When you step into the Las Vegas airport, the first sound you’ll hear is slot machines.

Gambling is an enormous business… The idea of taking a small sum and multiplying it within hours or days holds obvious appeal. Plus, we love to compete… and win.

But Vegas doesn’t hold a monopoly on gambling. Plenty of it happens daily in the stock market.

And one of the hottest gambles is trading meme coins and stocks like Dogecoin (DOGE), GameStop (GME), and AMC Entertainment Holdings (AMC).

With these new crowd favorites, it’s possible to be up 100%-plus in a few days.

“Get rich quick” schemes have always been popular… And that’s all you need to know to understand why these stocks are attracting so much attention.

So until there’s a huge, well-publicized bust, the meme trend is here to stay…

The meme-stock rallies are based on the classic short squeeze strategy. Put simply, this involves buyers targeting a stock with high “short interest”—meaning that traders have borrowed a lot of shares in order to bet on a decline in the stock price.

With the stock market at new highs (and risks of going long seemingly low), a new generation of traders are using this tactic.

Earlier this month, I talked about why it’s so difficult to bet against the meme crowd… and the dangers of using naked put options to bet on a price decline.

If you own any of these stocks, I’ll tell you how to play it smart…

But first, some basics.

Short selling is a bearish strategy. It involves selling borrowed stock in the hopes that the share price declines. When it does, the short seller will “cover” by buying back the stock at the cheaper price, pocketing the price difference.

The strategy is a big gamble, since the shorted stock can move higher. If that happens, the short seller will be forced to cover the borrowed shares at a higher price. As more short sellers get caught in this situation, their buying drives the price even higher.

Taken to the extreme, this becomes a “short squeeze”: a fast and sharp rally in a heavily-shorted stock.

The idea behind an engineered short squeeze is simple: find a small-cap stock (small caps have less trading volume and it takes less money to make a real price impact) with a large short interest… and create a buying storm around it.

Amplify this scenario with social media and trading platforms (like Robinhood) that encourage frequent trading—and voila! A trend is launched. Wash, rinse, repeat.

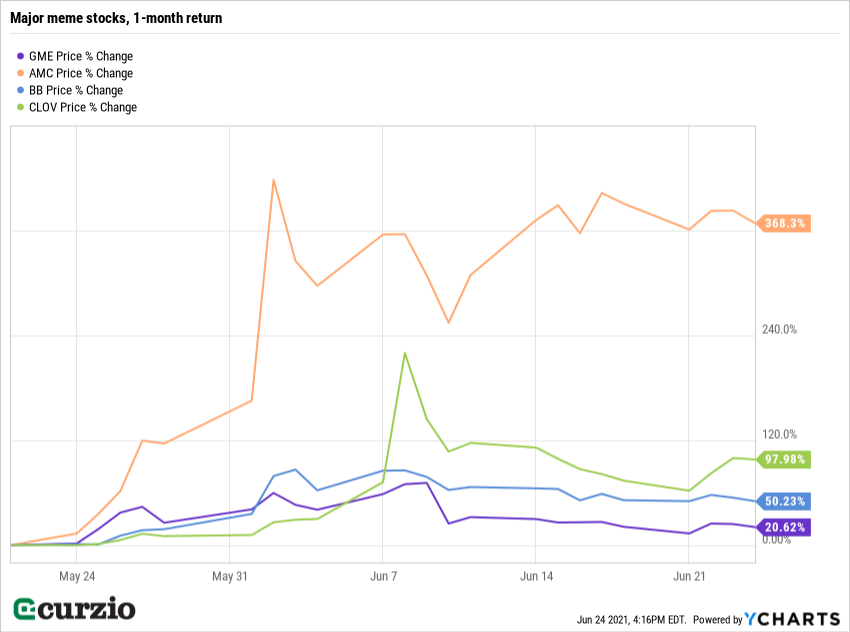

From GameStop (GME) to AMC Entertainment (AMC) to BlackBerry (BB) to Clover Health (CLOV)… Traders have used the strategy on stocks from a variety of sectors. Here’s the latest action in these meme stocks…

All of these stocks have one thing in common: high short interest.

But this doesn’t mean the meme buyers will always make money…

Just like a casino, some of them will make a killing. Others will be wiped out.

That’s because most meme stocks wouldn’t see a sharp run up without the engineered short covering.

And even for the best of the meme stocks, the short-squeeze rally usually pushes the stock price beyond a reasonable valuation.

Let’s take GameStop (GME), the mother of all meme stocks, as an example…

Despite being well below its January peak, GME is still up more than 10-fold this year… and the company’s been able to capitalize on this mad run by selling more shares at inflated prices.

Bulls argue that GME is one of the winners of a gaming revolution… and could become one of a few brick-and-mortar businesses left standing.

I made the same argument when I recommended GameStop in one of my old newsletters… when it was trading under $30 per share. But that was before meme stocks became all the rage… and when GME still paid a dividend.

If you don’t care how much you’re paying for a business, you’re not investing—you’re gambling.

Share price matters.

If a small-cap value stock you’ve owned forever suddenly becomes a WallStreetBets target, rejoice. Keep your target in mind, and take advantage of the runup.

Celebrated money manager Fidelity’s Joel Tillinghast regretted selling GME stock too soon. But as a value investor, he was compelled to sell GME when its price exceeded his estimate of what the stock was worth.

This discipline might have cost him some paper profits… but the point is, he walked away with profits… before GME turned into an even riskier stock.

Keep this lesson in mind if you’re tempted to play around with meme stocks…

Just like a trip to Las Vegas, you could make some money. But disciplined investors don’t need to rely on luck to make long-term gains.

P.S. Being a value investor doesn’t mean you have to sacrifice big upside. In my Unlimited Income advisory, I recommend hard-to-find assets that deliver market-beating dividends… as well as quick capital gains…

It’s a smart, easy way to gain exposure to growth AND value stocks…

And you won’t believe how affordable it is to gain access.