Former professional baseball player Bobby Bonilla is 57 years old and hasn’t played a pro game since 2001.

Yet, he still makes $1.2 million every year from the New York Mets—and these paychecks will keep coming until 2035.

How did this happen?

In 2000, the Mets bought out the remainder of Bonilla’s $5.9 million contract. They could have paid him one lump sum… but instead, they chose to pay him $1.2 million for 25 years beginning July 1, 2011… including 8% interest! (Back then, Mets owners were investing their money with Bernie Madoff, who was routinely providing big returns. There’s a chance that could have helped shape this amazing contract.)

But you don’t have to be a former pro athlete to find an opportunity like this…

For us regular folks, it comes down to finding amazing, dividend-paying companies, holding them, and reinvesting the dividends.

Warren Buffett is known for this strategy, and I’m sure most of us would agree that he’s done pretty well with his investments over the years…

But, here’s the rub…

It takes a long time.

Outlier stocks tend to go up over time

Bobby Bonilla struck a great deal.

But he had to wait for the deal to pay off. In fact, he didn’t receive his first payment until 11 years after the deal was made.

The same thing happens with great stocks: They require some patience, as they tend to go up incrementally over time… But eventually, they pay off in a big way.

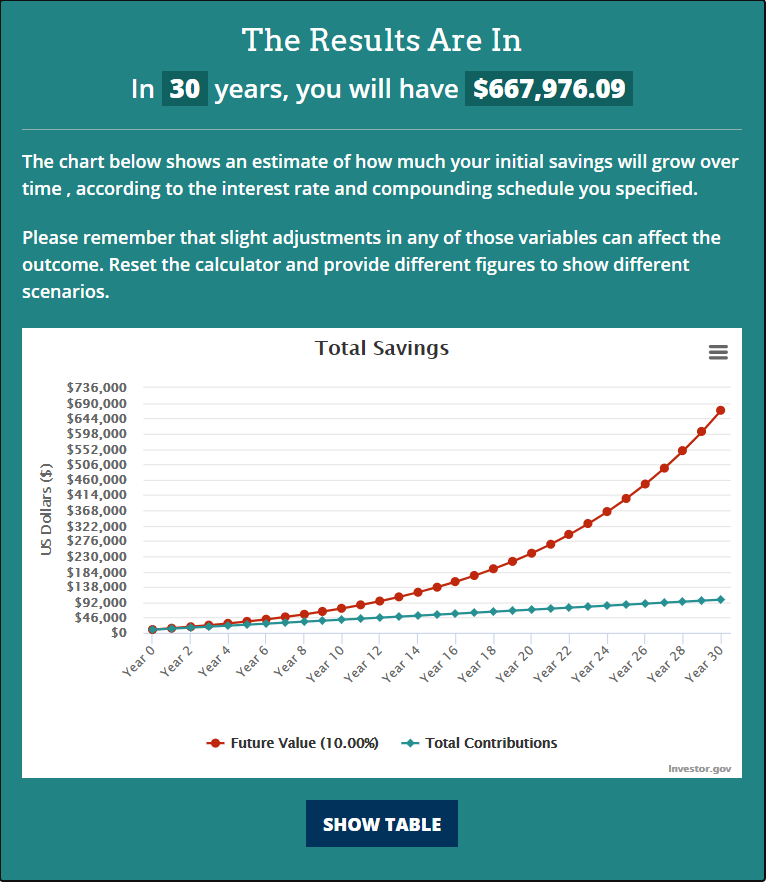

Let me show you what I mean. Below is a compound interest calculator. It assumes you start with $10,000 and reinvest $250 each month. The annual compound growth rate is 10% (the stock market average).

