For centuries, the evolving global economic order has determined the wealth of nations.

For almost five centuries (ending in 1944), a colonial trading system defined the global order. Prosperity was limited to the countries with vast trading empires. Then in 1945, the U.S. established a New World Order based on free trade. America shared its wealth, and prosperity expanded to the far corners of the Earth.

Now—75 years later—the U.S. is changing this global order again… It’s making free trade conditional on reciprocity and strategic cooperation. It’s a move that will once again change the fortunes of many countries… and today I’m going to tell you how to profit from it.

But first, let me give you some history on how—and why—the current world order came to be.

The Colonial Era (1492-1944)

For centuries, colonialism defined the global economic order. Around the 16th century, European countries and their fleets of ships scrambled to claim territory and resources around the world. England, France, the Netherlands, Spain, and Portugal all established vast colonial empires.

The colonies would produce raw materials and exchange them with their masters for high-value finished goods. The materials were then used to produce more finished goods or fund further exploration and expansion…

Most non-colonial countries couldn’t compete for resources and market opportunities, so lesser empires proliferated elsewhere. The Ottoman Empire, the Austro-Hungarian Empire, the German Empire, the Russian Empire, and eventually the Japanese Empire all competed with each other (and western colonial empires) for land and resources. Military powers grew more concentrated. War became a way of life for most.

America was the exception. Its resource-rich domestic economy had all the advantages of a vast colonial empire within its own borders. Aided by the world’s best water transportation network and an adequate naval force, America quickly became the economic powerhouse of the world… without the need for a standing army to actively protect its interests and borders.

Eventually, the big empires of the east (Germany, Austria-Hungary, and the Ottomans) collided with the colonial empires of the west (France, Britain, and America) in World War I, known at the time as “the war to end all wars.” (Sadly, it did not live up to the billing.)

At war’s end, U.S. President Woodrow Wilson proposed “self-determination of all peoples.” This was a ruse, used only to dismantle the empires of the east. If Wilson really cared about “self-determination,” he would have insisted on independence for all colonies.

When the Treaty of Versailles officially ended the war in 1919, England and France retained their colonial possessions. Their trading relationships remained intact, and their economies recovered after the war. But the trading systems of the lesser empires were destroyed. Recovery seemed impossible for Germany and eastern Europe.

This economic distress planted the seeds for an even bigger conflict. Hitler pulled together the remnants of the old German empire and waged a violent war to expand, while Japan did the same in Asia.

As we know, both ultimately failed to achieve their goals. The Allied Powers of World War II were victorious… but once again, the global economy was upended.

A New World Order (1945-2016)

The victors of World War II learned from the failure of Versailles…

In 1944, over 700 Allied delegates met in Breton Woods, New Hampshire to address the post-war global economy. At what became known as the Breton Woods Conference, U.S. and British Treasury officials unveiled a New World Order… one that guaranteed free trade to U.S. allies.

No longer would countries wage war to protect vast trading empires or colonial possessions. Every nation could rely on a U.S. guarantee of international trade and naval protection to trade goods and build vibrant economies. For the countries in the alliance, the new economic order would eliminate the need to go to war…

Or so they thought.

When the Soviet Union began encouraging a communist revolution in western colonies and territories, the U.S. pushed its allies to grant independence. By limiting the spread of Soviet influence during the Cold War period, the U.S. and its allies hoped to gain an advantage.

Allied nations were granted free-trade access to the lucrative, low-tariff U.S. market. Yet, the U.S. did not require reciprocal terms. These countries could sell goods into the U.S. at low tariff rates and simultaneously use high tariffs to protect their own industries. The U.S. also pledged its naval force to protect trade routes and all but eliminated the risk of piracy associated with international shipping. By guaranteeing freedom of navigation, the U.S. effectively bribed countries to join its alliance.

This New World Order provided an enormous subsidy to developing economies. For the first time in history, all (Allied) nations had access to vital resources. They could sell to the biggest, richest consumer market in the world (the U.S.) with minimal tariffs. And they didn’t have to spend a dime to secure their foreign trade.

This freedom transformed the world economy. Countries all over the world could deploy low-cost labor to produce low-cost goods, and then export them to the U.S. for a profit. The war-ravaged economies of Europe and Japan quickly recovered. Eventually, new success stories emerged in South Korea, Thailand, Indonesia, and Mexico.

When the Cold War ended in 1989 with the fall of the Berlin Wall, the influence of the New World Order could be felt in nearly every Allied capitalist country.

At that time, the U.S. could have withdrawn the generous trade incentives it had granted to Allies. Or it could have demanded Allies reciprocate with low tariffs on U.S. products. Instead, the U.S. expanded the trade subsidy strategy.

In 2001, the global economic tide had shifted so much, the U.S. extended free trade to China (with terms favoring the communist nation) when it joined the World Trade Organization (WTO).

What were U.S. officials thinking? Apparently, they hoped economic success would encourage China to embrace freedom.

