On Friday morning, biotech Merck & Co. (MRK) announced a breakthrough that could change the course of the COVID pandemic…

In short, a late-stage study showed its drug—called molnupiravir—reduced COVID deaths and hospitalization rates by half.

That’s great news by itself…

But the bigger story is how the pill could be a game changer for businesses hurt by COVID. As I’ll explain, the latest Big Money data shows a great setup for a bullish options trade.

A pill could end the vaccine debate

As you probably know, there are a ton of folks on both sides of the vaccine debate.

In the northeast (where I live) most folks are pro-vaccine. Just about everyone I know here got their vaccine shot immediately.

But keep in mind… I’m from Louisiana and have a lot of friends and family in the Deep South. Most folks in this group have reservations about getting vaccinated. When I ask why, they usually mention some distrust about what’s in the vaccines.

I don’t want to rehash the entire vaccine debate. Everyone is entitled to their opinion on the matter.

Nevertheless, we can all agree COVID remains a drag on our society, our economy, and the stock market. The sooner we put the pandemic behind us, the better.

And I believe a lot of my friends and family (who don’t trust the vaccine) would be much less skeptical about a drug that comes in pill form.

So when the news about Merck’s new pill hit, I got really excited. This pill has the potential to help solve our COVID problems… and bring a quick end to the pandemic.

Merck’s pill could quickly lower the mortality rates associated with COVID. In other words, it could help make the virus a much smaller threat to public health and safety.

The results could be huge: fewer deaths, fewer hospitalizations, and a lot less arguing over vaccines and masks.

And there’s one sector that would benefit the most from putting COVID behind us: travel and leisure.

Friday saw huge buying in one group

As longtime readers know, I sift through the trading data for thousands of stocks in order to find which ones are getting bought and sold.

Every now and then, there’s a news event that’s reinforced by the data. In other words, there’s massive buying or selling in the market that lines up with the news. In my experience, it’s a powerful “one-two” punch.

And that’s what happened last week…

The Merck news hit the tape during pre market on Friday morning. It instantly flipped the equity futures from negative to positive. By the end of the trading session, the S&P 500 gained 1.15% and the Russell 2000 ramped 1.69%, reversing a nasty three-day slump that pushed both indices down more than 3%.

And when I looked over Friday’s Big Money data, it was clear where capital flowed: into hospitality services.

There are 60 names in my universe of hospitality services stocks. On Friday, 15 of them saw large buying. In other words, 25% of the entire sector saw massive inflows. That’s rare and nearly unheard of. When a quarter or more of a group sees this type of action, it’s generally a macro move. And my bet is the sector is going to benefit from the pill.

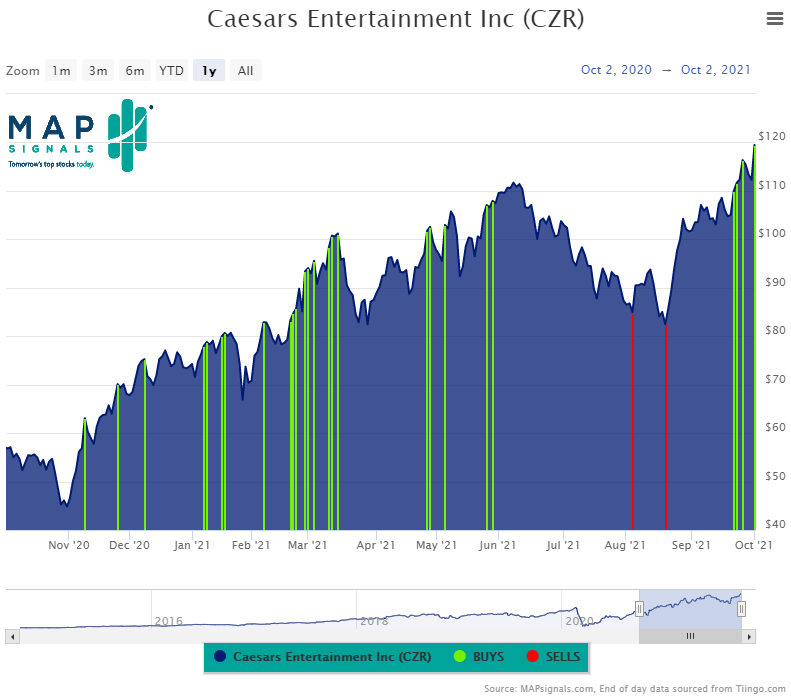

For example, let’s look at the action in Caesars Entertainment (CZR), the major casinos and hotel operator that also handles a ton of sports betting.

