As U.S. tax season winds down, there’s one smart move that every investor should be making.

Working-age investors can’t afford NOT to do this.

Instead of focusing on where to put your money, today I want to discuss something just as important… how you should invest to make sure you’re set for retirement.

In short, there’s a huge tax advantage every investor should know about. And if you set aside a few thousand dollars each year… the gains can be incredible. Plus, you’ll get to keep more of your profits by paying lower taxes.

Let’s get into it…

Investors have 2 more weeks to make this move

Most of you already know I love talking stocks. But I also have a soft spot for personal finance.

Before you doze off, hang in there with me… especially if you’re a young investor. And please keep in mind, this isn’t tax advice… this is sound advice.

In about two weeks (on May 17), the window closes for contributing to an individual retirement account (IRA). For simplicity, I’ll only discuss IRAs and Roth IRAs—which are specific to U.S. investors. But many other countries have similar programs.

In a nutshell, an IRA allows you to invest money in a tax-deferred account until retirement. You can set aside a few thousand dollars each year… and watch the money grow tax-free until you start withdrawing after you retire.

You can start withdrawing from an IRA at age 59 1/2. For a traditional IRA, you’ll pay taxes on your withdrawals at the ordinary income tax rate. This is an important point because most investors will end up in a lower tax bracket at retirement age. Currently, almost any U.S. citizen with taxable income can contribute to a traditional IRA.

But if you really want to avoid future taxes… there’s an even better type of IRA to consider…

It’s called a Roth IRA. Like a traditional IRA, it’s a special account that grows tax-deferred. The main difference is that you must contribute after-tax dollars. In other words—unlike a traditional IRA—you’re not deferring any current taxes on the income you’re putting into the account.

But here’s the amazing thing about a Roth IRA…

You’ll pay ZERO taxes on any future gains in the account.

Put simply, a Roth IRA gives you a tradeoff. You pay your full income tax today. In exchange, you get to avoid all future taxes on that money AND any gains you make from it. There are income limits for contributing to a Roth account ($139k in annual income for individuals and $206k for couples filing jointly).

For the Roth IRA in particular, there’s no better retirement vehicle on this planet!

Whether you go with a traditional IRA or a Roth IRA, you’re setting yourself up for huge tax benefits down the road. They’re both great vehicles that help investors defer—and possibly avoid—paying taxes.

It’s great for investors… and not so great for the government. That’s why there are limits on how much you can contribute each year.

For the 2020 tax year, the limit is $6,000.

Typically, the deadline to contribute to these accounts is April 15 of the following year. But, because of the pandemic, contributions for 2020 are allowed through May 17, 2021.

Once this date passes, you’ll lose the chance to contribute anything for the 2020 tax year. Anything you contribute after May 17 will count towards 2021.

That’s the 14-day window!

Keep in mind, IRAs are one of the few places you can have your investments grow with tax benefits.

If you’re a working adult in America, chances are you can contribute to an IRA. And you’ll want to… because the gains can be incredible…

It would be crazy not to do this

IRAs can be incredible for younger investors. Straight out of high school, I started a Roth IRA. Back then, the contributions were a lot smaller, but I kept at it year after year.

Today, my account has grown tremendously. By putting a few thousand bucks into the account each year, I’m in a better spot financially. Best of all, these assets will continue to grow tax-free for decades. And since I went with a Roth IRA, I’ll avoid paying any taxes… as long as I wait until age 59 1/2 to start withdrawing from the account.

Whether you choose a traditional IRA or a Roth IRA, the tax benefits can really juice your returns.

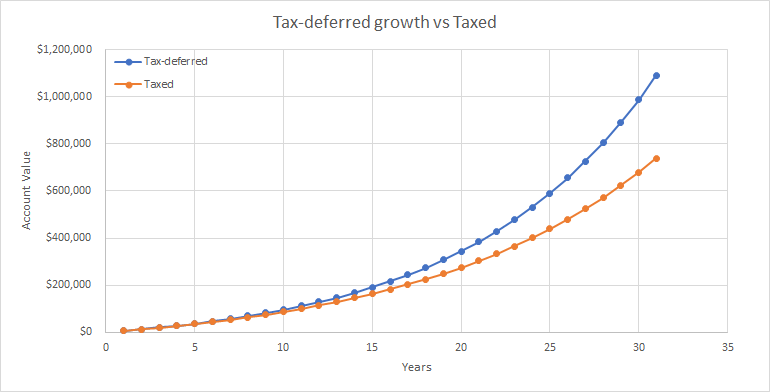

Below, I made a hypothetical chart that shows the difference between tax-deferred vs. taxed growth (and the longer you let that money grow). For this example, I started with $6,000, contributed $500 each month, and assumed both accounts generate a 10% gain each year. The blue line shows the result for a tax-deferred account. And for the taxed account (shown in orange), I applied a 20% tax rate.

In both cases, you can generate amazing gains the longer you contribute to an IRA (and the longer you let that money grow). Starting with just $6,000… you can become a millionaire in 30 years if you keep contributing $500 each month.

But as you can see, taxes really eat into your gains. If you were investing in a normal (taxed) account, you’d be more than $250k short of a million after 30 years. And the effect becomes more dramatic the longer you invest.

It’s especially important right now… as there’s a lot of chatter about a potential increase in the capital gains tax. I covered the latest tax news last week. You can check it out here.

Higher tax rates don’t impact deferred accounts like IRAs. When I see headlines about proposed tax hikes, I’m not worried about my retirement accounts because the taxes won’t be applied for many years.

Look, if you’re at least 10 years away from retirement age, these tax-advantaged accounts are a no-brainer. You’d be crazy not to put money into an IRA each year. And you only have two weeks left to make your 2020 contribution.

And if you’re a younger investor in your 20s or 30s, take it from me… you can’t afford NOT to do this.

P.S. For the best growth and income stocks to build long-term wealth… check out my colleague Genia Turanova’s advisory, Unlimited Income—where she’s recommended names that deliver market-beating dividends AND quick capital gains as high as 104%.

Start accumulating the kind of wealth you can leave to your children. Become a member of Unlimited Income today for a 66% OFF discount.