Editor’s note: In honor of Labor Day, we’re revisiting a Curzio Classic from May 2020. Luke Downey reveals a little-known fact about how stock market gains are created… and why he’s devoted his career to finding “outliers.”

We all know stocks go up and down.

But did you know that only a handful of stocks are responsible for nearly all the gains in the market?

They’re what I call outliers. And they’re one of the market’s best-kept secrets.

The truth is… most stocks are a waste of your time. I can confidently tell you the majority of stocks on the market today are flat-out uncompetitive. They barely match Treasury bills in terms of yield.

It sounds crazy when you see 100-year charts of stock indices going up. But it’s true: Nearly all of those gains come from a thimble’s worth of stocks.

That’s why owning just a few outliers in your portfolio can make the difference between winning big… and struggling to keep your head above water.

If we stop and think for a second, it’s logical. Outliers exist in real life.

An easy example is sports. Michael Jordan, Tom Brady, and Wayne Gretzky are literally off the chart compared to other players. Just look at Wayne Gretzky’s points scored vs. time played, compared to all other NHL forwards over a 60-year period.

Note: In sports analytics, PSAR represents the points Gretzky has scored above what the average player has scored. (“R” stands for replacement player, or the average player.)

Like Gretzky, outlier stocks consistently outperform their peers. So, how do we spot them before the big moves?

Four simple words: Follow the Big Money.

4% of stocks are responsible for most market gains

When I say “Big Money,” I mean big-time investors—pension funds, hedge funds, and other large professional institutions. When they pour money into under-the-radar stocks with superior fundamentals, those stocks become the outliers of tomorrow.

Microsoft, Home Depot, and Apple all started out with humble beginnings. But they got it right over and over, and big-time investors eventually noticed. Today they’re the Jordans, Gretzkys, and Bradys of the stock market—the ones everyone wished they’d bought years ago.

But don’t take my word for it. Professor Hendrick Bessembinder did an exhaustive study of long-term buy and hold returns from 1926–2016 titled, “Do Global Stocks Outperform Treasury Bills?”

He and his team found that just 4% of stocks are responsible for all of the gains above Treasury bills. But get this: Only 1% of stocks are responsible for 50% of the gains!

I was so excited to read it that I reached out to him.

And he confirmed personally that his findings mirror mine: Just a handful of stocks make up the majority of the market’s gains.

So, when the market gaps higher each month, realize it’s a tiny few that are responsible for those gains. (Think FAANG stocks.)

I’ve said it before and I’ll say it again: To find outlier stocks, follow the Big Money. Follow the brightest investors out there. They have big budgets, teams of analysts, tens of thousands of research hours, and in many cases, decades of experience. They should know where to look. So following them is where I spend my time and energy.

Outlier stocks attract Big Money

I admit it: I’m a snob—a stock snob. When it comes to risking my hard-earned money on investments, I only want the best. And outlier stocks are the best in class—the ones that repeatedly grow earnings and sales.

Once these companies have grown into their shoes and developed, they become household names.

The key is to find them early on. How I do it is by trying to identify big investors making a bet.

They won’t announce a buy until they have to. They try to keep it quiet. They hire bigtime brokers and traders to ensure their market operations are almost unnoticed.

I know, because I was one of those people they hired. I spent my Wall Street career handling huge stock orders for the biggest investors out there.

I learned when Big Money buys a stock, it rallies—regardless of the fundamentals.

At my research firm, Mapsignals, we’ve created algorithms that look for this trading activity. We use computers to crawl through more than 5,500 U.S. stocks every day to find which ones the Big Money investors are likely buying.

Usually, we see roughly 65 Big Money buys per day—they’re rare. In those 65 buys, the ones with the strongest sales, earnings, and profits are potential outliers. Maybe 5–10 possible outliers show up every day.

That makes sense, right? If 4% of stocks make all the gains, then 10 stocks out of 5,500 is less than 1%.

So what does an outlier stock look like?

