A picture is worth a thousand words. Even in investing.

For most of us in the business, this picture is a stock chart. When we want to know how well a stock has done, we almost always look at a price chart. With just a glance, we can see the direction of the share price and assess—with a high degree of certainty—whether or not the stock has been in trouble.

When it comes to mutual funds, there’s more to a price chart than meets the eye…

A peculiar year-end drop in the share price of a mutual fund doesn’t always mean that the fund’s investments have suddenly declined in price or are in trouble.

Rather, when you see a sharp year-end drop in a mutual fund’s price, it might mean that the fund has just made a distribution…

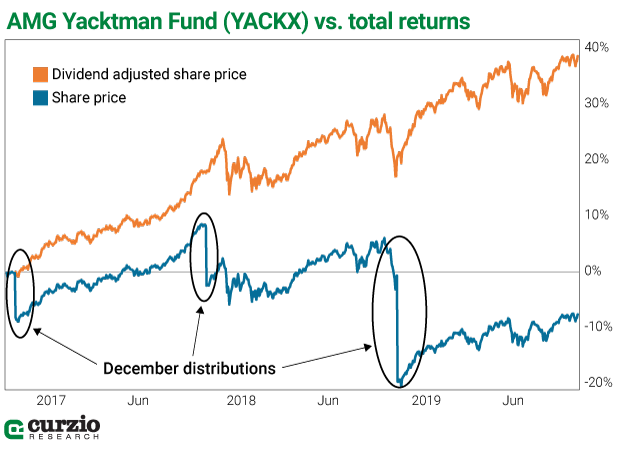

As you can see on the chart above, when a mutual fund like AMG Yacktman distributes a gain, its share price declines. But unlike a falling stock price, it doesn’t mean investors have lost money.

This phenomenon happens because of the way mutual funds operate…

After every market close, a mutual fund’s share price is recalculated to reflect its current net asset value (NAV). This NAV decreases on days the fund is scheduled to distribute its dividends or capital gains… because these assets are no longer held there.

Now, you have two options when it comes to collecting mutual fund distributions… if you own the fund on the record date, you can choose to take your distributions in cash, or reinvest.

In both cases, the value of your account won’t change. A cash payout will compensate for the lower per-share value of your mutual fund holding. If the capital gains are reinvested, you’ll own more shares.

Regardless of the way these distributions are received, the distribution itself can create a taxable event, depending on how the mutual funds are held… But the good news is, in most cases it’s not too late to make adjustments to your holdings.

Here are four things to consider…

- If you haven’t done so, go to your fund’s website and check whether or not the fund will be making a distribution, and when. In some cases, it makes sense to preemptively sell your mutual fund shares to avoid a larger tax bill. (Remember, when it comes to taxes, everyone’s situation is different… Consult your tax advisor before making any final decisions.)

- Reinvesting capital gains is a viable strategy. When mutual fund investors choose to reinvest distributions, they allow future gains to accumulate. Moreover, reinvesting distributions can raise your cost basis and thus reduce the amount of future taxes owed. To see why this happens, look at the chart again: reinvesting your gains at higher prices results in a higher purchase cost.

- When researching prospective year-end investments, consider avoiding mutual funds with an imminent distribution. If you hold the fund in a taxable account, you’ll be on the hook for the gains (and taxes) regardless of how long you’ve held the shares.

- If you hold a mutual fund in tax-deferred account like an IRA or 401(k), don’t worry too much about a potential distribution… These accounts are tax-sheltered. You won’t be taxed for any distributions, but you also won’t be able to access this cash as you would in another account. You’ll be tied to the terms and conditions of your IRA or 401(k).

As 2019 comes to a close—the tenth year of this record-long bull market—we’re sure to see some mutual funds distribute capital gains to investors. As investors continue to abandon the market (in anticipation of a pullback) and shift their investment dollars from actively managed funds to exchange-traded funds (ETFs), some mutual funds are even more likely to distribute significant gains.

Be sure to look at your holdings and consider how you might be affected, this year—and the next.

To a healthy portfolio,

| Genia Turanova Editor, Moneyflow Trader |

Editor’s note: We can’t know for sure how these last few weeks of 2019 will play out in the markets… But with the powerful algo-driven technology behind Rich Suttmeier’s upcoming trading advisory, 2-Second Trader, you’ll know (in two seconds) when it’s time to buy and sell.

To get all the details as they become available, click here.