“Buy low, sell high.”

It’s probably the best known Wall Street adage. And it’s ingrained in new investors’ minds.

But it’s wrong.

I’m here to tell you that if you buy things that constantly head lower, you’ll turn a large fortune into a small one.

Rarely do you see fire sale prices on great investments. Sure, it happens sometimes… But tell me the last time fine jewels were priced in pennies.

I’ll wait…

Of course, there are exceptions to the rule, but don’t rely only on exceptions.

Instead of searching for the needle in the haystack, look for the best businesses.

They tend to make new highs, not new lows.

One of my early trades was a buy low disaster. But it changed me for the better…

The needle in the haystack

We’ve all heard a wonderful story about the next big thing, the next great stock.

One of my first trades ever was in a little-known company called eCost.com. This is back in the early 2000s. I thought it was going to change the world—the message boards said so!

I made the classic mistake most novice investors make: I bought low, and then lower, and then lower. There never was a high to sell!

The story I made up in my head was how it was going to replace eBay.com. But this company should have been called eLost.com.

(Too bad I wasn’t smart enough to buy eBay instead.)

I was looking for the needle in the haystack. As the stock kept heading lower, I bought more. I felt I was getting a deal.

If memory serves me right, I lost over 90% on this investment.

I don’t have a chart to show you because the ticker doesn’t exist anymore.

At the time, I lost a lot of money. It was painful. But it ended up changing me for the better. Soon, I began to “buy high,” or buy great companies heading higher…

“Buy high” companies

I’m the type of person who learns from my mistakes. Failure made me focus. It made me rethink my game plan.

Eventually, I landed my dream job on Wall Street. I got an inside look at how big investors pile into stocks. When you handle billions of dollars in trades, it changes you.

Lines on a chart aren’t random anymore. From that seat, I saw that the best stocks attract the best investors. I learned to follow the Big Money.

Soon enough, I was looking for companies that created wonderful products, made profits, and had a chart that went up.

I ended up leaving Wall Street and formed a company that surfs the waves of Big Money: Mapsignals. And my partner and I put that experience into practice.

We specialize in finding amazing companies likely being bought by Big Money investors. We call these stocks outliers.

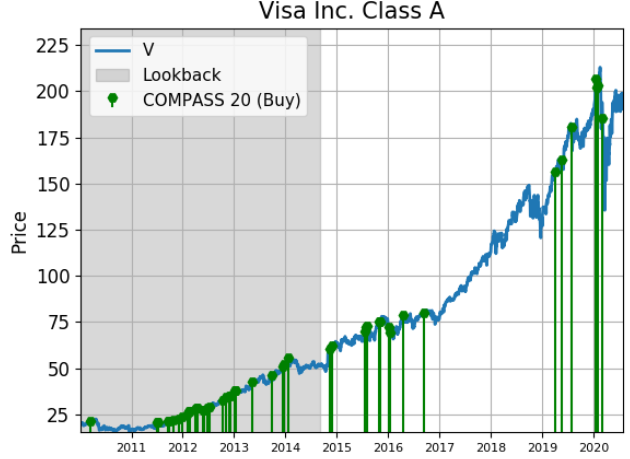

A great example that I’ve owned for years is Visa Inc. Those green bars you see in the chart below are our Big Money signal. Generally speaking: the more green, the better the stock:

Big Money kept moving into Visa… pushing it higher. But based on its fundamentals, I had every reason to believe it would keep climbing. So in 2017, I bought the stock…

Instead of looking for the needles in the haystack, I’d learned to look for dominant businesses. I bought high.

The bottom line is this: The best stocks ever have one thing in common… they go UP.

So, if you’re looking to find the next Apple or Amazon, don’t look in obscure places. Don’t look for low prices. Price is just one indicator.

An amazing company with a great business will likely have a chart heading higher.

Once you find one of these outlier stocks—hold it… and keep riding it higher!

That’s how you make outsized gains.

Over time, your portfolio will thank you.

Editor’s note: If finding “outlier” stocks is a challenge, let Frank take all the guesswork out of it for you…

Each and every month in Curzio Venture Opportunities, he reports on the best small companies on the planet—companies that could become the next Amazon or eBay… Like his newest pick—a tiny biotech few investors have ever heard of… but its new COVID technology could send shares up 200% to 400% over the next few months.

With a Venture membership, you’ll get immediate access to this name—along with other outliers that could easily triple your money…