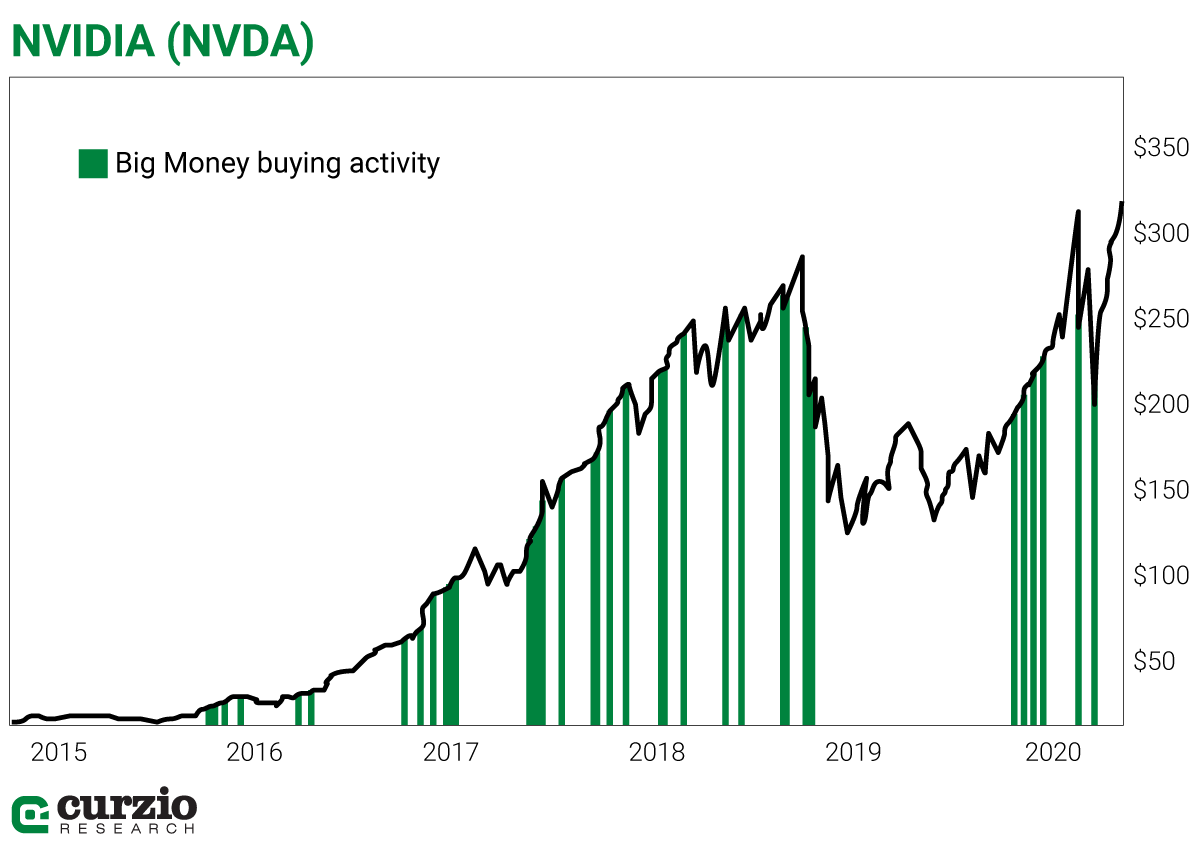

Below you can see chipmaker NVIDIA Corp. the Mapsignals way:

Those green bars are our signal that Big Money is likely buying the stock. And the best outlier stocks have repeated green buy signals.

This also makes sense because the best companies have the best attributes for success. They have great businesses/products and make a ton of money. Big Money investors know the outliers.

Look, Michael Jordan wasn’t good for only one year—he was good every year. He had the best attributes for success—an outlier.

So, next time you decide to buy a stock you’re sure is the next big thing, do your homework. Wayne Greztkys aren’t easy to find.

Or are they?

Just follow the Big Money…

P.S. Want to know which stocks Big Money is buying right now?

Check out my newsletter, The Big Money Report, where I uncover the best growth stocks on the market.