Editor’s note: Today we’re excited to introduce our newest guest commentator, Steve Koomar. Steve’s a former derivative trader at Goldman Sachs, editor of Vigilante Investor, and one of Frank’s most popular Wall Street Unplugged guests.

Steve’s been pounding the table on the dirt-cheap U.S. oil sector to his subscribers. Today, he explains why he’s betting on higher oil prices… and a great way to profit.

For the past four years, the market has grown complacent about oil supply threats.

That changed this past weekend…

Proxies for Iran attacked and damaged Saudi Arabia’s second largest oilfield, Khurais, the gigantic crude oil processing facility at Abqaiq. The drone attack forced Saudi Arabia to shutter half of its oil production, amounting to 5% of global supply.

Oil prices jumped 12% on Monday. And prices would have soared much higher if not for an assurance from both Saudi Arabia and President Trump to keep the market adequately supplied.

But if production cuts last longer than expected, or if tensions escalate, oil prices will indeed soar.

U.S. oil and gas stocks, which still trade at dirt-cheap levels, offer a great way for investors to hedge for the chaos that may come. And today, one of these stocks is so cheap it has lots of room to run higher… even if oil prices hold steady…

The attack

Abqaiq is the lynchpin for Saudi crude exports. The facility transforms heavy-sour crude oil into light-sweet crude. Most of the world’s refineries are not equipped to refine heavy crude. So without Abqaiq, Saudi Arabia can export very little. Via this single attack on Abqaiq, Iran shut down the Saudi export machine.

Houthi rebels from Yemen claimed responsibility for the attack. This is almost certainly a lie. Their “backpack” drones could not have travelled the 300 miles from Houthi territory to Abqaiq. The only way they could carry out such a mission is to travel far into Saudi Arabia with explosive-laden drones—and then release them.

The U.S. State Department doesn’t believe the attack originated in Yemen. Officials suspect that cruise missiles may have been deployed in a coordinated attack originating from southern Iraq and/or Iran.

Iran denies responsibility for the attack. But there’s no doubt… Iran did it.

Saudi Arabia downplays attack

So far, Saudi officials have downplayed the damage and announced a quick resumption of operations. President Trump tweeted a threat of retaliation pending Saudi verification of the culprit, but Saudi Arabia has remained silent… for good reasons.

Prior to the attack, state-owned oil giant Saudi Aramco was close to completing an historic, massive IPO. Now, if investors fear the Aramco assets may not be safe and secure, the IPO will fail. So officials are quietly working to restore full production. They want to make this look like “business as usual.”

The Saudi royal family has another good reason to downplay the attack. Silence buys time for the Saudis to find a way out of a dilemma.

If the Saudis don’t punish Iran, the royals will look weak. This would invite future attacks. But Saudi retaliation could also lead to an escalation in tensions with Iran. If escalation leads to a ground war, the Saudis will lose. The massive Iranian army would overrun the tiny Saudi army… absent the unlikely prospect of U.S. intervention.

Nonetheless, Saudi Arabia has an excellent target for retaliation. All Iranian oil exports pass through Kharg Island. The Saudi air force could cripple Iran’s oil exports… for years… with an airstrike on Kharg. And if Saudi Arabia inflicts heavy damage to Kharg, Iran will likely counter-attack. It could get ugly, causing oil prices to soar.

Strong oil prices

For the first time in years, markets fear a disruption in Middle East oil supplies.

The $7-per-barrel jump in oil prices represents a modest risk premium. That muted response can be attributed to the commitment of Saudi and U.S. officials to tap reserves and keep the market supplied. However, if it takes some time for production to recover, or if tensions escalate, oil prices will move sharply higher.

American shale is a bargain now

Even without an escalation in tensions, oil prices will hold their recent gains for some time. The risk to supplies isn’t going to recede… not for a long time. And at current prices, the most competitive shale oil producers will enjoy higher profits… and higher stock prices. If rising tensions fuel a bull market in oil, they’ll perform even better.

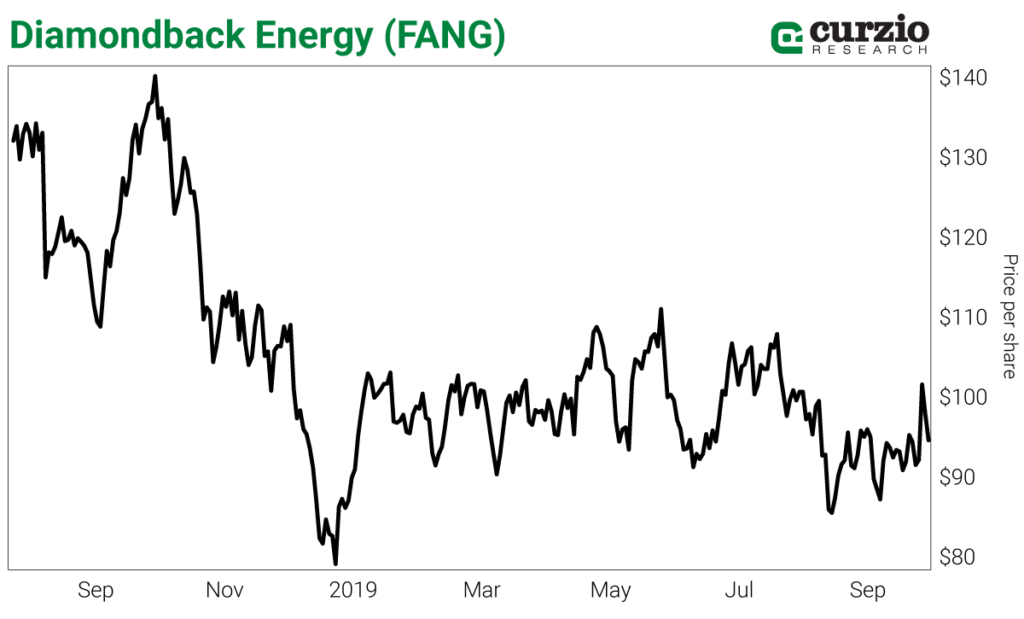

Diamondback Energy (FANG). The company enjoys some of the lowest costs (and highest profit margins) in the industry.

For 2018, Diamondback reported production costs of $24.70 per barrel of oil equivalent (BOE). The BOE metric blends all of Diamondback’s production of oil, gas, and gas liquids into a single number. Diamondback’s average BOE sales price was $42.20. So Diamondback earned $17.50 per BOE gross margin in 2018. As a point of reference, Diamondback’s crude oil sales price averaged $54.66. So Diamondback earns a healthy gross margin, even at the current oil price.

The company plans to expand production by 27% per year going forward. Considering the hefty gross margin, earnings should expand at least as fast as production. Securities analysts seem to agree with management’s production forecast. They expect 30% compound average annual earnings growth. If the Middle East conflict drives oil prices higher, Diamondback’s gross margin will rise… and earnings will spike far above the current expectation.

With these lofty expectations for earnings growth, you’d think the stock would trade at a very high price-to-earnings (P/E) multiple. Not so. Right now, it trades at a P/E of just 10 times (10x) forward earnings.

FANG’s price is currently back down to where it was before the Saudi attack. But this kind of volatility is to be expected. This stock should easily take out the 2018 high of $140 in the next year.

The time is right… and the price is right… for FANG.

All the best,

![[signature]](https://www.curzioresearch.com/wp-content/uploads/2019/09/SKoomar-sig-1.png)

Steve Koomar

Editor, Vigilante Investor

Editor’s note: Want more advice from Steve? Learn how to profit from the “New Strategic Order” in global trade on his latest Wall Street Unplugged interview with Frank.