This isn’t the sexiest chart, but like we saw with Bobby, the 11th year starts to show the payoff… and it’s worth the wait:

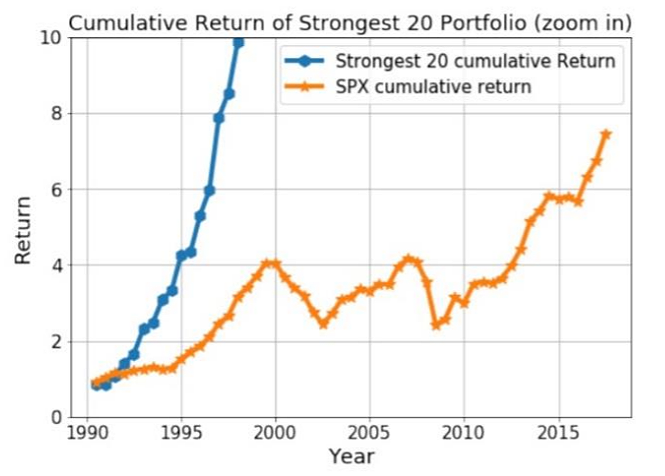

Outliers are responsible for most of the returns in the market (think AAPL, IBM, NFLX, MSFT, WMT, etc.)—the best of the best over the long term.

My research firm spends all of its time searching for outliers. Our historical back-test shows how owning outliers might have beaten the market by 5,000 times.

The blue line is a six-month rebalanced portfolio of the top 20 performing outlier stocks, and the orange line is the S&P 500.

Finding great deals on stocks

If we agree that stocks tend to go up—and better stocks go up even more—when is the best time to buy big?

Buffett famously said, “Be fearful when others are greedy, and greedy when others are fearful.”

That means: Buy when things are scary.

Think back to mid–late March. I saw an incredible opportunity shaping up. It was scary, but from my perspective, the potential payoff was worth it.

Now, greed is in the air.

If you’re a buy-and-hold investor with a long-term horizon, I’d bet that you’ll do fine owning stocks at any point.

But right now, it’s time to be fearful.

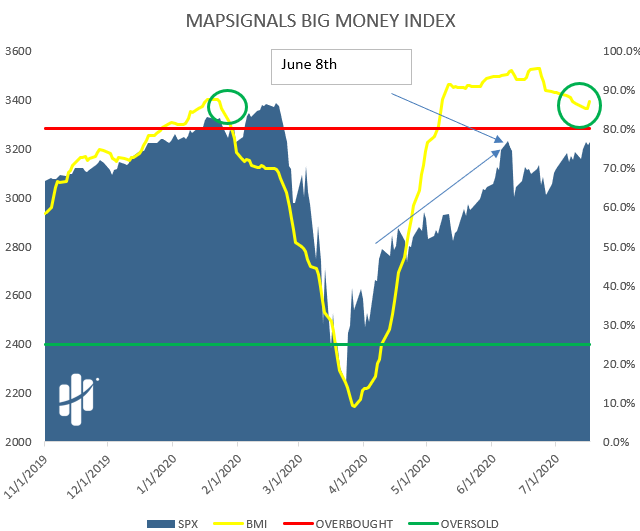

Here’s a chart of the Mapsignals Big Money Index. It’s a moving average of Big Money signals in the market.

If the yellow line is increasing, Big Money is flooding into stocks. If it’s going down, Big Money buying is slowing.

In late March–June, we saw Big Money pouring into stocks. But on June 8, things started to sputter. And when Big Money loses steam, markets get choppy:

It’s clear that the monster buying has slowed in the last six weeks.

But that’s a good thing.

I’ll keep waiting for the eventual pullback. Zeroing in on outlier stocks has the potential for a Bobby Bonilla-type future payday.

You may not be inking a multimillion-dollar deal. That’s OK. You can still create huge wealth when you:

- Buy amazing stocks

- Hold them

- Reinvest dividends

- Be aggressive when fear hits the market

In other words, when the market lobs a fast pitch… swing big to hit it out of the park.

Editor’s note: If you’re looking for the best income and growth opportunities in today’s zero-rate market, Genia Turanova’s new income advisory, Unlimited Income, officially launched last week… And 8 out of 9 recommendations are already up—one by nearly 30% in just over a month.

Click here to start earning income—risk-free—at an incredible, limited-time discount.