For the first time since the COVID crisis started, inflation is the No. 1 risk for the market.

Yesterday’s horrific market action—with major indices losing 2% or more—was a response to the latest inflation report.

In April, consumer prices jumped by 0.8%, the most since 2007. And the so-called core Consumer Price Index (CPI)—i.e., consumer prices without the more volatile food and energy spaces—rose by 0.9%, the most since 1982.

Today I’ll break down why the Fed has no choice but to let inflation loose… and why investors should be prepared.

But first, let’s take a quick look at inflation and deflation… and why too much of either isn’t good for the economy.

Inflation vs. deflation

As we’ve been beating back COVID, demand has come roaring back—and so has inflation.

Simply put, inflation is when prices of goods and services are rising… while deflation is when prices are declining.

Because prices result from the ever-changing supply/demand equilibrium… a slight increase in an average price reflects growing demand, and isn’t such a bad thing. Plus, inflation is stimulatory: When your money can buy fewer goods or services year over year, you’re more inclined to invest (in stocks, a house, or a small business, etc.) or to spend sooner rather than later (before prices go even higher)… benefiting the economy further.

On the other hand, deflation—falling prices—can lead to delayed demand.

If you know a price will be lower tomorrow, you’re likely to delay the purchase. And as consumers keep waiting, lower demand results in more price drops, and so on—a vicious cycle that can lead to hard-to-end recessions.

Deflation is good for savers, but bad for borrowers: When money appreciates, it’s more reasonable to sit on it than to borrow and repay with money that’s worth even more.

Conversely, inflation is stimulatory because it makes more sense to borrow and invest… with an eye on replaying the debt with the money that costs less.

But inflation can easily get out of control, distorting the economic balance and hurting people on fixed income.

Inflation could soar higher… but don’t run from the market

Inflation is now on the mind of 87% of the country’s population, according to a recent CivicScience survey. This number jumped by 10 points in only a month: A similar survey in March indicated that only 77% of the country were worried about inflation.

That’s because multiple signs of inflation—such as higher gas, food, and lumber prices—have become hard to ignore.

Just how much inflation is tolerable? And when does it become scary?

The Fed has an answer: 2%. It’s the level that signifies strong growth without too much pressure on prices. And it’s the Fed’s stated inflation goal.

But even moderate inflation (under 2%) can be a problem for an average person: It eats into the value of savings by reducing purchasing power.

There was a time when you could buy a Big Mac for much less than today’s $5. That’s inflation.

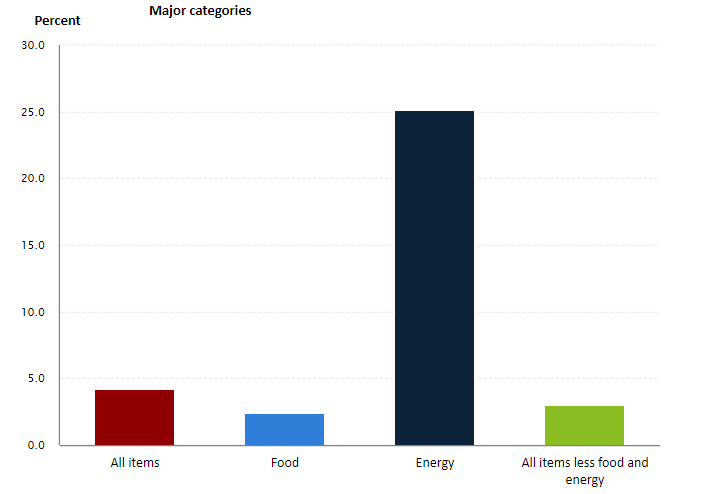

Over the past year, CPI prices—led by energy—have jumped 4.2%. That’s more than double the Fed’s goal.

CPI (April 2021), 12-month change for select categories

And yet, the Fed doesn’t plan to fight inflation over the next year or even two…

Higher interest rates have long been the main tool of the U.S. Fed and other monetary authorities around the world to combat inflation.

But today’s situation is different.

A worldwide pandemic has already impacted supply and demand in myriad ways… The Fed’s taken the stance that continuing monetary stimulus is a must.

In the COVID fight, the government’s been testing a helicopter money theory—giving money to people directly in an effort to prevent economic suffering and depression. And it works: Real (adjusted for inflation) GDP grew 4.3% (annualized) in Q4 2020… and by 6.4% more in Q1 2021.

But, paired with ultra-low interest rates, flooding the economy with stimulus inevitably raises inflation risks… Too much of this money will chase a limited amount of goods and services. Supply is growing, but it will take time for production to catch up with sharply higher demand.

It’s Economics 101: To resolve this new supply/demand imbalance, prices adjust higher.

The Fed sees little choice in this matter: It needs to make sure we’re not crippled by limited supply… and it doesn’t want to suffocate our still fragile economy with a higher cost of borrowing… even if that means letting inflation loose.

This translates into a lower likelihood of interest rate hikes… just when inflation is higher than we’ve seen since at least 2007.

In other words, the risk of accelerating inflation is greater than at any point in recent memory.

Investors must be prepared.

If the Fed is willing to let inflation get well out of its desired range, there’s no telling just how high inflation could go…

But here’s the good news: As I explained a few weeks ago, we’re going to see a strong recovery and a new “Roaring ’20s”… soon.

Even if it comes with a higher inflation risk, a stronger economy will pull the market out of its doldrums… And though we’re likely to see selling pressure continue in some sectors—including the money-losing and overpriced tech space—investments better suited for this new reality will do well in the months ahead.

So don’t let inflationary fears kick you out of the market… there are ways to protect your standard of living from inflation, even if you’ve already retired.

Next week, in Part 2 of this series, I’ll explain two strategies to combat inflation, including some of my favorite inflation-beating investments.

So keep an eye on your inbox…

Editor’s note:

Be sure to catch the latest episode of Wall Street Unplugged, where Frank gives his take on inflation and Fed policy… and the sectors that will do well in this environment.