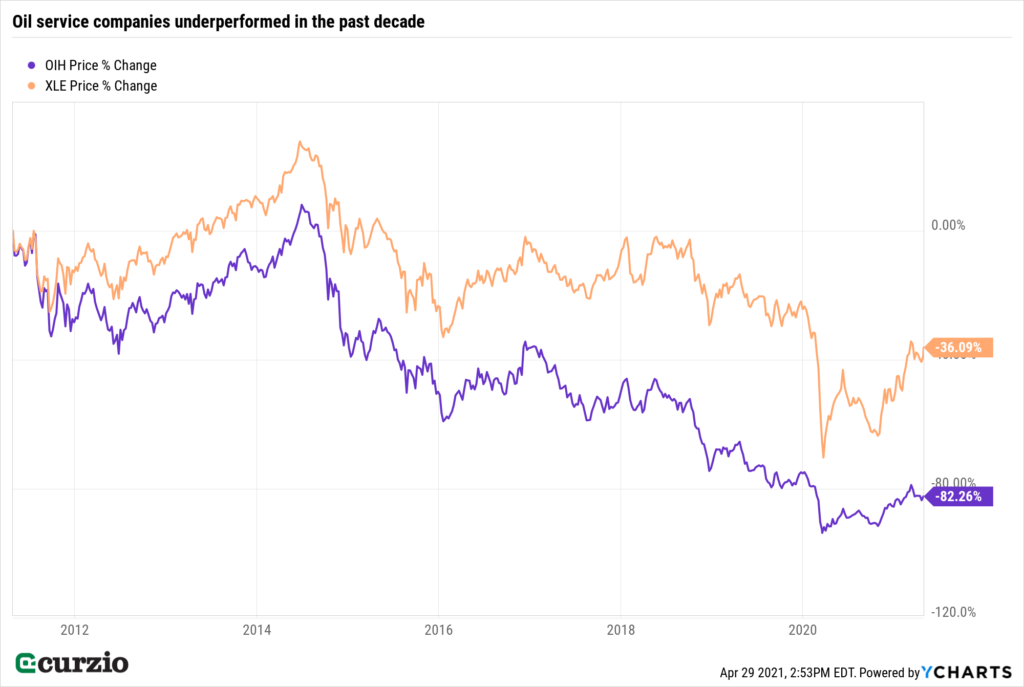

No wonder oil equities, represented on the chart below by an exchange-traded fund (ETF)—the Energy Select Sector SPDR (XLE)—are sharply down as well.

While the market is up 240% in 15 years, energy stocks in the XLE lost some 12% on average (not counting dividends).

You can’t blame this massive underperformance on COVID.

Clearly, something else has been going on with the sector…

Two major trends have changed the oil landscape forever

For one, oil fell victim to alternative energies. The emergence of cheaper alternatives, such as solar or wind, has reduced long-term oil demand.

This is a trend that’s only going to accelerate—a long-term negative for most oil-related stocks.

Plus, the shale revolution turned the oil world on its head.

In the early 2000s, we saw the invention of hydraulic fracturing and horizontal drilling—better known as fracking. It created access to a sea of oil and natural gas that had been previously unreachable (or unfeasible to produce). Today, fracking accounts for 36% of total U.S. crude oil production… and has contributed to lower oil prices worldwide.

Thanks to fracking, the U.S.—the largest oil market in the world—has been able to achieve energy independence… while depressing energy prices. Low energy prices are good for the economy (and the markets), but bad for energy stocks…

Sharply higher oil prices might well contribute to a market decline—just like they did back in 2007–08. But we’re not there yet. Today, even though the price of crude has rallied sharply since its 2020 lows, it’s still flat on a two-year basis.

And in many different corners of the economy, there’s no substitute for oil—not yet, anyway. From airplanes to trucks to the majority of cars on the road, oil is a must-have fuel.

U.S. oil consumption by sector in 2020

- Transportation: 66%

- Industrial: 28%

- Residential: 3%

- Commercial: 2%

- Electric power: <1%

(Source: EIA)

And this is where the demand lost in 2020 will come back the fastest… as we get back on the planes for a well-deserved vacation or drive longer distances to visit friends and relatives…

This jump in demand will further support oil prices, without endangering the market or the economy.

In other words, today’s higher oil price is a sign the recovery is in the works.

This leaves us enough time to benefit from oil-related stocks, as well.

Where to invest to benefit from oil recovery

You can benefit from oil’s strength by investing in two distinct groups of stocks: oil producers and oil servicers.

And the easiest way to do so is via ETFs, such as the Energy Select Sector SPDR (XLE) or the VanEck Vectors Oil Services ETF (OIH).

The XLE is dominated by oil majors, Exxon (XOM) and Chevron (CVX).

Together, these two big oil companies account for nearly half of the fund’s assets: XLE is 22.8% invested in Exxon and 21.9% invested in CVX. In other words, if you own XLE, your returns will depend more on Exxon or Chevron than on any other individual stock.

Both companies will report their most recent earnings tomorrow, April 30.

The market expects positive news, given the price action in both stocks.

Earlier this week, London-based BP (BP) gave us a peek into what to expect tomorrow. BP’s reported profit of $2.63 billion was sharply higher than $791 million a year ago… and destroyed analyst estimates calling for only $1.48 billion in profits.

If both companies beat expectations by this much, expect XLE to get an extra boost… and trade higher.

But OIH could soar even more. If your goal is to gain maximum leverage to oil price action, the VanEck Vectors Oil Services ETF (OIH) is more leveraged to oil prices… and the continued strength in oil should benefit OIH disproportionately—especially considering how much the sector’s been lagging its producing peers.

Oil service companies aren’t for the faint of heart. It’s a boom-bust sector—when all is well in the oil patch, the service companies flourish… and when oil prices are lower and companies need to contain costs, service companies suffer.

OIH is dominated by Schlumberger (SLB), with 22% of the total assets invested in this sector leader… and Halliburton (HAL), with 14.1% invested. These two oil service companies make some of their money by providing drilling services—but the bulk of their revenue comes from services such as oilfield management or geological analysis.

Historically, the group has done well in the periods of rising oil, and this year shouldn’t be an exception.

Just watch out for the drillers like Transocean (RIG). This group has the most narrow focus of the oil sector, and, historically, it’s been the most volatile. Drillers could be good speculative plays in this market… but they’re still questionable as a long-term investment. OIH gives you some exposure to the drilling sector without it overwhelming the ETF.

Both XLE and OIH will do well in the environment we’re about to see (oil prices rising steadily).

But XLE has the advantage over OIH when oil prices go down… It’s well-diversified, and with a greater than 4% yield, it’s a lower-risk choice to play the oil rally.

Editor’s note:

On yesterday’s episode of Wall Street Unplugged, Chris MacIntosh, founder of Capitalist Exploits, explained why he’s preparing for a commodities “supercycle”…

Today, he shared his favorite commodities play with The Dollar Stock Club members—a “boring” agricultural company set to explode on a reopening economy and higher food prices.

For the price of membership—$4 a month (yes, $4!)—you can be one of the first to get in on this stock… before it skyrockets.