A trade war truce between China and the U.S. appears to be imminent… But don’t get sucked into making a big China investment.

While China’s stock market will most likely rally in anticipation of better trade conditions (and a corresponding uptick in the economy)… the bounce will quickly fade. Multiple forces are converging to thwart China’s future progress.

The Chinese century

Many so-called experts say that this is the “Chinese century”—they claim China will overtake the U.S. as the most dominant economic power on Earth.

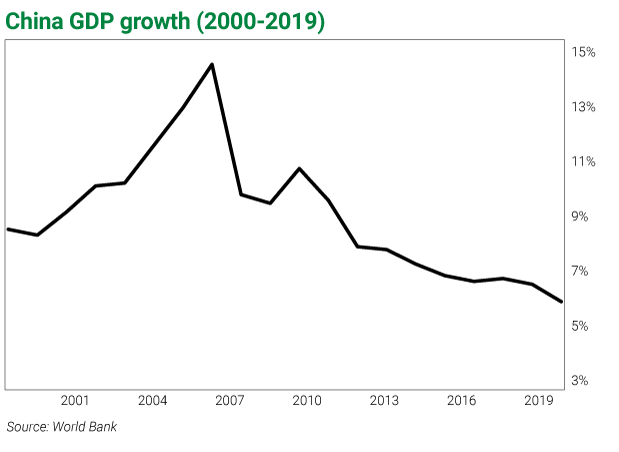

For a while, that seemed to be happening. Annual gross domestic product (GDP) growth averaged 10.3% for the first decade of the century.

But recently, the Chinese economy has run into a wall. Since peaking at 14.2% in 2007, China’s growth rate has declined every year but one. Growth will barely hold 6% in 2019. In the next decade, China will struggle to average 3% annual growth.

…So much for the “Chinese Century.”

China’s wall of woes

Three critical problems are converging to sink the Chinese economy. First, the country’s abundant labor force—the engine of China’s economy—will soon begin to shrink. Secondly, China will lose its competitive edge, as it must accept less favorable trade terms and restrictions on intellectual property (IP) theft. Thirdly, China’s economy is built on a mountain of debt. The mountain is starting to crumble. As the mountain of debt sinks, so will the economy.

No. 1 Demographic imbalance

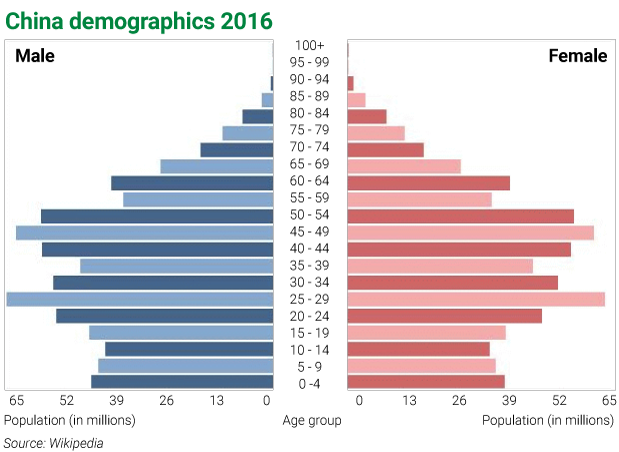

China’s “one child” policy caused a demographic disaster. China’s birth rate has fallen to 1.6 births per woman, far below the global 2.10 “natural replacement rate.” The low birth rate assures an aging and shrinking population.

Gender imbalance compounds the population problem. The “one child” policy caused many Chinese families to abort or abandon female babies. Today, officials estimate that 118 boys are born for every 100 girls, on average. Because of this shortage of girls, China’s “natural replacement rate” is 2.48 births per woman.

China’s newfound prosperity will keep the birth rate way below the replacement rate. The reasons are complex, but the trend around the world is clear—wherever prosperity starts to rise, people have fewer children. In China, the phenomenon will create a terminal shortage of workers. Barring unforeseeable advances in artificial intelligence (AI), the economy will shrink, too.

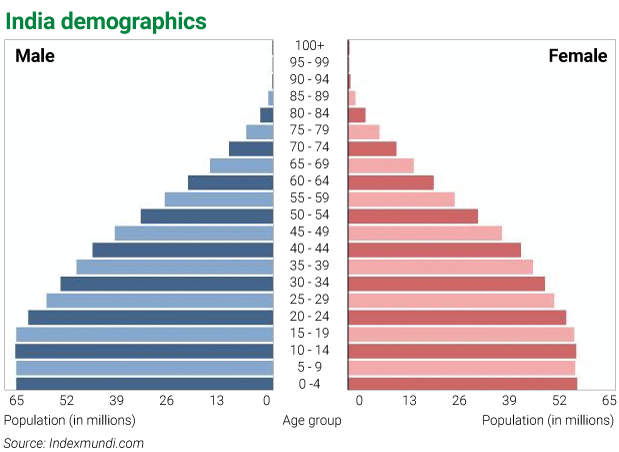

The chart below shows the population bulge above 45 years of age. These people will all retire within 20 years. Fewer people will enter the workforce than are leaving. China’s workforce will begin to shrink around 2027.

