Rarely do you see a decoupling of industry fundamentals from stock prices—but we’re seeing it in the world of uranium right now.

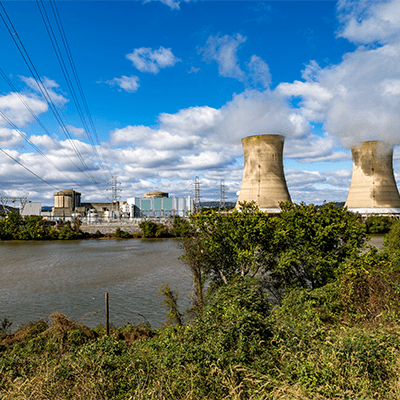

Massive supply deficits will require a significant rise in the price of the underlying commodity to incentivize new production required to meet growing nuclear power demand…

But the aftereffects of a seven-year-long bear market in uranium are lingering as the overall equity markets get hit.

And although positive newsflow for the uranium industry keeps coming…

Stock prices haven’t caught up.

My guest today is fellow uranium hedge fund manager—and my buddy—Arthur Hyde of Segra Capital Management.

Grab your beverage of choice and join Art and me for part one of a two-part interview—as we dive deep into the world of uranium and the fundamental drivers behind the market.

And bring a pen… You’ll want to take lots of notes.

Download TranscriptNote: Please send your questions or comments to me at podcast@curzioresearch.com. Be sure to put “Mike Alkin Show” in the subject line.

FOLLOW MIKE ON TWITTER: @FOOTNOTESFIRST