This was a huge miscalculation. China developed a powerful economy, and after rising to the top of the Communist Party, President Xi Jinping devised a strategy to transform China into a Eurasian hegemon.

Ultimately—instead of leading to freedom—WTO membership intensified Chinese suppression of human rights and funded a campaign challenging America’s global leadership.

New Strategic Order (2016-present)

Today, some of the largest global economies still depend on America’s free-trade generosity… But America is far less dependent on international trade than most other countries.

Most global economies need access to U.S. trade… the world’s biggest consumer market. But U.S. businesses already have that access.

In other words, the world depends on the New Order, but the U.S. doesn’t. Consequently, the U.S. is now finding itself in a position to either walk away from the New Order… or to make it fit America’s needs.

The art of the trade deal

Under President Trump, the U.S. is renegotiating free trade on a bilateral basis, meaning it grants free trade in exchange for cooperation on new strategic policy goals.

You’ve already seen how it works.

The U.S. threatens to increase tariffs on a country unless it helps with specific policy objectives. If the country refuses to play ball, the U.S. hammers it with tariffs. If the country does play ball, the U.S. deepens the trade relationship.

Let’s look at two recent examples, China and Mexico…

China

In the years since China joined the WTO, the country has morphed into a complex commercial and geopolitical threat. It’s exploited America’s free trade generosity better than any other, building itself into a global export giant.

In the process, Chinese entities systematically stole advanced technologies from businesses around the world. This empowered China to develop high-value manufacturing businesses. With the benefits of state subsidies, cheap labor, and stolen tech, Chinese manufacturers toppled manufacturing titans all over the globe.

Today, China is using its prosperity to fund a bold effort to replace America’s influence around the world. One such plan, its Belt and Road Initiative, seeks to control strategic transportation routes and establish more foreign influence. China also subsidizes the telecommunications networks of the Huawei Corporation, allowing Chinese intelligence services to control and monitor communications all over the world.

America’s new China trade policy seeks to halt this strategic progress. President Trump imposed punishing tariffs on Chinese imports in an effort to level the playing field and stop the theft of intellectual property. The trade war has done the U.S. little, if any, harm. However, companies all over the world are reconfiguring supply chains to avoid buying from China.

If this economic pressure keeps up, China will almost certainly lose the trade war. Either it gives up on its plan to dominate global commerce (which won’t happen), or its manufacturing base shrinks as quickly as its competitors can build new capacity.

Mexico

If China is a good example of how not to trade with the U.S., Mexico is a good example of the opposite…

In June 2019, a new Trump policy initiative threatened Mexico with punitive tariffs unless it took aggressive action to stem the flow of immigrants illegally crossing the Mexico-U.S. border.

Almost immediately, Mexico pledged to redeploy national guard and law enforcement assets to better control migration. It also devised a system to retain asylum seekers while they await rulings from U.S. authorities.

The episode solidified Mexico’s role as America’s most important economic partner (and second-largest after China). Mexico and America will soon ratify an updated free trade agreement, and Mexico’s economic future has never been brighter.

A history of stability and low debt

Mexico has a tradition of stable economic management, regardless of whether the left, right, or center controls the government. The country’s two greatest assets—a border with the U.S., and a large, cheap, and growing labor force—assure its success. For many large manufacturing businesses, Mexican labor serves as an extension of the fully employed U.S. labor force.

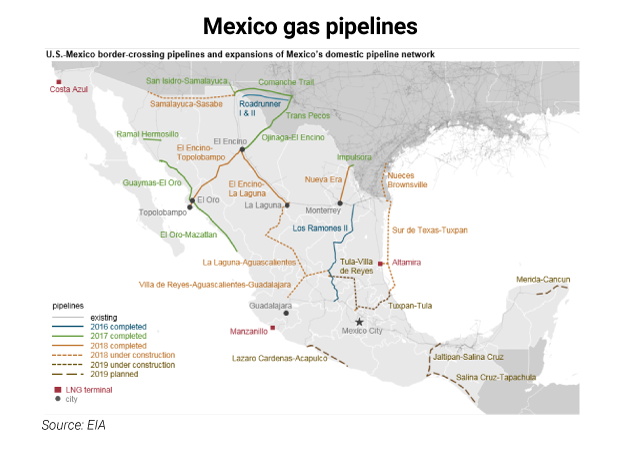

A rapidly growing cross-border transportation infrastructure supports the increasing mutual dependency of these two economies. Mexican rail lines move freight to and from all the commercial centers on the U.S. border…

And U.S. gas pipelines feed the voracious energy demand of Mexican industry…

As the U.S. economy grows, Mexico will grow even faster.

For investors, Mexico’s biggest strength is this potential for future growth… a ratified trade agreement and a strong U.S. economy practically guarantee it.

But the country offers another great benefit… safety.

While most major economies are feeling the pressure of deficits and debt burdens, Mexico isn’t. High debt strangles an economy, forcing businesses and consumers to focus on debt service instead of investment and consumption. This eventually leads to a stagnant economy and poor investment returns.