Chinese officials are beginning to come to grips with their demographic time bomb. A study released by the Communist Party Central Committee revealed the magnitude of the problem. By 2050, China’s population will shrink 4%. Its workforce will shrink 12%. And retirees will grow to about 36% of the population. Economic, generational, and societal strains will surely intensify.

No. 2 Loss of competitive edge

The coming trade agreement will also slow China’s economic machine. China has built a huge trade surplus by selling its goods into unrestricted markets while simultaneously restricting foreign competition in its domestic market. The new deal will also restrict China’s habit of IP theft. The country will struggle to compete without free access to others’ IP.

No. 3 Debt crisis

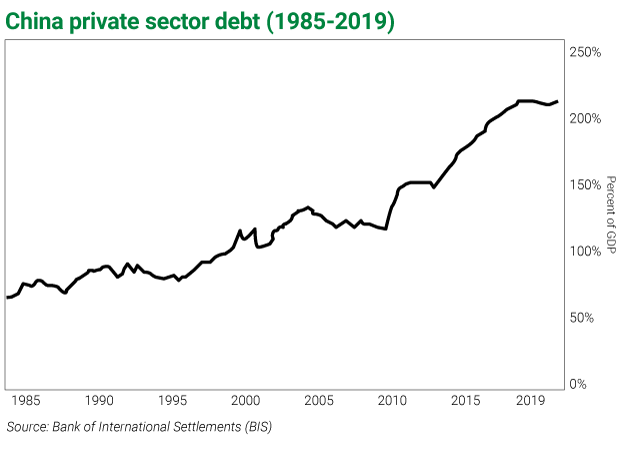

Buried in debt, China sits on the precipice of a financial crisis.

In recent years, Chinese businesses have ramped-up borrowing. According to official statistics, China’s private-sector debt recently hit 210% of GDP—double the long-term average. But China’s debt burden is even worse than the statistics indicate. According to the Brookings Institute, China overstates GDP by about 16%. Adjusting for that factor, China’s private debt burden soars to 248% of actual GDP.

Debt service is sucking the energy from the Chinese economy. Chinese banks increase lending to private businesses to keep the economy growing… and even more to help businesses avoid defaults on existing loans.

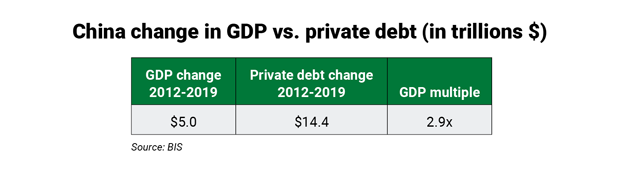

The table below shows that private debt (in absolute terms) has grown faster than the economy… by a ratio of 3:1.

China’s economy has expanded by a total of $5 trillion since 2012. But to accomplish that growth, the private sector borrowed $14.4 trillion. In the absence of increased borrowing, China’s economy would be contracting by roughly 12% per year.

Effectively, China is delaying a depression by allowing businesses to borrow at unsustainable levels.

Eventually, China’s well of credit will run dry. Deflation will make debt repayment almost impossible. The government will increase spending to offset the private sector decline, but the economy will stagnate… at best. At worst, it’ll shrink… perhaps significantly.

Where to invest?

Chinese stocks will stage a “relief rally” after a trade deal is completed. But they’ll come back down to Earth. In the years ahead, Chinese businesses must learn to compete under new rules of trade and IP protections. At the same time, a massive debt burden will suck the oxygen out of the economy. And the economy must also fight the headwind of a rapidly shrinking workforce.

Don’t get sucked in. Investors should look for growth opportunities in countries with a growing workforce and minimal debt burdens… like Mexico (see last month’s ETF recommendation) and India…

India

This rising star of Asia boasts the world’s largest democracy. It’ll soon boast the world’s largest workforce, too. By 2027, India’s workforce will surpass China. Due to a remarkable demographic balance, India’s workforce will continue to grow for the foreseeable future.

India’s low private sector debt burden (55% of GDP) demonstrates an abundant capacity to fuel future growth.

A recent rally has made India stocks a little expensive. But keep an eye on this market. When the global stock markets trade lower… and India stocks get cheaper… you’ll want to take the opportunity to invest in the world’s next big growth story.

All the best,

All the best,

![[signature]](https://www.curzioresearch.com/wp-content/uploads/2019/09/SKoomar-sig-1.png)

Steve Koomar

Editor, Vigilante Investor

Editor’s note: If Trade War fallout has you worried about the future of your investments… don’t be. Our upcoming 2-Second Trader service can tell you when it’s time to buy or sell your portfolio holdings, or just about any major stock on the market. It will be as simple as entering a ticker… and getting an answer. It literally takes two seconds. To get all the details as soon as they’re available, click here.