If you’re a chess player, love math, or simply like puzzles, you must be familiar with the “chessboard problem.”

As the story goes, the inventor of chess was given a choice of rewards for creating the game. Instead of a set monetary amount, he asked the ruler to reward him with wheat—one grain for the first square, two for the second, four for the third… and to continue doubling the number of wheat grains until the end of the board—the 64th square.

The ruler happily accepted, only to learn that—by the end of the chessboard—the inventor was able to claim 18,446,744,073,709,551,615 grains of wheat… more than enough to deplete the Treasury.

This is all about compounding… A simple doubling, starting with just one grain of wheat, means 18.4 quintillion grains (or more than 1,500 times the world’s global wheat production) by the 64th step.

In the age of the highly contagious coronavirus, the power of compounding should be respected more than ever.

If not slowed, the quickly mounting number of infections could overwhelm the world.

This is why China initially shut down the entire province… and why governments all around the world nearly uniformly reacted to the threat by largely shutting down their economies…

This is all to prevent the infection from spreading uncontrollably. Or to “flatten the curve.”

The economies, though, suffer from sudden stops… Consumer demand falls off the cliff, supply chains get interrupted, and the markets sell off.

But, as uncertainty rises, three important factors can make all the difference between panic selling and bargain-hunting.

Here are the three factors to watch…

1. Liquidity

Almost daily, the Fed is implementing new measures designed to help maintain ample “liquidity,” designed to keep the flow of money moving freely through the economy and the markets.

Meanwhile, the government is attempting to flatten the economic curve, as it were. The $2 trillion economic rescue package, the CARES Act, was passed by the lawmakers in record time—with provisions to help corporations, small businesses, state and local governments, and individuals. More fiscal measures are being considered as we speak.

These policies are designed to fight this crisis… and they’re a must for the economy we’re in.

This is why the market has already recovered half of what it lost in the first-quarter selloff.

But true market recoveries take time.

In addition to a dramatic near-zero rate cut—executed faster than ever before—the Fed has implemented other important measures—both traditional and nontraditional, including unlimited quantitative easing… offering repurchase (repo) agreements so that banks can borrow cash more easily… and relaxing the Dodd-Frank Act.

Just today, central bankers unveiled a new $2.3 billion lifeline to small and midsize businesses, corporations, and U.S. cities and states.

And in another unprecedented move, the Fed will start buying junk-rated debt—and municipal bonds.

The Fed is truly pulling all the stops to make sure the economy keeps operating, banks keep lending, and local governments have financing.

Still, investors would be well-served to keep an eye on signs that liquidity is ample and that the money flow through the economy is uninterrupted… low bond-market yields are the single most important indicator.

2. Sentiment

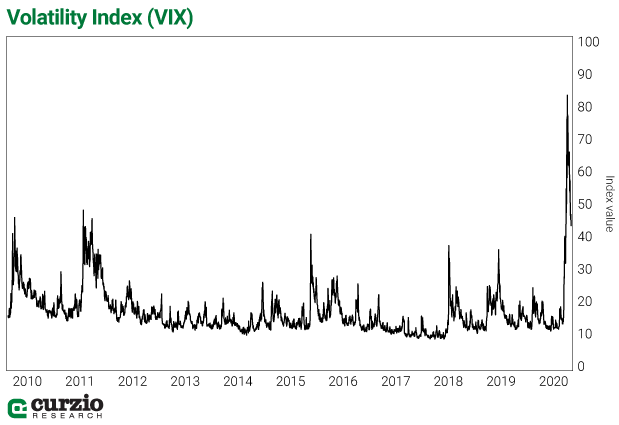

The VIX, also called the “fear index,” is one of the leading measures of market volatility.

It measures market stress by tracking the implied volatility of S&P 500 option prices… and while it might sound complicated, the VIX has a track record of accurately tracking market sentiment.

Generally speaking, when the VIX is low, the market is experiencing little or no stress… When it’s high, the market is under stress.

Today, the VIX, with a 41.5 level, is still well above its 10-year average.

The good news is that the VIX is down sharply from the panic levels of less than a month ago.

But it’s far from signaling market comfort.

Although a high VIX doesn’t always mean you can’t buy stocks for a bargain price, I’d expect to see the VIX fall even further before we can predict a sustainable recovery.

I’d look for a level around 30. This would still be significantly higher than the 10-year average (17.2), but would still be more than 50% lower than it is today.

3. Rate of infection

Remember: There’s a reason for all the unprecedented policy response.

That reason is the sudden economic pause due to the coronavirus.

Therefore, the biggest factor in global economic recovery is the growth rate of new coronavirus cases around the globe. When the rate of growth of new infections slows significantly, I’ll treat it as an indicator that the economy is nearing a restart…

And a prolonged decline in new cases would tell us that the worst is likely behind us.

I hope this happens soon and that our collective financial pain is minimal… while our collective health withstands this tremendous challenge.

Meanwhile, the story is changing fast, so continue keeping an eye on these three factors: liquidity, volatility, and the rate of new infections.

And even if you feel confident enough to buy stocks, don’t forget that a hedge or two—such as a put option or a short—might go a long way to keep you safe in this market. Just like any other kind of insurance, it might look like a waste… until you really need it.

Stay tuned, stay safe, and remember: Social distancing works.

Frank note: If you’re not a member of Genia’s Moneyflow Trader service, it’s one of the best things you can do to protect yourself—and profit—in this crazy market.

In March—one of the worst months on record for the markets—Genia closed not one, not two, but five trades for 100%-plus gains.

Watch this short clip to hear why I personally follow Genia’s advice… and how you can get a FREE subscription to her upcoming Unlimited Income advisory.