In 10th grade, my Spanish teacher told me about the 5 Ps: “Proper planning prevents poor performance.”

I’ve loved that quote ever since. It’s true in nearly all facets of life.

In fact, that message rang loud and clear in my mind just last week.

After watching markets scream higher for months following the March lows, stocks finally got walloped…

And it’s about time!

I know a selloff is unnerving for many investors, but it’s actually healthy in the long run. That’s because markets are constantly balancing supply and demand for shares. And when demand gets extreme, it’s only natural for supply to catch up.

That’s exactly what happened last week. And I invite more of it. I want lower prices so I can add to my portfolio. In other words, patiently waiting for selloffs puts me in a better position than others who fail to plan.

I shared some of my long-term plans a few weeks back. But before I delve into my near-term plan, let’s look at what the Big Money is up to…

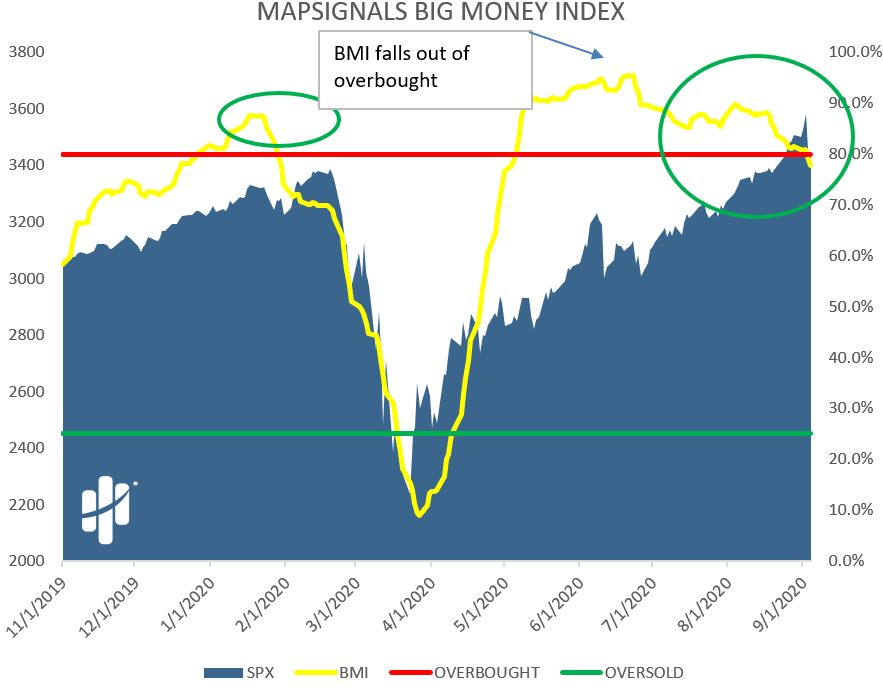

The Big Money Index (BMI) keeps falling

When you follow the Big Money as long as I have, you know that it can predict market movements. Two weeks ago I pointed out how the BMI was falling while the market was rising.

As you can see below, that trend is still downward. And I expect it to continue near-term.

When I see a divergence like that, I pay attention. Again, this is where preparation comes into play. I’ve been slowly raising cash the past few months for an inevitable pullback.

Chances are, markets will feel some pressure moving forward. Once the BMI starts to show any signs of stability, I’ll be shopping for deals.

For now, I don’t expect any prolonged selloff—I think “buy the dip” is still alive and well. So, what’s my plan?

Make a shopping list… and be patient

The most difficult thing investors struggle with is patience. That makes sense, given financial headlines and media hawking all day long.

But don’t focus on the noise. Focus on the plan.

When I’m deciding on the stocks I want to own, I do a mini checklist of attributes… and you should, too:

- It’s growing sales and revenues

- It’s profitable

- It has a product moat (barrier to entry) or at least a large market share

- It attracts a lot of Big Money

Then, when there’s a meaningful pullback in the shares, I buy with both hands.

One example from my shopping list is Home Depot (HD), which exhibits all of the qualities mentioned above. It was one of the names I mentioned to Frank recently on Wall Street Unplugged. HD is one of my core positions… and I try to add to it when the markets face turmoil. (I scooped up more of it in March.)

My short-term view is simple: Buy great companies only on steep pullbacks. My long-term view is even easier: Hold these companies for many years.

If the BMI is any indication of what’s in store for markets in the coming weeks, I’d wager that I’ll be putting some of my cash to work soon.

Specifically, I’m waiting to see big selling in my favorite stocks before I go shopping for deals. I prefer a market full of fear to buy into, rather than exuberance.

Once you’ve done your homework and laid out your strategy, you’re way ahead of the game. Most won’t do this… and that’s OK.

No matter what you do, make sure that you have calculated reasons to do it. Don’t fly by the seat of your pants. Because when you invest recklessly, you’re almost guaranteed to have poor performance.

Editor’s note: If the latest selloff has you rattled, a controversial presidential victory could really destabilize markets… Luckily, Genia Turanova specializes in profiting from instability. Year to date, she’s posted gains as high as 6x while many experts lost their shirts… and she’s showing no signs of stopping.

Go here now to learn about her incredibly powerful trading system… and how you can get in on her next triple-digit trade before it’s too late.