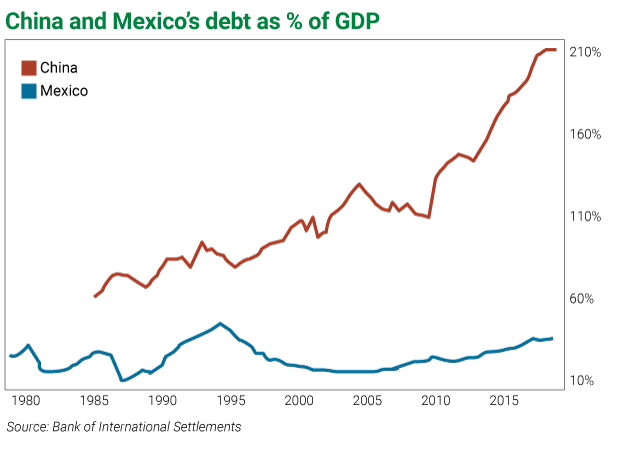

A very low debt level means Mexico’s businesses can borrow to expand and seize new commercial opportunities. By comparison, Chinese businesses are so consumed with servicing debt that they must borrow more money just to pay existing obligations. Debt is literally strangling China’s economy.

In contrast, Mexico’s private sector debt (as a percentage of GDP) is among the lowest in the world.

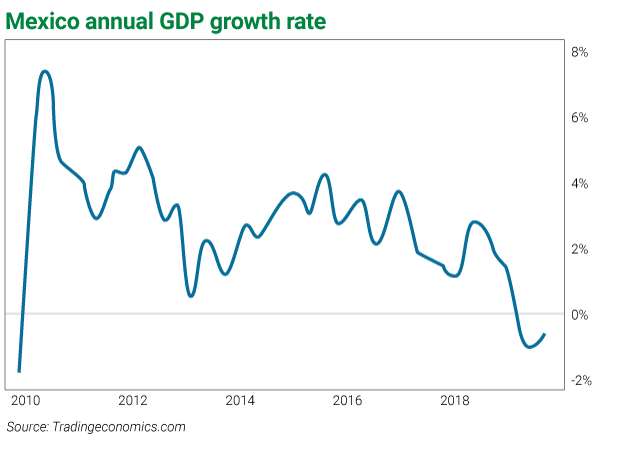

Mexico’s GDP growth rate also consistently performs… Historically, Mexico’s GDP has run at 3% or higher.

Although Mexico has a solid handle on its debt and growth, there’s something to keep in mind…

Mexico’s economy recently entered a recession due to its central bank’s (Banco de Mexico) fight against inflation.

In 2017, Mexico’s inflation rate had soared from 2% in 2015 to almost 7%… well above the target range of 2–4%. In response, Banco de Mexico nearly tripled the target interest rate to 8.25%, last year.

Since that time, inflation has dropped to the middle of the target range (3%), and the Banco de Mexico is cutting interest rates. These rate cuts will ignite Mexico’s explosive growth potential.

Capitalizing on the New Strategic Order

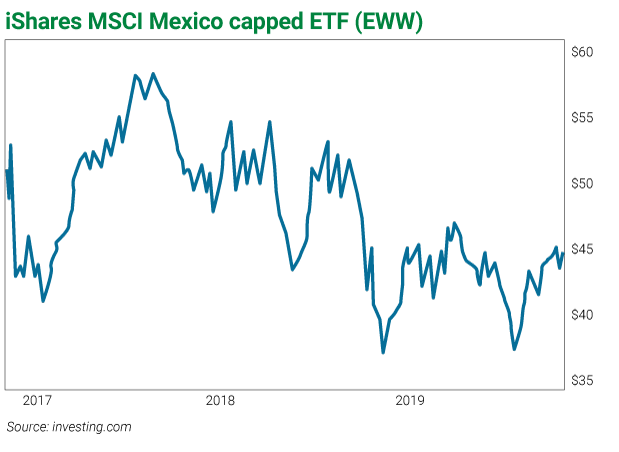

The iShares MSCI Mexico Capped ETF tracks a market-cap weighted Mexican stock market index. The ETF is broadly diversified across a number of sectors, and with a weighted average price to earnings (P/E) ratio of 12.8 (about equal to its growth rate), this looks like a very cheap growth stock.

EWW has trended lower for the past 2 years, as expected when interest rates rise and economic growth slows. But now, as rates start to tumble, Mexico’s growth is poised to recover and its stock market will soar.

This is a great opportunity to invest in the economy that will gain the most from the New Strategic Order. You can buy it cheap right now… just as the next cyclical boom turbocharges Mexico’s stock market returns.

Strategy recommendation: Buy the iShares MSCI Mexico Capped ETF (EWW) up to $48. To manage downside risk, top the position out if EWW closes below $38 for three consecutive days.

All the best,

![[signature]](https://www.curzioresearch.com/wp-content/uploads/2019/09/SKoomar-sig-1.png)

Steve Koomar

Editor, Vigilante Investor