On March 12, 2020—two years ago almost to the day—the markets took their biggest plunge since the crash of 1987.

Dubbed “Black Thursday,” the S&P lost 9.5% in a single day—on top of previous losses—due to COVID fears. And with many international markets selling off even more, the feeling of panic was widespread.

One-of-a-kind “black swan” events—such as 9/11, COVID, and Russia’s invasion of Ukraine—can trigger a big selloff.

But the answer isn’t to run away from the markets. Today I’ll tell you why… and how to stay safe among the mounting risks.

In 2020, the market was saved from COVID shock by the timely interference of central bankers all around the world—including the U.S. Fed.

Nobody in their right mind criticized the Fed at the time. It was the right thing to do: The entire financial system was reacting to the COVID-related economic contraction… and the actions of the Fed—from cutting rates to zero… to starting a new bond-buying program—helped the economy and the markets.

But today, the story is different.

Next week, the Fed meets for its highly anticipated regularly scheduled meeting. But it’s no longer business as usual. Instead, this second meeting of the year must be devoted to the mounting economic and market risks.

A rate hike of 0.25%, or even 0.5%, seemed to be locked in before the Russian war in Ukraine. Now, the calculus is likely to change again.

The Fed doesn’t have much room to maneuver… given its failure to hike rates since the emergency cut of 2020 and its record-sized balance sheet.

New quantitative easing (QE) measures seem unlikely… and there’s no room to cut rates from their zero level.

Inflation, already at a 40-year high, is set to get worse as the price of oil and other materials skyrocket. A rate hike (or two) won’t change this fact…

And while the economy looks strong… we simply cannot know just how widespread the contagion from the war will be.

Add inflation to the mix… and it’s clear why the market has been selling off lately.

My best advice is not to panic. Don’t sell your entire portfolio… but rather reposition it for the new risks. Here’s how…

No. 1: Stay invested… but focus on dividends

Historically, the path of least resistance for the stock market is up. This means, over time, stocks, despite short-term setbacks, are your best bet for making money and protecting its purchasing power.

And the longer your holding period, the better your odds of profiting.

If you own a well-selected set of dividend stocks, you can keep making money during downturns… And, if you don’t need income right now, you can reinvest dividends… and be positioned to make more money during bull markets.

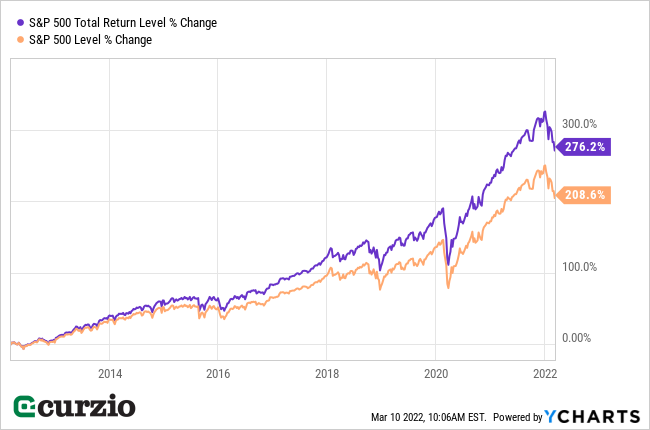

As you can see from the chart below, the difference between capital gains and dividend-reinvested (total) returns can be massive… Over the past 10 years, for instance, the market has more than tripled—but dividend reinvestment has added some 70% more to that impressive return.

Income investors don’t need to be overly concerned with the market’s temporary downside…

That’s because they know what they get from the market—a steady (and ideally rising) stream of income—and are willing to wait out market fluctuations.

Let’s say your ACME stock holdings are worth $10,000, with a current yield of 3%. This means you get $300 from your ACME investment every year.

Now, let’s say ACME loses 25%… but keeps its payout.

The value of your ACME stock is now only $7,500… but it continues to pay the same $300 a year. No matter what the market tells you about the value of ACME today, your annual income is intact.

So you can afford to wait for ACME (and the market) to recover… because you’re being paid regardless.

One potential problem: This math only works if the company doesn’t reduce its dividend.

If ACME’s business (or the overall economy) sharply deteriorates, it could cut its payout to preserve cash and survive the downturn.

Let’s say you count on that $300 per year… so you decide to sell ACME and replace it with another income stock. Since ACME is down 25%, you have that much less to put into a new stock position. To compensate, you either need to find a stock with a higher yield (which often means more risk) or settle for a cut in your annual income.

Obviously, that isn’t ideal… But selling out of problematic, vulnerable stocks is a valid risk reduction strategy.

This market is riskier than the one we’ve been dealing with over the past couple of years. But your strongest positions will take care of themselves… through dividend income and price appreciation.

No. 2: Maximize your U.S. exposure

Investors are now pulling money from emerging markets and flocking to safer international corners. And one likely beneficiary is the U.S. dollar.

A stronger currency is not only good for the U.S. politically… It also helps the country buy more in the international markets by spending relatively less.

But the stronger dollar can be negative for some businesses, especially those that sell a lot of goods and services abroad: Multinational corporations are at a slight disadvantage with a stronger dollar… while smaller domestic stocks benefit.

All else equal, small- and mid-caps stocks will get an extra boost from a stronger dollar… And U.S. stocks of any size remain safer than international (and especially emerging) markets.

No. 3: Invest in inflation-resistant securities

At this point, there’s little chance inflation will simply die down. The Fed missed its optimal window for starting rate hikes, and now it’s too late to keep the lid on… There will be rate hikes, likely as soon as next week—but not nearly enough to overcome the inflationary pull of higher oil and war-related disruptions.

In such circumstances, commodities of all kinds, from oil to wheat, as well as precious metals, could be your best bet.

Energy equities and ETFs—such as the Energy Select SPDR ETF (XLE) and the VanEck Oil Services ETF (OIH)—have long been my top inflation-beating picks… and they just got a huge boost from the sharply higher oil prices.

Precious metals, too, are serving double-duty in this market… If you have a position in gold or silver, you’ve benefited from both the flight to safety and inflation risks.

In sum…

With the Russian-Ukraine war thrown into the mix, investors are worried the fallout will be wider than the market currently anticipates.

But this new risk is piling up on top of others—including inflation, slower growth, higher energy and food prices, and rising interest rates… all the usual suspects that often cause widespread bear markets.

The most important thing is not to panic… as bear markets are part of investing. Instead, rotate with the market. Invest in inflation-resistant stocks… commodities and precious metals… and high-quality dividend-payers.

In the stock market—just like in life—the optimists win.

P.S. Interested in my favorite high-yield, high-quality stocks for today’s market? Join us risk-free at Unlimited Income.