If you’ve been investing for a while, you know that stocks often move in groups.

Factors like sector, company size, and valuation all play a role in investment performance.

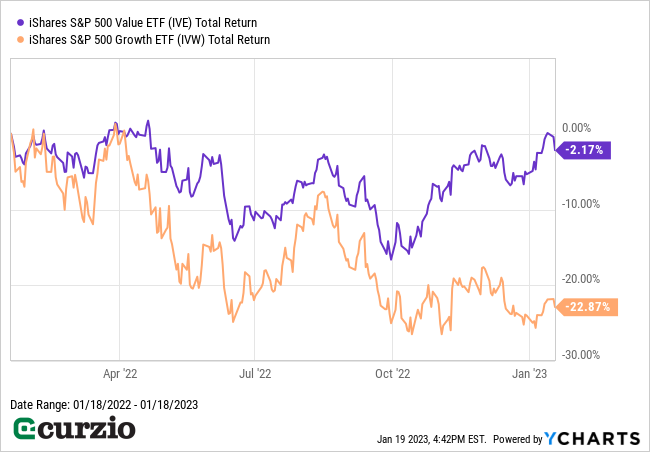

We saw this throughout the bear market of 2022 when it came to growth stocks vs. value stocks.

Growth stocks—the more expensive half of the market—got crushed… while value—the less expensive half of the market—never even declined into “bear market” territory (defined as falling 20% or more).

As you can see in the chart below, value stocks—represented by the iShares S&P 500 Value ETF (IVE)—are down less than 3% over the past 12 months… while growth stocks lost almost a quarter of their value.

This outstanding performance of value stocks is even more amazing if you consider that it’s been more than a decade since value indexes did better than their growth counterparts.

Until a year ago, we were in a “growth at any cost” market—largely thanks to ultra-low interest rates. But the market cycle has shifted… and the era of “free money” is over…

Investors of all kinds have been fleeing growth stocks… and instead flocking to the dividend-paying value sector of the market.

Most of the income-paying value-priced companies are profitable, stable businesses… making them a much better choice in the new regime than the unprofitable, pie-in-the-sky, overly expensive high-growth companies.

This is why I fully expect the dividend-rich value sector to keep outperforming.

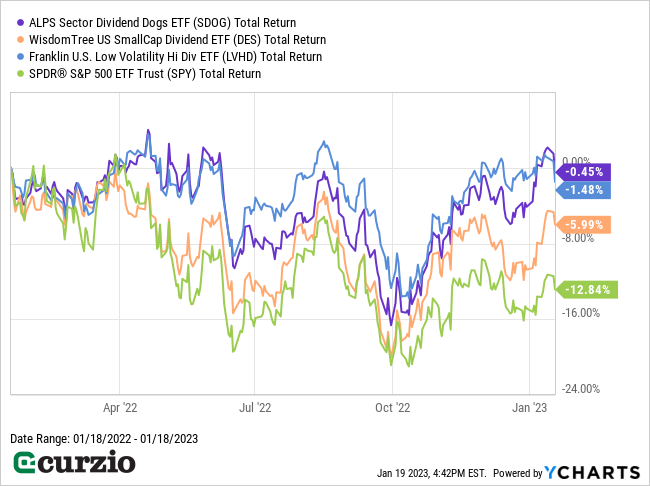

Below, I’ll share three specialized exchange-traded funds (ETFs) that focus on high-income value stocks. As you can see from the chart below, each of these funds significantly outperformed the market over the past year… and I expect them to keep beating the market in 2023.

Even better, they use dramatically different investment strategies… So you can find the one that works best with the rest of your portfolio.

1. The ALPS Sector Dividend Dogs (SDOG)

SDOG owns the 50 highest-yielding stocks across all market sectors—specifically, it holds the five best-paying stocks from each of the ten S&P 500 indices (selected each December).

This strategy guarantees that SDOG delivers an above-average yield (most recently, 3.6% vs. the S&P’s 1.7%).

It also ensures the fund’s investments are equally distributed across sectors. This makes SDOG a safer pick than many other high-yield funds, which tend to be overly concentrated in a handful of sectors, like utilities or real estate investment trusts (REITs). If a fund isn’t well-diversified, it could get into trouble if its chosen sector starts sinking.

As you can see in the chart above, SDOG easily outperformed the market over the past year: delivering a 0.6% gain vs. a 13% decline for the S&P 500.

2. The WisdomTree U.S. SmallCap Dividend ETF (DES)

This ETF invests in dividend-paying small-cap value stocks with strong fundamentals.

This focus on quality allows DES to avoid “value traps”—cheap stocks tied to businesses that are in decline. That’s why the fund offers the lowest yield (2.7%) of the three ETFs discussed here. (Note that this yield is still well above the S&P 500).

Plus, its large number of holdings (629 at last count) minimizes the impact of big losers.

DES’s largest sectors are financials (24% of total assets), industrials (16%), and consumer cyclicals (15.7%). And its top 10 positions—which include EPR Properties (a REIT), Arch Resources (a coal miner), and Cal-Maine Foods (the biggest egg producer in the U.S.)—only account for 6% of total assets.

In 2022, DES lost just 11%. But it easily beat the overall market (down 18.2%) as well as its small-cap benchmark, the Russell 2000 Index (down 20.5%).

This strong relative performance will continue as value stocks maintain their strength in 2023.

3. Franklin U.S. Low Volatility High Dividend ETF (LVHD)

This fund sifts through the 3,000 stocks in the broad market… ranks them based on valuation and earnings volatility… and invests in the highest-scoring stocks (typically around 100 different names).

As a result, LVHD’s portfolio is full of companies that can pay relatively high, sustainable dividends.

And to avoid the possibility of overconcentration, the fund limits how much it can invest in a single company (no more than 2.5%) or sector (no more than 25% of the portfolio). Plus, REITs—an economically sensitive sector—are restricted to less than 15% of the portfolio.

Currently, the fund’s largest sector exposure is in utilities (23%), followed by consumer staples (22%), real estate (10%), and industrials (9%).

In short, LVDH is well-diversified across sectors… and yields a very attractive 3.3%.

In sum…

The three ETFs above are very different, thanks to their unique approaches to stock selection (and focus on varying company sizes). But each will help you profit from the market’s pivot towards value stocks that pay steady dividends.

And for more of my favorite dividend payers for this market, be sure to join us at Unlimited Income.