Here’s the Big Money chart for Caesars. You can see the green bars that hit all last week:

The rest of the hospitality services sector looks similar—the Merck news sent the entire group surging as investors celebrated the potential effects of Merck’s “wonder pill.” Specifically, the fact it would encourage more travel to hotels, resorts, casinos, and similar businesses.

When Big Money zeros in on a group, it tends to keep heading in that direction. I’d expect the group to head higher in the coming weeks and months.

And I see a fantastic trade setup in the data…

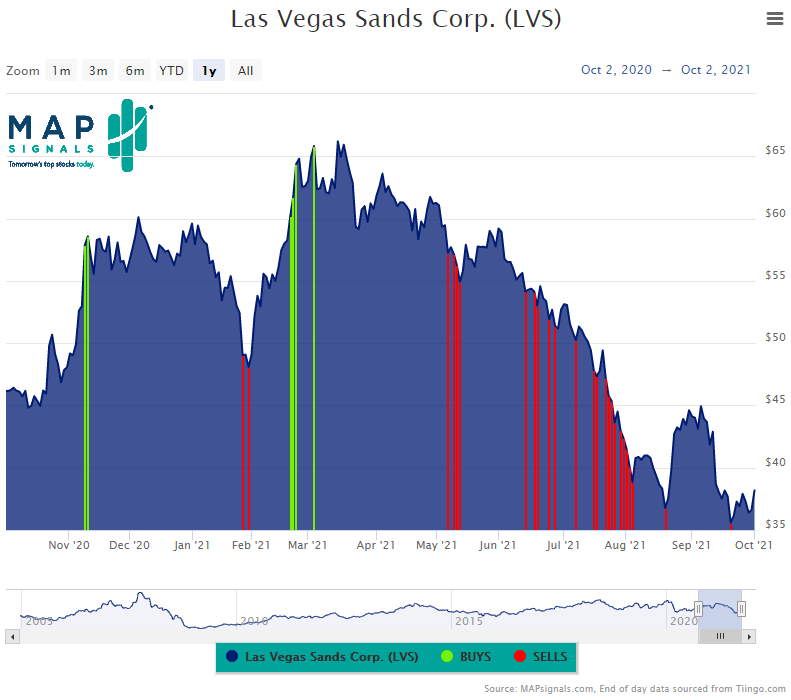

Las Vegas Sands (LVS) is another big player in the hospitality sector. The company operates hotels, resorts, and casinos in Asia and the U.S.

As you can see in the chart below, shares of LVS have been on a one-way train down since April. Look at the relentless selling:

That’s one ugly chart. But this could quickly change based on the Merck news and the recent Big Money data. I see LVS as undervalued… and hated enough to warrant a bounce.

Shares of Las Vegas Sands are a no-brainer buy at current levels. But there’s an even better way to capture the upside while limiting our downside: buying a call option.

With LVS at $37.00, a call with a $40 strike price will give us massive upside… for a relatively cheap price.

I recommend buying the LVS January 21, 2022 $40 call. Right now, it’s trading around $2.53.

I like this call option because it gives us more than three months of long exposure to LVS. Our risk is limited to the $2.53 premium spent… with big upside potential if LVS breaks above $42.53 by expiration.

If you’re new to call options or need a refresher on how they work, here’s an easy-to-understand guide.

Here’s the bottom line: It’s hard to decipher which news is relevant or just noise. I’ve found combining big market headlines with data helps put the odds in my favor.

The Merck news could be a huge step towards a post-COVID world. Intuitively, it makes sense that the hospitality services sector will benefit. And the latest Big Money data shows that Wall Street agrees.

P.S. Want to know which stocks Big Money investors are buying right now?

Check out my newsletter, The Big Money Report.

Just last week, I recommended a small-cap tech stock in an exploding sector that could easily triple your money…

Sign up today and get immediate access to this name… as well as a portfolio of other assets Big Money is pouring into…