Wayne Gretzky once said, “Skate to where the puck is going, not where it has been.”

That quote always stuck with me.

It’s a great reminder to always look ahead. Being forward-thinking is important in sports. If you can be a step ahead of your competition, you’re at an advantage. Gretzky is arguably the greatest hockey player ever. And his quote provides a clue about how he gained an edge over others.

Thinking ahead also makes a lot of sense when it comes to stocks.

It’s important to keep an eye out for signs of where the market is going next (as opposed to where it’s been).

You can make big bucks if you get ahead of the next move higher.

And right now, my favorite indicator is pointing to a rip for stocks in the weeks ahead.

The Big Money Index is set to rise in the coming weeks

I’m a simple guy when it comes to investing. My focus is twofold: Find fundamentally superior companies and follow the Big Money trading activity.

If you’ve read my work before, you know I pay close attention to what institutional investors are doing. They’re the “Big Money” that moves the market.

And their buying and selling provides clues as to when big moves are ahead for stocks.

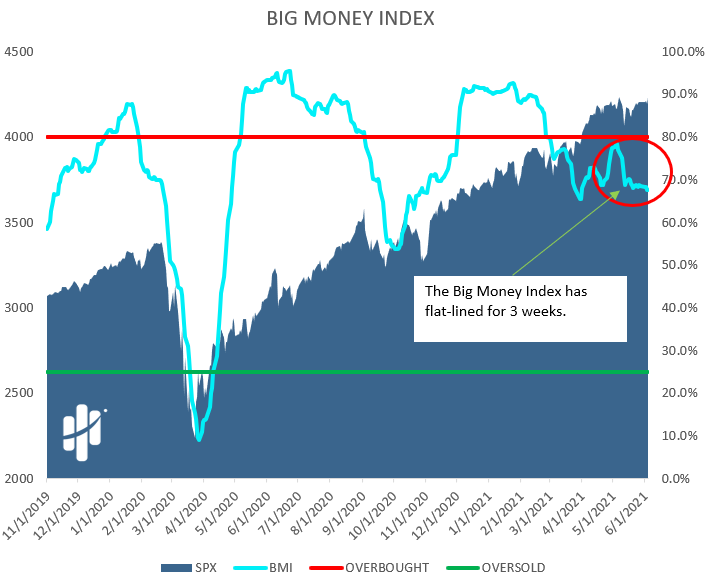

Before I show you why stocks are headed higher, let’s take a look at the BMI. As a refresher, it measures the daily buying and selling in stocks. When the index goes up, the market tends to rise. When it falls, you should prepare for a pullback.

Looking at the BMI today, it’s been range-bound for the past three weeks:

I’ve circled the recent action. The index has traded sideways lately. In short, there’s been no acceleration in buying or selling.

But that’s about to change. Viewing the BMI today is like looking at where the puck has been.

Let me explain.

You see, the BMI incorporates 25 days of trading activity. And the last five weeks have been rather ho-hum. That’s not surprising given the fact the S&P 500 gained 1.1% during that time.

But if we dig deeper into the latest data, the picture gets a lot more bullish. Over the last two weeks, there’s been a lot of buying and hardly any selling in stocks.

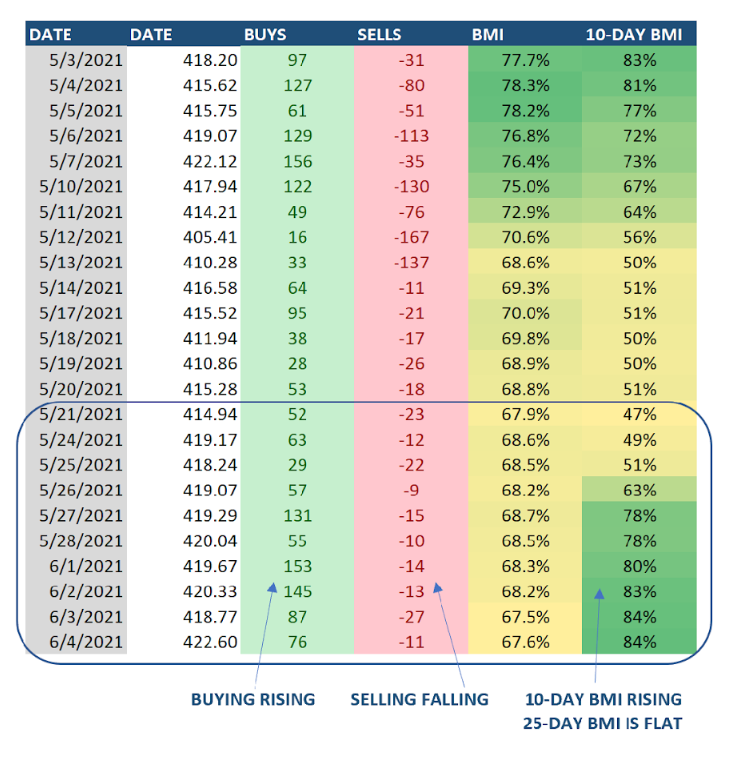

Take a look at the table below to see what I mean…

I’ve broken out the daily buys and sells that make up the BMI. In the right-hand column, I calculated the 10-day moving average of buys and sells.

As you can see, the 10-day average has jumped from 47% to 84% over the past two weeks. A higher number means more buying. And as you can see in the table, there’s been a lot of buying—and not much selling—over the past 10 days.

Put simply, the latest action is signaling a liftoff is likely soon.

So, while the BMI appears to be stalling on the surface, it’s really about to race higher. Because the BMI is a 25-day moving average, the latest buying data hasn’t registered yet. That’ll change over the next couple weeks.

In other words, we know where the BMI index is heading… it’s about to make a big move higher.

That’s bullish for the entire stock market.

The easiest way to play a potential surge is to buy shares of SPY—the S&P 500 exchange-traded fund. This ETF includes the 500 largest U.S. listed companies. It’s a perfect “one-click” way to benefit from a market-wide rally.

The bottom line is this: Signs are pointing north for stocks. With the BMI set to rip in the coming weeks, I’m expecting new highs for the market. Consider owning the SPY ETF to ride the wave higher.

Be like Gretzky. Focus where stocks are heading, not where they’ve been!